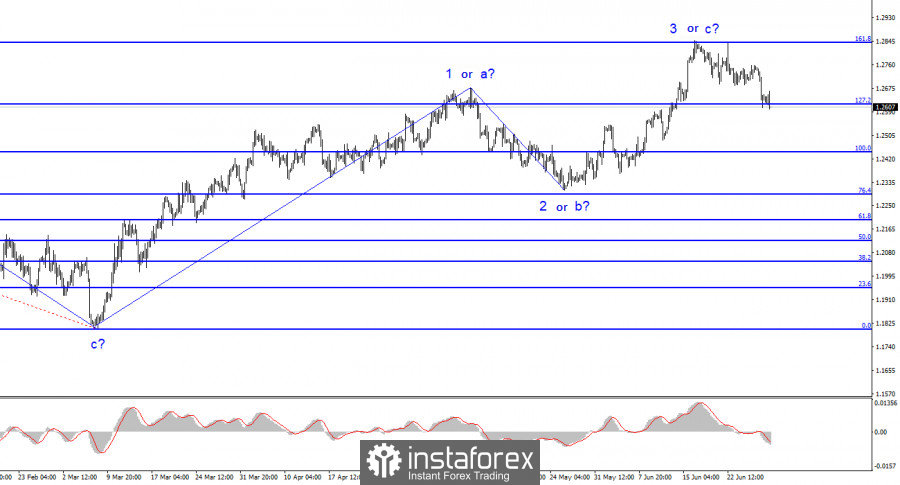

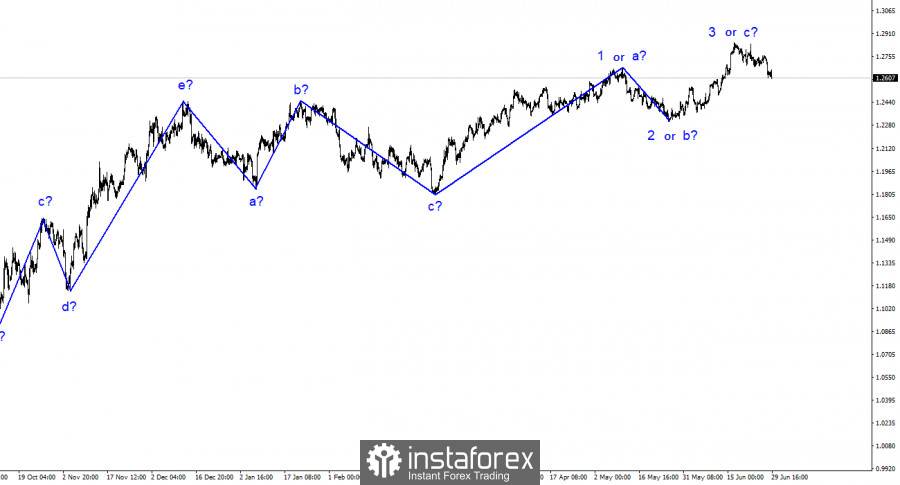

The GBP/USD pair's wave analysis has changed its appearance to a simpler and more understandable. Instead of a complex corrective trend section, we may see an impulsive upward wave or a simpler one. The formation of the ascending wave 3 or c continues, and the British pound has an excellent opportunity to rise to the 30 figure. It is up to you to decide whether the current news background justifies this. The British pound has no reason to continue rising to the 30 or 35 figure (possibly if it is an impulsive trend section), and the presumed wave 3 or c may already be completed. Wave analysis can always transform into a more complex one, but I prefer to rely on its simple manifestations as they are easier to work with.

A descending set of waves is expected for the euro, but the wave analysis may transform into a similar one as the pound, and then everything will fall into place. The 161.8% Fibonacci level and two unsuccessful attempts to break through it indicate readiness for a decline. However, within wave 3 or c, there should be a five-wave structure, which implies at least one more upward wave.

Demand for the pound continues to decline

The GBP/USD exchange rate decreased by 30 basis points on Thursday, but its losses could be much greater by the end of the day, as the U.S. released a strong GDP report today. "Strong" in both the literal and figurative sense of the word. GDP is one of the most important reports in the calendar as it directly reflects the state of the economy. In addition, market expectations were for a 1.4% q/q growth in the first quarter, and the first two estimates showed exactly that value. However, the final estimate unexpectedly rose to 2.0% q/q, so demand for the U.S. currency sharply increased today, which fully corresponds to the current wave analysis.

Jerome Powell announced two more interest rate hikes yesterday, which the FOMC will likely approve at the upcoming meetings. This is higher than market expectations from two to three months ago, so the dollar receives additional market support. A successful attempt to break through 1.2615 will only reinforce my expectations for a further decline in the pair. The stronger the pair falls, the higher the chances of completing wave 3 or c and the entire upward trend section.

Overall conclusions.

The wave pattern for the GBP/USD pair has changed and suggests the formation of an ascending wave that may complete at any moment (or already be completed). One could advise buying the pair, but only in the case of an unsuccessful attempt to break through the 1.2615 level. Then wave 3 or c could take on a more extensive form, and the pair would return to the 1.2842 level. Selling appears more promising, and I recommended it two weeks ago with a Stop Loss set above the 1.2842 level. If a downward trend section has begun, the decline could continue by another 400-500 points.

The picture is similar to the EUR/USD pair on a larger wave scale, but there are still some differences. The descending corrective trend section has been completed, and a new ascending trend section is formed, which may already be completed or take on a full five-wave structure. The third wave could be extensive or truncated even if it forms a three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română