The euphoria surrounding the potential creation of a Bitcoin ETF linked to BlackRock is gradually fading. BTC/USD quotes have been stuck in a narrow trading range after volatile movements. Even the news that another major asset manager, Fidelity Investments, has submitted a renewed application to launch its specialized exchange-traded fund (ETF) did not resonate with investors. However, their sentiment is gradually improving.

Since the beginning of the year, Bitcoin has grown by 85%, significantly outperforming stock indices, commodities, and other assets. However, for most of the second quarter, the token faced pressure due to lawsuits filed by the Securities and Exchange Commission (SEC) against major cryptocurrency exchanges Binance and Coinbase. They are accused of manipulations, commingling their own funds with customer funds, and illegal issuance of digital assets that are purportedly considered securities.

The fact that Bitcoin held its ground in such challenging conditions speaks to its resilience. When it seemed like the future of the crypto industry was under threat, BlackRock filed an application with the SEC to create a specialized exchange-traded fund. Previous applications from other companies were discarded by the SEC. However, specialists at the world's largest asset manager have significant experience in creating ETFs. They have undermined all of the regulator's arguments, except for the fact that the SEC simply does not like Bitcoin.

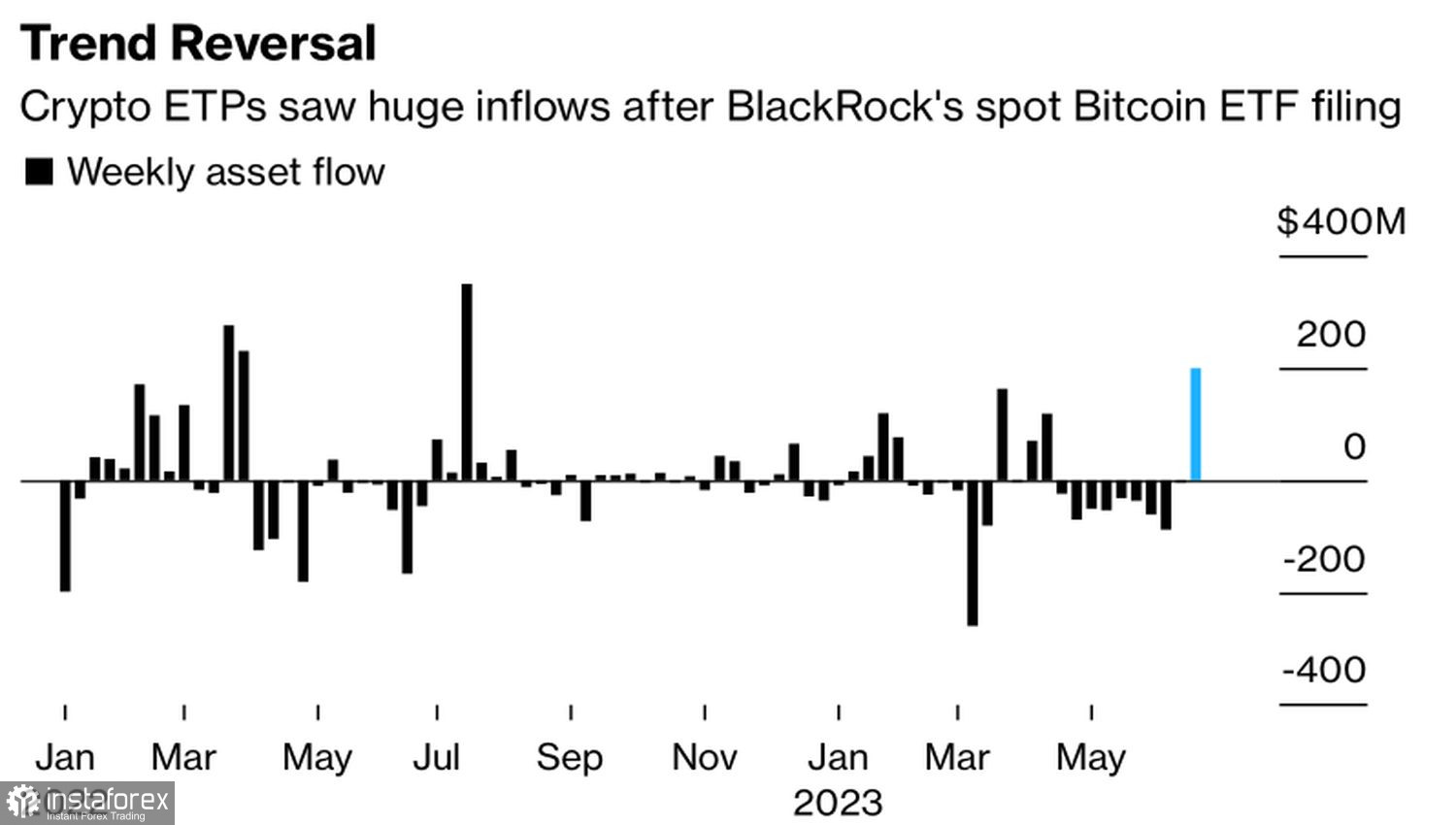

The SEC has three months to review the application, but investors are increasingly convinced that it will be approved. As a result, investment products with digital assets attracted $199 million by the week ending June 23. This represents the largest capital inflow in almost a year. Approximately $187 million, or 94%, was attributed to Bitcoin.

Capital flows in digital asset ETPs

Markets believe that BlackRock will succeed in breaking down the SEC's aversion to cryptocurrencies. If this happens, the inflow of money from institutional investors will contribute to further growth in BTC/USD quotes.

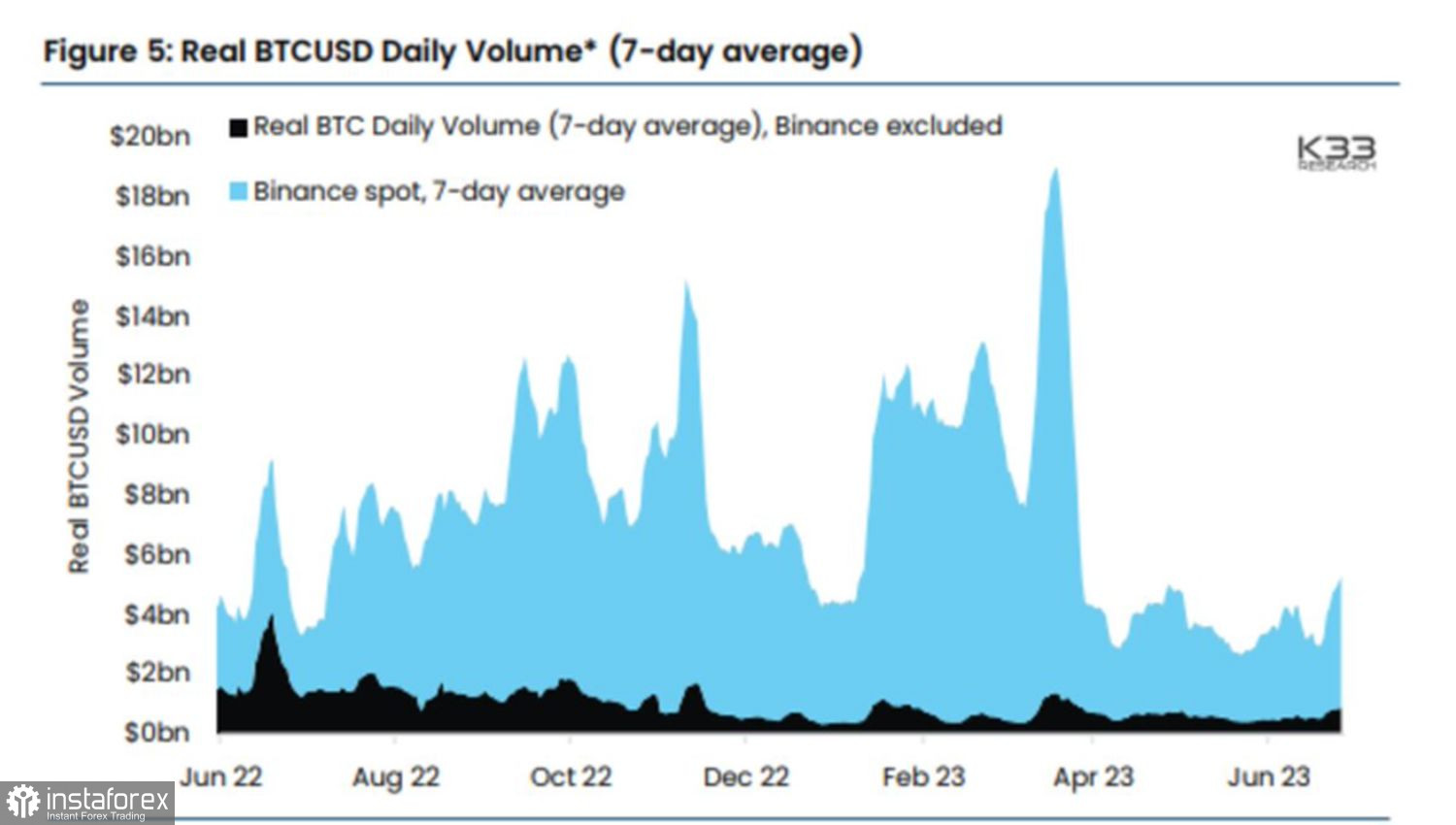

According to Kestra Investment Management, the dynamics of Bitcoin trading volumes serve as a good indicator of risk appetite. When the indicator rises, excess money circulates within the system in search of risky assets. In such a scenario, the value of cryptocurrencies increases. When people turn away from risk, trading volumes decrease. Currently, there is an increase in volumes, although they are still far from reaching local highs.

Bitcoin trading volume dynamics

Thus, the leader of the cryptocurrency sector has not yet exhausted its potential. As capital inflows into investment products expand and trading volumes grow, BTC/USD quotes have the potential to pleasantly surprise their supporters.

Technically, the consolidation after the volatile rally may be associated with the accumulation of long positions or the distribution of short positions. It is advisable to set limit orders to buy Bitcoin from the level of 31,470 and to sell from 29,690.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română