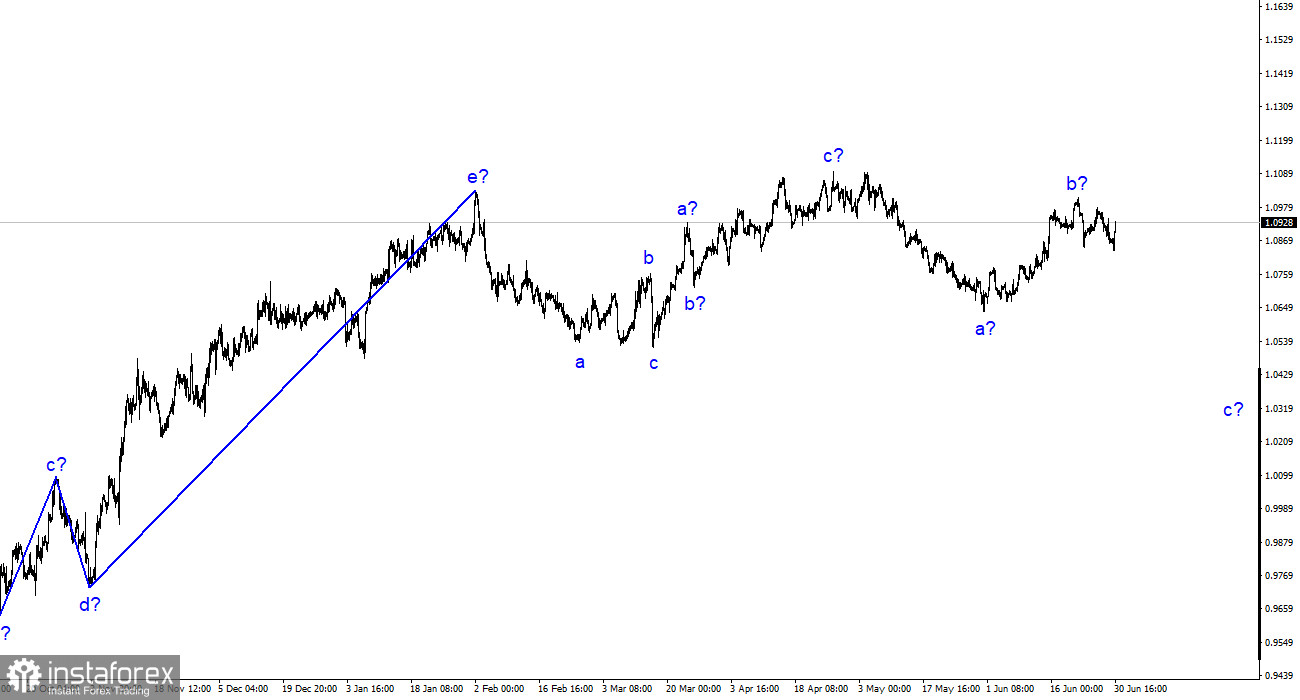

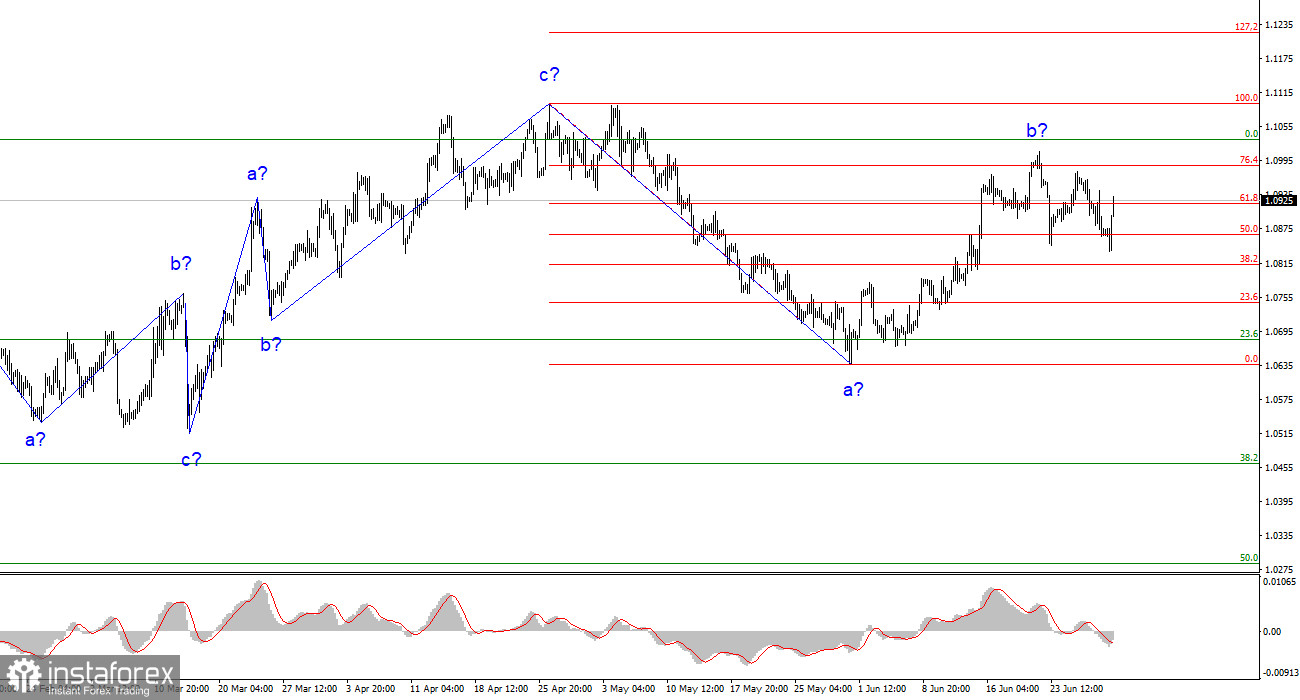

The wave analysis of the 4-hour chart for the euro/dollar pair remains somewhat unconventional but understandable. The upward trend starting on March 15 might still develop a more complex structure. However, at the moment, I anticipate the formation of a descending trend segment, likely consisting of three waves. I have consistently mentioned my expectation for the pair to reach near the 5th figure, where the upward three-wave structure began. I haven't deviated from this prediction. The presumed wave b might have completed its formation this week, indicated by the subsequent pullback of quotes from the achieved highs.

Considering recent events, particularly the GBP/USD pair movements, I have developed an alternative wave analysis. The entire trend segment between March 15 and April 26 represents a single wave a. If this is indeed the case, the next wave would be b, and we are currently witnessing the formation of an upward wave c. In this scenario, the wave analyses of the British and European pairs align, making everything fall into place. If this assumption proves correct, the euro will likely resume its upward movement from the current positions, surpassing the 11th figure.

As anticipated, inflation in the EU has decreased. The euro/dollar exchange rate on Friday increased by 60 basis points. Before the start of the American session, the pair was declining, but it began to rise afterward. In the morning, the Consumer Price Index for the Eurozone was released, showing a decrease from 6.1% y/y to 5.5% y/y in June, slightly below market expectations. Overall, market expectations were met. What does this decrease in inflation within the forecast mean? It indicates that inflation continues to slow down as planned. Consequently, the ECB can proceed with its current plan, which involves raising the interest rate in July.

Regarding future speculation, I prefer to refrain from engaging in it now due to the potential occurrences in the currency market and the world before September. I will mention, though, that Americans welcomed the decrease in Eurozone inflation, leading to increased demand for the euro during the latter half of the day. No significant reports or surprises occurred in the US. It seems likely that Americans were responding to the morning report on inflation in the EU.

Based on the conducted analysis, I conclude that the formation of a descending trend segment is ongoing. The pair still has significant room for further decline. I maintain the view that targets around 1.0500-1.0600 are quite realistic, and I recommend selling the pair based on "down" signals from the MACD indicator. The presumed wave b appears to have concluded. According to the alternative wave analysis, the upcoming upward wave might be more extensive and complex, but I wonder if it will assume a more intricate form. The current news background does not primarily support the euro.

On a larger wave scale, the wave analysis of the ascending trend segment has taken on an extended form, which is likely completed. We have observed five upward waves, which constitute the structure of a-b-c-d-e. Subsequently, the pair formed two three-wave structures, one downward and one upward. It is likely in the process of constructing another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română