Meanwhile, interest in the British pound has somewhat faded against the backdrop of a holiday in the US and the difficulties that the Bank of England and the government have been facing recently. The cost of mortgage loans in the UK has jumped to a new annual high as rising interest rates continue to wreak havoc among households and homeowners.

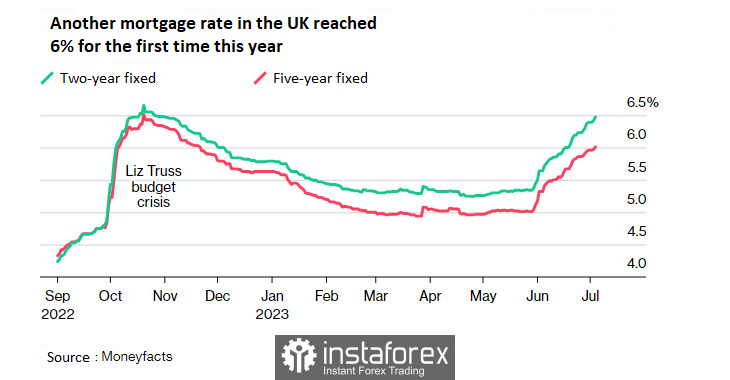

It's clear that the actions of the Bank of England, which raised the interest rate by half a point last month, came as somewhat of a shock to the general public and created additional problems for the lending market, including the real estate market, which is currently going through not the best, but not yet the worst of times. Data from Moneyfacts Group Plc showed that the cost of a five-year housing loan with a fixed rate jumped to 6.01%, approaching a 14-year high reached at the end of 2022. As for the two-year fixed rate, it has risen to 6.47%.

However, despite all this, according to the latest data, housing prices in the UK in some regions have continued to rise. This growth will only last a while, as the UK housing market is under pressure from expensive loans, economic uncertainty, and the worst cost-of-living crisis in a generation. Because markets are betting on the Bank of England raising the interest rate to 6%, it's impossible to expect a stabilization of the situation in this direction. The regulator has no other option but to continue fighting high inflation, closing the door to an era of cheap money, which stimulated demand for houses and led to endless price growth.

Following the Bank of England, local lenders are also raising borrowing costs, withdrawing deals from the market, and tightening borrowing criteria, making it more difficult for new buyers to access financing. It should also not be forgotten that rising interest rates add hundreds of pounds to the monthly mortgage bills of those homeowners who have ended their fixed-rate grace period.

The data also shows that approved mortgage loans - a measure of future borrowing - rose slightly to 50,524 in May but remained significantly below pre-pandemic levels. This suggests that the rate hike is putting pressure on potential buyers, while the effective interest rate on new mortgage loans increased by ten basis points to 4.56% in May, according to the Bank of England data.

As for the technical picture of GBP/USD, demand for the pound remains quite restrained, indicating a continuation of the correction. The pair can be expected to grow after gaining control over the 1.2720 level, as breaking this range will bolster hope for further recovery to around 1.2755, after which we can talk about a more sharp surge of the pound upwards to around 1.2795. In case of a fall in the pair, bears will try to take control over 1.2680. If they manage to do this, breaking this range will hit the bulls' positions and send GBP/USD to the minimum of 1.2640 with the prospect of reaching 1.2590.

As for the technical picture of EUR/USD, for buyers to regain control, they need to climb above 1.0930 and consolidate there. This will allow them to climb to 1.1000. From this level, it can climb to 1.1060, but doing so without new good data for the eurozone will be problematic. In case of a decrease in the trading instrument, I only expect any serious actions from large buyers around 1.0885. If no one is there, it would be good to wait for the renewal of the minimum of 1.0830 or to open long positions from 1.0800.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română