Positive Changes at General Motors: One of the notable events in the market was the rise in General Motors' stocks, spurred by their announced share buyback plan.

Revised US GDP: In addition, the recent upward revision of the US GDP data for the third quarter has brought some optimism to the market, alleviating fears of an economic recession.

Decline in Humana and Cigna Stocks: In contrast, the stocks of Humana and Cigna showed a decline against the backdrop of news about a possible merger of these companies.

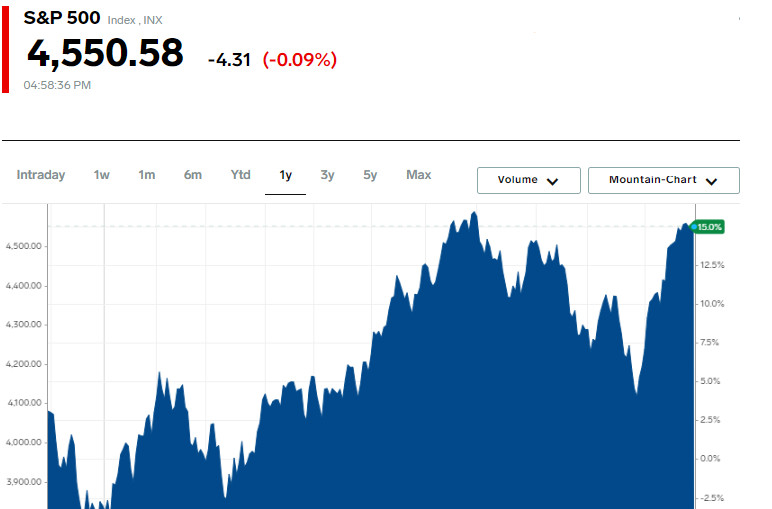

Changes in Major Indices: In the general market context, the Dow Jones Industrial Average showed a slight increase of 0.04%, while the S&P 500 and Nasdaq recorded declines of 0.09% and 0.16%, respectively.

The market situation remains uncertain in anticipation of an important Personal Consumption Expenditures (PCE) inflation report, expected next Thursday. This makes investors adopt a cautious stance, especially considering recent statements by Fed representatives, raising questions about the duration of their current policy.

Nevertheless, despite the fluctuations in indices in recent days, November demonstrates significant growth for the S&P 500, putting it on track for the largest monthly gain since July 2022. Experts, such as Tim Griskie of Ingalls & Snyder, note the observed consolidation in the market after significant growth, which is a normal phenomenon following a period of significant gains.

In the context of Fed policy, Christopher Waller's opinion is of interest, suggesting a possible end to the rate hike cycle, hinting at a potential reduction in rates to ensure a "soft landing" of the economy and avoid a recession. This view contrasts with other statements by Fed representatives, creating additional uncertainty in the market.

"The Fed is currently holding rates, but the mantra remains the same," continued Griskie. "The US economy is showing resilience, leaving no reason for the Federal Reserve to cut rates, which could provoke a return of inflation."

Loretta Mester, president of the Cleveland Fed, emphasized the importance of maintaining flexibility in response to economic changes. Her comments reflect the Fed's overall concern regarding the need to balance between stimulating growth and controlling inflation.

These statements followed the U.S. Department of Commerce's revision of its initial GDP estimate for the third quarter, which showed an increase, indicating the resilience of the economy. However, this growth leaves the Federal Reserve (Fed) little room to lower rates in the near future, especially considering that inflation is still significantly above the target level of 2%.

The Fed's "Beige Book," presenting an analysis of economic activity across various regions, also reflected some slowdown in activity in the context of the current monetary policy. This indicates the Fed's cautious approach in the context of current economic conditions.

Against the backdrop of these events, major stock indices showed mixed results. The Dow Jones Industrial Average slightly increased by 13.44 points (0.04%), reaching 35,430.42. At the same time, the S&P 500 index lost 4.31 points (0.09%), dropping to 4,550.58, and the Nasdaq Composite index fell by 23.27 points (0.16%), closing at 14,258.49.

Thus, there is a continuation of cautious dynamics in the U.S. stock market, where investors and economists closely follow every move of the Fed and its impact on the country's economic indicators.

Among the various sectors represented in the S&P 500 index, the real estate and financial sectors showed the highest percentage gains, while the communication services sector experienced a notable decline, falling by 1.1%.

In the context of the reaction to interest rates, the stocks of tech giants Microsoft and Apple had the greatest impact on the S&P 500 index. These stocks, sensitive to changes in interest rates, made a significant contribution to market dynamics.

The situation in the health insurance sector also had a noticeable impact on the market. Shares of Humana and Cigna Group showed a significant drop of 5.5% and 8.1% respectively after news emerged about a possible merger of these companies.

In the automotive industry, shares of General Motors rose by 9.4% after the company announced plans to buy back shares worth $10 billion and increase dividends by 33%. Shares of Ford Motor also showed growth, increasing by 2.1%.

CrowdStrike Holdings, a cybersecurity company, recorded a 10.4% increase in its shares after publishing a fourth-quarter revenue forecast that exceeded analysts' expectations.

Shares of NetApp, a cloud data management platform, also showed impressive growth of 14.6% following the company's increase in its annual earnings forecast.

On the New York Stock Exchange, the number of rising stocks outpaced the number of falling stocks in a ratio of 2.06 to 1, while on the Nasdaq this ratio was 1.51 to 1 in favor of rising stocks.

The S&P 500 index recorded 30 new 52-week highs and one new low, while the Nasdaq Composite registered 82 new highs and 97 new lows.

Trading volume on American exchanges reached 11.42 billion shares, exceeding the average of 10.45 billion shares over the last 20 trading days, indicating increased investor activity in the market.

The CBOE Volatility Index (VIX), a key indicator of expected market volatility based on options trading on the S&P 500, rose by 2.29%, reaching a level of 12.98. This reflects increased investor interest in defensive strategies amid current market uncertainty.

In the commodities market, December gold futures observed a moderate increase of 0.26%, or $5.25, reaching $2,000 per troy ounce. This could indicate increased demand for gold as a traditional safe-haven asset during periods of economic instability.

Among energy commodities, January futures for American crude oil WTI rose by 1.71%, or $1.31, to $77.72 per barrel. Similarly, February futures for Brent crude oil increased by 1.46%, or $1.19, to $82.66 per barrel. This price increase may be related to various global economic and geopolitical factors affecting the oil market.

In the currency market, the euro to US dollar exchange rate (EUR/USD) changed slightly, rising by 0.15% to a level of 1.10, while the USD/JPY pair showed a decrease of 0.18%, dropping to 147.22. These changes reflect current trends in the currency markets, where investors closely monitor the dynamics of key currencies.

The US Dollar Index (DXY) futures, reflecting the value of the American dollar against a basket of major currencies, also showed an increase of 0.09%, reaching a level of 102.74. This may indicate the strengthening of the American currency on the international stage.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română