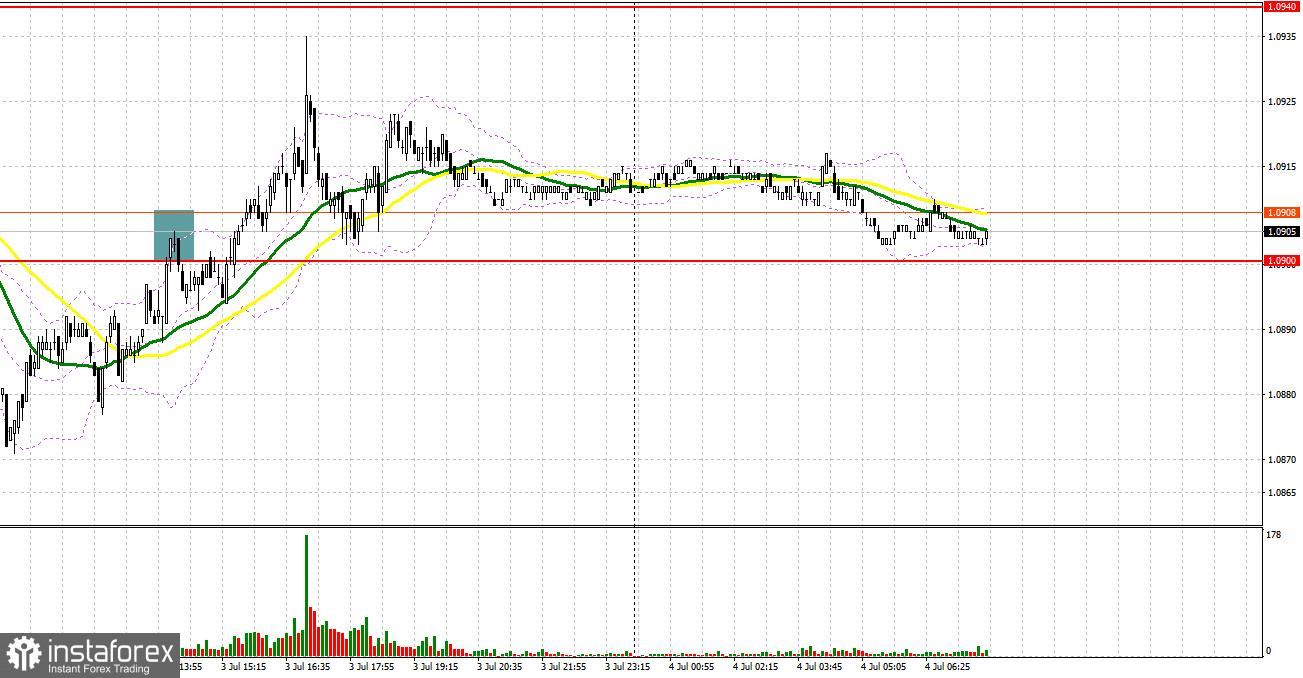

Yesterday, the pair formed one entry signal. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.0900 as a possible entry point. A rise to this level and its false breakout served as a sell signal but the pair couldn't develop a deeper decline.

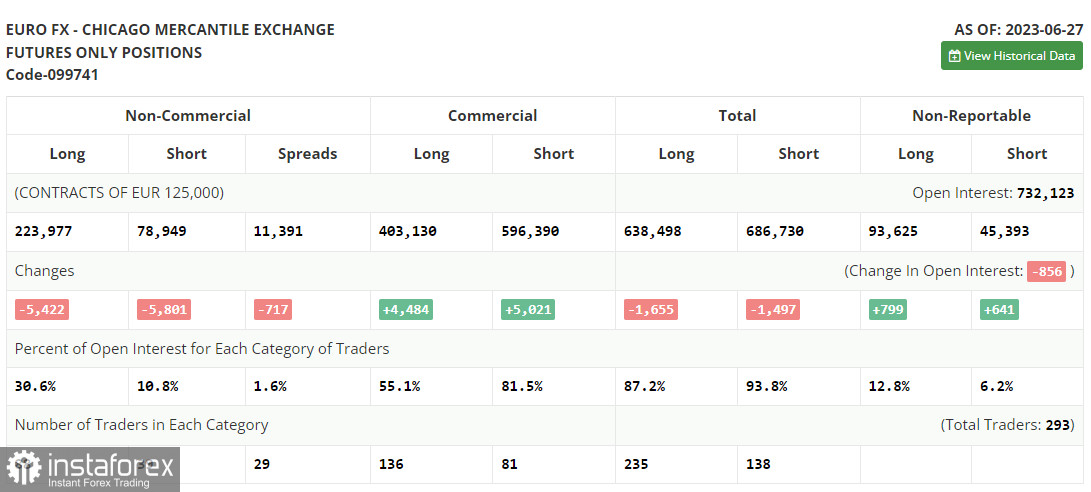

Before discussing further prospects of EUR/USD, let's see what happened in the futures market and how the Commitments of Traders' positions have changed. The COT report for June 27 showed a reduction in both long and short positions, leaving the market's balance practically unchanged. The GDP data released last week once again confirmed the resilience of the American economy even in the face of high interest rates, allowing the Federal Reserve to actively combat high inflation which is gradually returning to normal. In the near future, the minutes of the Fed's meeting will be released, and we will also learn about the state of the US labor market, which may strengthen the US dollar against the euro. In the current conditions, buying on pullbacks remains the optimal medium-term strategy. The COT report indicates that long positions of the non-commercial group of traders decreased by 5,422 to 223,977 while short positions fell by 5,801 to 78,949. At the end of the week, the overall non-commercial net position increased slightly to 145,028 compared to 144,025. The weekly closing price went up to 1.1006 from 1.0968.

For long positions on EUR/USD

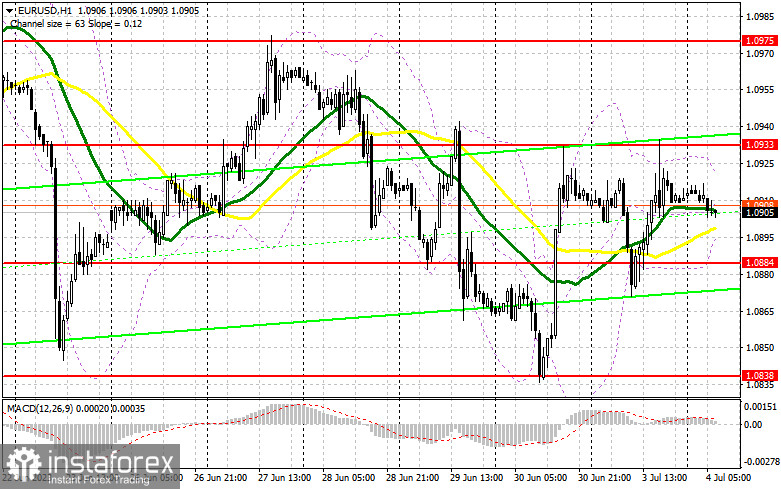

Today is Independence Day in the United States, so there are no important fundamental statistics in both the first and second halves of the day. I expect low trading volatility and volume, which speculators can take advantage of. For this reason, I will only act on declines near the support level of 1.0884 that was formed yesterday after the bears' unsuccessful attempt to push the price lower. A false breakout at this level will provide a buy signal, allowing a return to the key resistance at 1.0933. A breakout and a downward retest of this range will strengthen demand for the euro and may bring it to 1.0975, but this is unlikely. The ultimate target remains the area of 1.1010 where I will take profit. In the case of a decline in EUR/USD and the absence of buyers at 1.0884 due to the lack of important statistics, bears may increase their presence, expecting a downward correction. Therefore, only the formation of a false breakout around the next support at 1.0838 will provide a buy signal for the euro. I will open long positions immediately on a rebound from the low of 1.0807, keeping in mind an intraday upside correction of 30-35 pips.

For short positions on EUR/USD

Considering that volatility will be very low after yesterday's unsuccessful attempt by bears to return to the market, they are unlikely to show themselves in the first half of the day. To develop a downward correction, bears need to keep the price below 1.0933, and protecting this level will be a priority task. A failed consolidation there will provide a sell signal that can push EUR/USD towards 1.0884. Consolidation below this range, as well as its upward retest, will lead directly to 1.0838. The ultimate target will be the low of 1.0807 where I will take profit. In the event of an upward movement of EUR/USD during the European session and the absence of bears at 1.0933, the situation will come under the control of buyers, and the pair will break out of the sideways channel. In such a case, I will postpone short positions until the pair hits the next resistance at 1.0975. Selling can also be done there but only after a failed consolidation. I will open short positions immediately on a rebound from the high of 1.1010, considering a downward correction of 30-35 pips.

Indicator signals:

Moving Averages

Trading around the 30- and 50-day moving averages indicates a sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a rise, the upper band of the indicator at 1.0920 will serve as resistance. If the pair declines, the lower band of the indicator at 1.0890 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română