AUD/USD

Yesterday, the Reserve Bank of Australia maintained the current rate at 4.10% against an expected increase to 4.35%. Apparently, investors were prepared to buy the currency, and although the RBA left interest rates unchanged, the aussie rose at the end of the day, a range of more than 60 points was worked out with target ranges worked out in both directions.

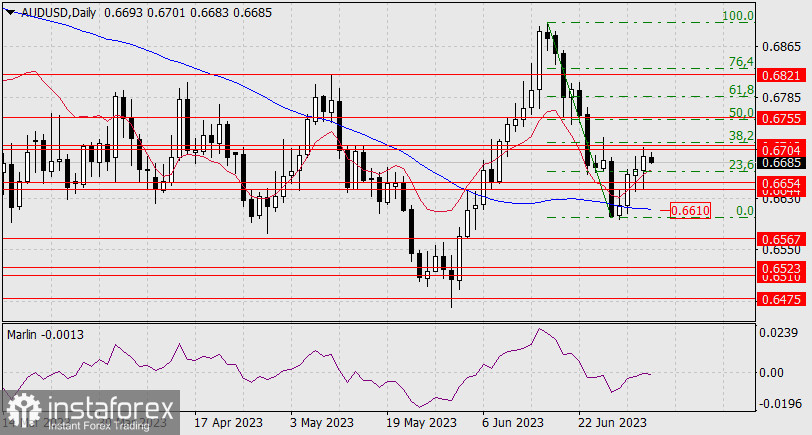

This morning, the price is staying at the upper target range of 0.6704/12. The signal line of the Marlin oscillator on the daily chart touched the border of the bulls' territory. Consequently, if the price climbs above the upper band of the range, it will open the way to the next resistance level at 0.6755. However, it will be very difficult for the price to execute such a plan, as the Fibonacci correction level of 38.2% is above the 0.6712 level, and the correction could have ended with yesterday's growth. This position will be confirmed once the price returns to the 0.6644/54 range. The next target on the MACD line will become available at 0.6610.

On the four-hour chart, the price is struggling with another resistance - the MACD line, and the Marlin oscillator is declining. The bears have the advantage. However, if the price manages to hold above 0.6712, then it will overcome the MACD line and the corrective phase will extend to the level of 50.0% (0.6755).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română