Currently, the pair is slightly above the moving average line, but it is challenging to conclude that the trend has shifted upward due to the insufficient depth of the consolidation. Moreover, the pair has frequently changed direction over the past week, indicating that we are currently in a local consolidation zone. This consolidation period has been ongoing for half a year, as observed in the 24-hour time frame. It is important to note that consolidation represents an extended period during which the pair remains within a limited price range, but it does not indicate a flat market.

Therefore, the movement in the upcoming week may resemble a "swing." With several diverse macroeconomic events expected, the market is likely to react to them. However, if the reports contradict each other, the "swing" will likely persist. Currently, the European currency does not hold an advantage over the dollar as both central banks tighten monetary policy. The European economy is weaker than the American economy, as indicated by the latest GDP reports. Thus, the European Central Bank's more aggressive approach to interest rates in 2023 is counterbalanced by the weakness of the EU economy and a higher likelihood of a recession.

We anticipate that the "consolidation movement" will continue to dominate the market, which is most clearly seen in the 24-hour time frame. Trading during such movements is most effective in lower time frames. After the consolidation phase concludes, we still expect the European currency to decline unless there is a significant change in the fundamental background.

While Powell provided an opportunity for the dollar, the market quickly took advantage of it.

One of the key events of the past week or so was the series of speeches by Jerome Powell. Following the Federal Reserve meeting, he spoke twice in Congress and twice at the economic forum in Sintra. Based on his speeches, the conclusion can be drawn that the Fed rate may increase two more times in 2023. It is worth noting that many experts expected the tightening cycle to end at 5.25%. However, it is now evident that the Fed is concerned about the deceleration in the pace of inflation decline, and the current state of the American economy allows for further rate hikes. Therefore, it seems reasonable to hedge and take advantage of this favorable situation.

Inflation in the US is causing less concern as it has already dropped to 4%. While this is still twice as high as the Fed's desired level, the situation is worse in other countries, making it more necessary for other central banks to worry about further tightening instead of the Fed. However, the FOMC wants to rely on more than just inflation reaching the target level naturally. Hence the decision for two more rate hikes. What does this imply for the dollar? It receives support from the fundamental background, as the market did not anticipate such an outcome. Considering that the euro is overbought and the dollar is oversold, we still believe the pair will likely decline. The number of times the ECB raises rates does not matter because the European currency has been rising for the past ten months, and traders have already factored in all possible rate hikes into the current exchange rate. Unlike the pound, the EUR/USD pair does not exhibit any inertia growth, further supporting the notion of an impending decline.

The decline may not be strong or dynamic, similar to the pair's movements over the past five months. However, we cannot identify any factors that could revive the upward trend of the European currency. While the market can make purchases under any circumstances, the decline should commence if we consider logical movements.

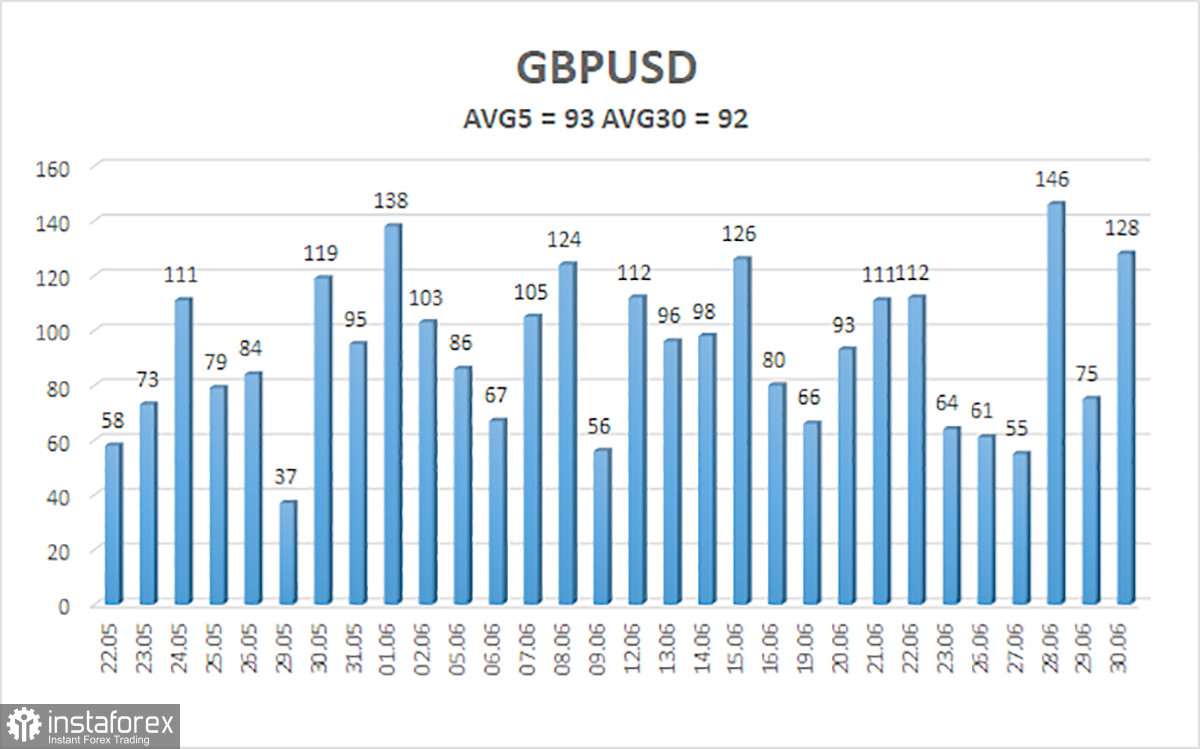

As of July 2nd, the average volatility of the EUR/USD currency pair over the past five trading days is 70 pips, classified as "average." Consequently, we expect the pair to fluctuate between the levels of 1.0840 and 1.0980 on Monday. If the Heiken Ashi indicator reverses downward, it will indicate a potential resumption of the downward movement.

Nearest support levels:

S1 - 1.0864

S2 - 1.0803

S3 - 1.0742

Nearest resistance levels:

R1 - 1.0925

R2 - 1.0986

R3 - 1.1047

Trading recommendations:

The EUR/USD pair has settled below the moving average as the "head and shoulders" pattern has formed. It is advisable to consider new short positions with targets at 1.0840 and 1.0803 in case the price rebounds from the moving average. Long positions will become relevant again only after the price consolidates above the Murray level "3/8" (1.0925), with targets at 1.0980 and 1.0986.

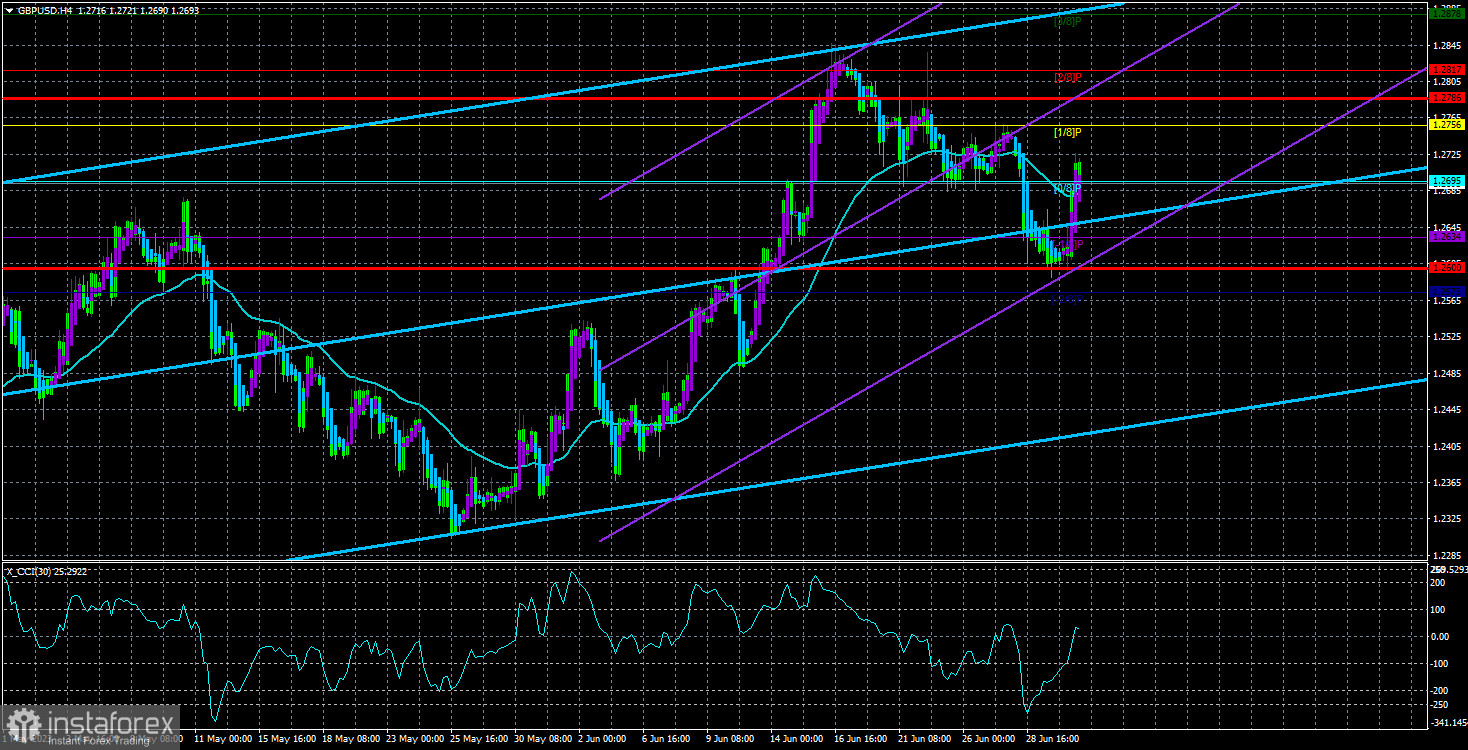

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels move in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel the pair is expected to trade in the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română