Initially, the dollar strengthened yesterday, thanks to the fact that in the eurozone, the final data on the manufacturing PMI turned out to be worse than preliminary estimates. But then it returned to the values at which it opened the day, as this same indicator from the UK came out better than the preliminary estimate. While similar data for the United States fully coincided with the preliminary estimate. They couldn't affect market sentiment, no matter how much they wanted to.

Today, it's a public holiday in the United States, in celebration of Independence Day. This means that institutional investors in the US are taking a break. They control a large part of the capital circulating in the global financial market. And in this case, market activity naturally grinds to a halt. Therefore, markets will simply stand still.

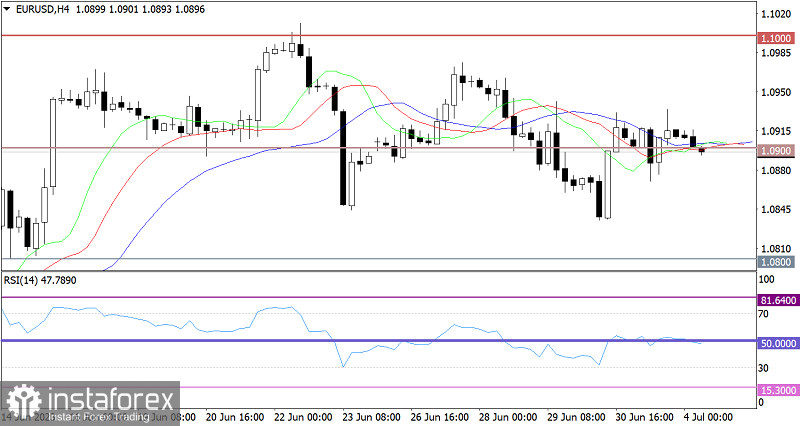

The EUR/USD pair is moving around the 1.0900 mark. This resulted in a decline in the volume of long positions, which significantly grew last Friday.

From the perspective of the RSI technical indicator on the four-hour chart, the stagnation phase is confirmed by movement along the 50 middle line.

In turn, the Alligator's MAs on the same time frame are intertwined with each other. This also confirms the flat phase.

Outlook

In this case, the pair could move along the 1.0900 level due to the absence of the main player in the market. However, if the price stays below the 1.0880 mark, we shouldn't rule out a gradual increase in the volume of short positions. This indicates a fall in the euro's exchange rate.

The complex indicator analysis unveiled that in the intraday and short-term periods, technical indicators are pointing to a mixed signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română