The Australian dollar slumped against its US counterpart as the Reserve Bank of Australia (RBA) opted to maintain its key interest rate unchanged, signaling that the board needs more time to assess the impact of over a year of tightening on the economy and inflation. However, the central bank stated that more rate hikes were possible in the future.

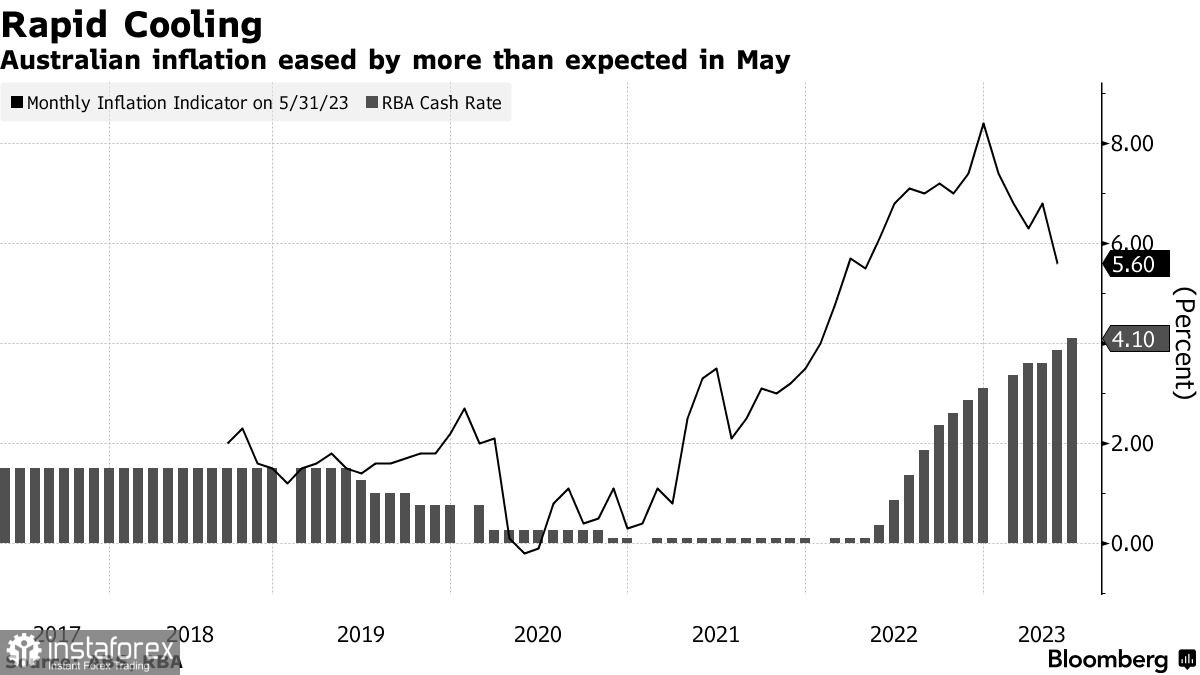

Following its latest meeting, the RBA decided to hold the interest rate steady at 4.1%, marking the second pause this year, in line with economists' predictions. This move allows the board to gather further insights into the economic conditions, prospects, and associated risks. "Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve," RBA governor Philip Lowe said. "The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that," he added.

Consequently, the yield on three-year bonds, which are sensitive to policy shifts, dipped as traders adjusted their expectations of two more hikes this year. The RBA's cautious approach stands in contrast to other central banks, such as the Federal Reserve and the European Central Bank, who recently said they still have options for curbing inflation.

The RBA will study thoroughly the upcoming quarterly inflation data, which will be released on July 26. The central bank's economists will also present updated forecasts in the coming weeks.

Today's decision reaffirms RBA Governor Philip Lowe's efforts to engineer a soft landing for the economy while preserving the employment gains achieved during the pandemic. Moreover, it is noteworthy that the RBA currently maintains rates at a modest 4%, trailing behind its counterparts in neighboring New Zealand (5.25%) and in the United States (5%).

RBA's analysts have highlighted the imminent expiration of a substantial number of housing loans acquired at historically low rates during the pandemic. According to RBA research, nearly 90% of fixed-rate mortgage loans will mature this year, triggering payment increases of 30% or more. This poses a significant threat to households, and the central bank has clearly factored it into its decision-making process. Higher key interest rates will consequently amplify the cost of existing and future loans.

However, the board remains vigilant about the potential risk of inflation expectations fueling further price and wage hikes, particularly given the limited spare capacity in the economy and persistently low unemployment.

From a technical perspective, AUD/USD faces resistance at 0.6690, which is limiting further upside momentum. A breakout above this level would pave the way towards 0.6770 and 0.6875 further above. If the pressure observed following the RBA meeting persists, buyers are likely to act near 0.6605. A breakout below this level could trigger a decline towards 0.6540, with the most distant target being 0.6480.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română