EUR/USD

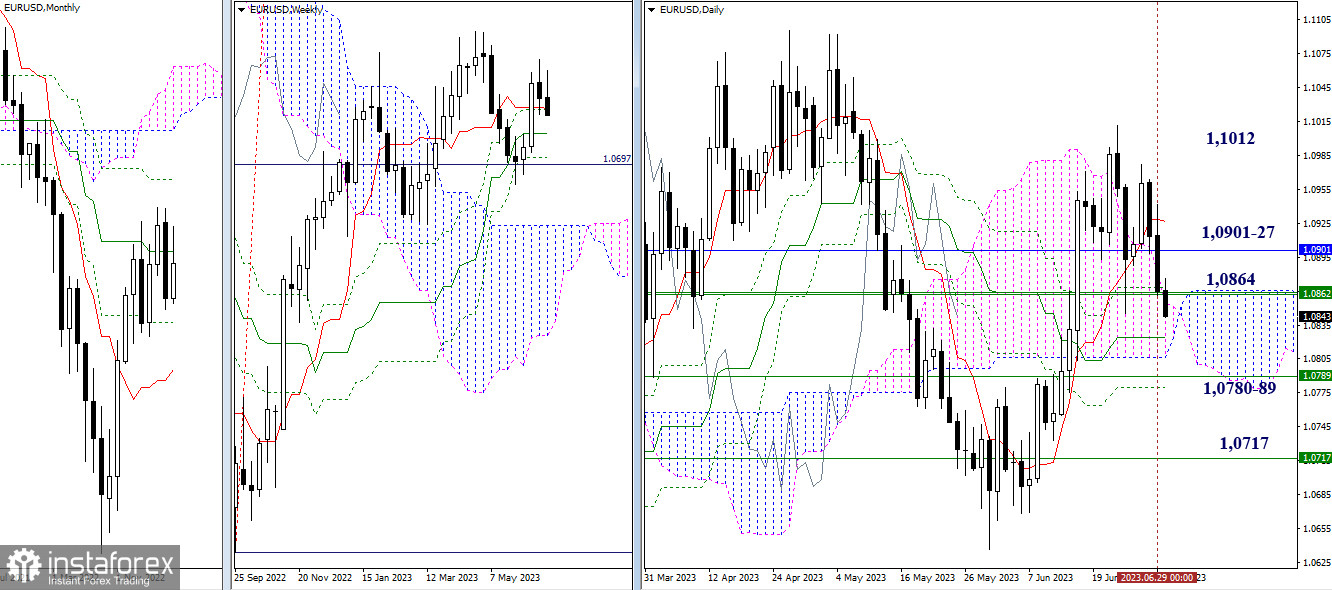

Higher timeframes

The decline continues. Weekly supports (1.0862-64) have been tested, and bearish players have reentered the daily Ichimoku cloud. In the current situation, with further strengthening of bearish sentiment, the main objectives are to enter the bearish zone from the daily cloud (1.0806), and eliminate the daily (1.0780) and weekly (1.0789 - 1.0717) golden crosses of the Ichimoku.

The nearest bullish targets today remain in the area of 1.0901 - 1.0927 (monthly medium-term trend - daily short-term trend) and the high at 1.1012.

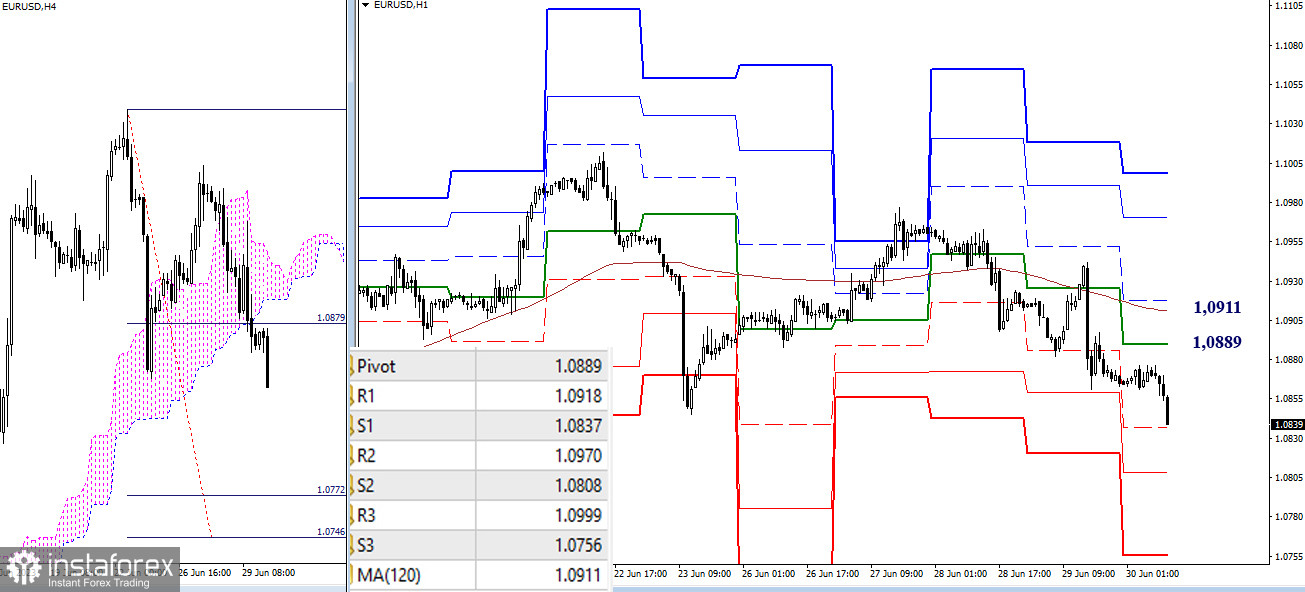

H4 - H1

At the moment, bearish players maintain and develop their advantage on lower timeframes. Currently, the first support of classic pivot points is being tested (1.0837), followed by S2 (1.0808), S3 (1.0756) as subsequent bearish targets, and the target for breaking the H4 cloud (1.0772 - 1.0746). The key levels that determine the current balance of power act as resistances today. In the case of an upward correction, they will meet the pair at 1.0889 (central pivot point of the day) and 1.0911 (weekly long-term trend).

***

GBP/USD

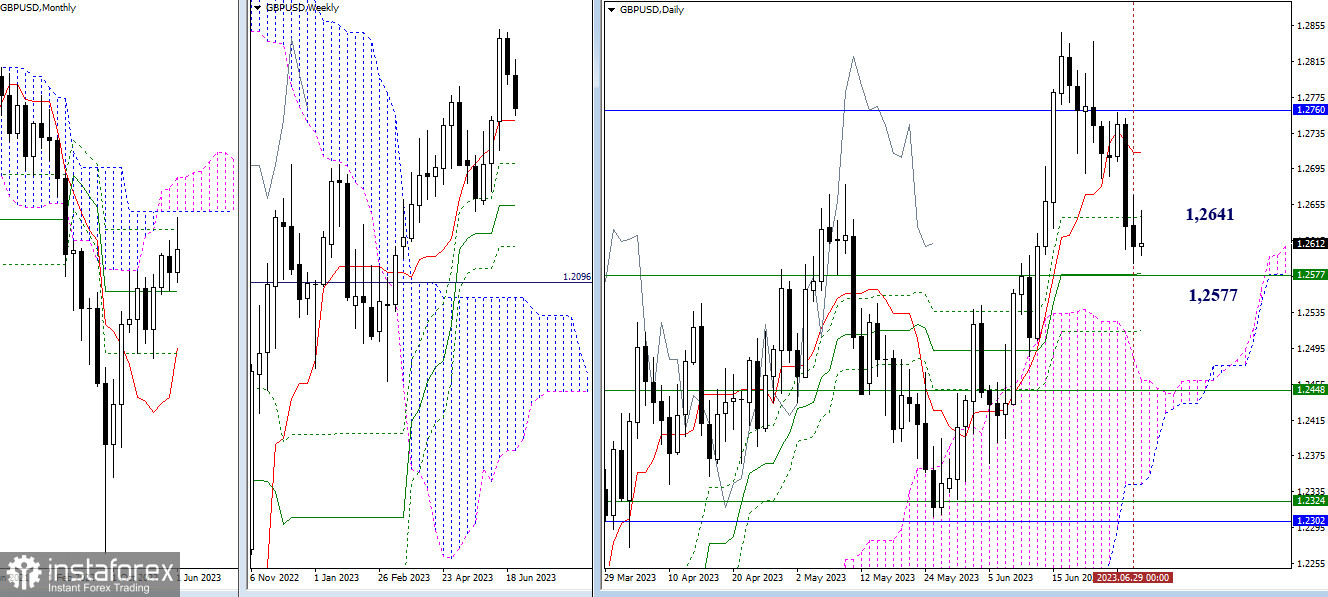

Higher timeframes

Bearish players have dropped below the support level of 1.2641. This reference point still holds attraction and influence on the current situation. If the decline continues, ahead of the bears is an important level of 1.2577, which combines the support of the daily medium-term and weekly short-term trends. The outcome of this interaction will determine further developments.

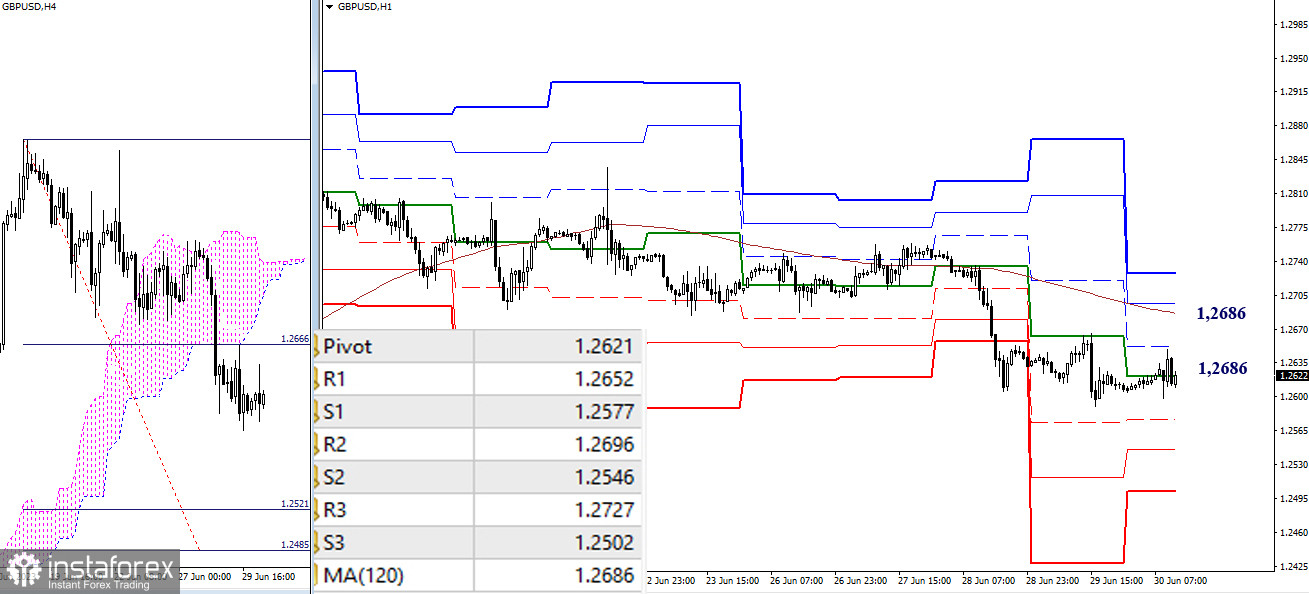

H4 - H1

On lower timeframes, a corrective pause is observed within the movement. The key level that currently maintains bearish advantage is at 1.2686 (weekly long-term trend). Consolidation above and a reversal of the movement will shift the current balance of power in favor of the bulls. The next intraday targets could be the resistances of classic pivot points at 1.2696 - 1.2727. The resumption of the decline will bring back the relevance of bearish targets at 1.2577 - 1.2546 - 1.2502 (supports of classic pivot points) and 1.2521 - 1.2485 (target for breaking the H4 cloud).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română