Charity begins at home. What should representatives of Germany in the ECB do if German inflation accelerated from 6.1% to 6.4% in June? Correct, continue to use a "hawkish" rhetoric abundantly! And what should representatives of Spain do if consumer prices in this country fell below the 2% target? They will probably talk about the need to end the cycle of monetary restriction. And this split within the Governing Council does not bode well for EUR/USD.

Dynamics of Spanish inflation

Inflation statistics have shown how unevenly the tightening of monetary policy by the ECB affects the 20 countries in the currency bloc. The high share of Germany's manufacturing sector compared to Spain, due to supply chain problems and employers' desire to retain workers, generates higher prices. On the contrary, the non-manufacturing sector is more sensitive to the increase in deposit rates.

The split within the Governing Council may limit the upside potential and deal a blow to EUR/USD. Especially since households' annual inflation expectations in the eurozone sharply slowed down from 12.1% to 6.1% in June. The last time the indicator was at this level was in 2016.

Dynamics of European inflation expectations

According to Credit Agricole, the key factor behind the euro's success in June was the narrowing of spreads between bonds of peripheral eurozone countries and Germany. However, as the economic prospects of the currency bloc deteriorate, the indicator will begin to widen. This will have a negative impact on EUR/USD. Danske Bank also considers itself among the "bears" on the main currency pair. They believe that the deterioration of the global economy in the second half of 2023 and American exceptionalism will contribute to the weakening of the euro against the U.S. dollar.

In any pair, there are always two currencies. Regardless of what is happening in Europe, investors also look at North America. And there, another round of strong macroeconomic statistics has been released. The revised estimate of U.S. GDP for the first quarter showed faster growth, up to 2%, and the decline in the number of initial jobless claims indicates labor market strength. It is not surprising that the chances of a federal funds rate hike to 5.75% in December jumped to 36%, and EUR/USD returned below the 1.09 mark.

Thus, the divergence in economic growth between the United States and the Eurozone is evident. At the same time, the split within the ECB ranks and a significant slowdown in European inflation expectations prevent the euro from spreading its wings. The market, on the other hand, is convinced that the FOMC's forecasts of two more interest rate hikes this year are most likely correct. This leads to the strengthening of the U.S. dollar against major world currencies.

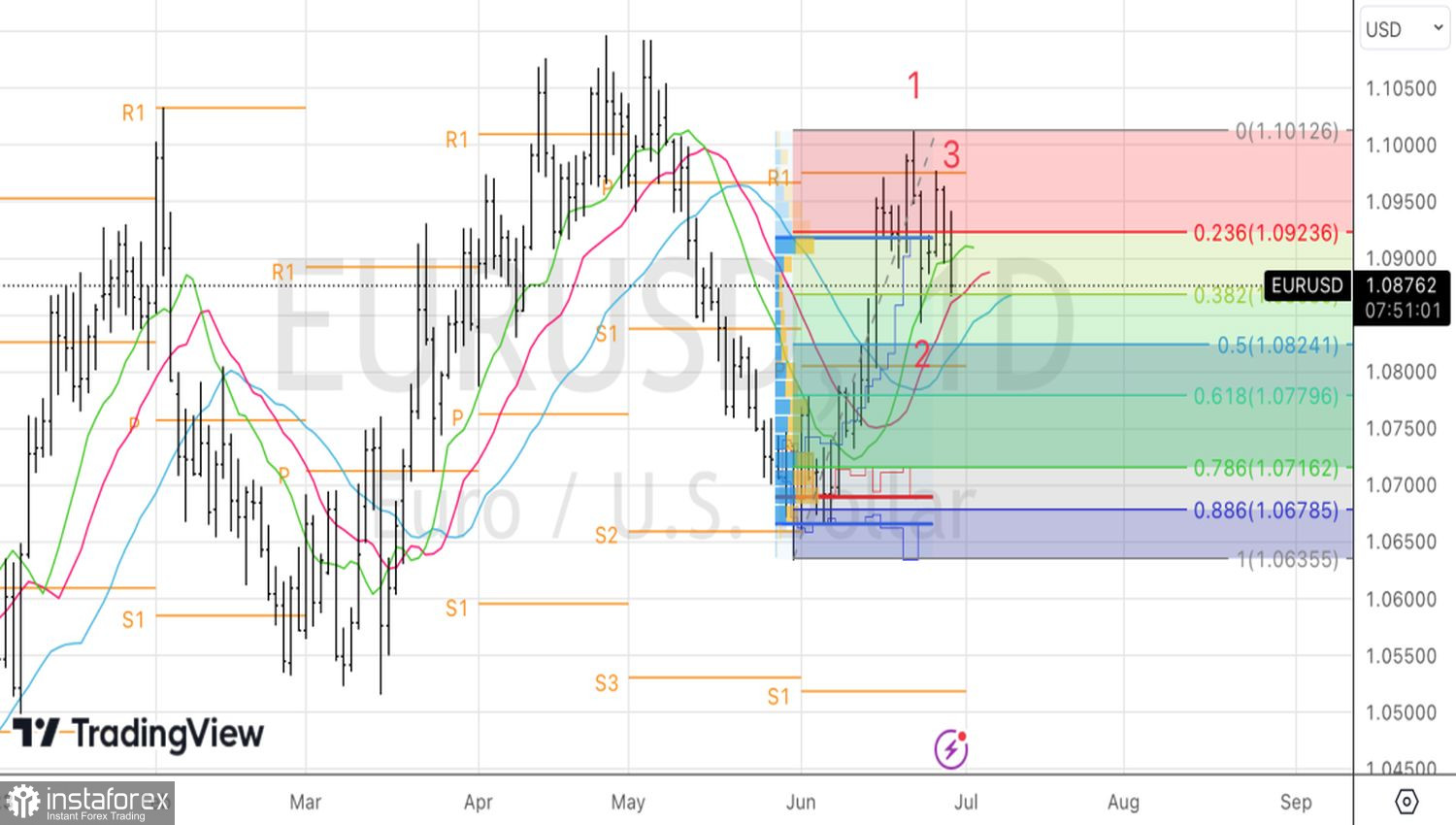

Technically, on the daily chart, the implementation of the 1-2-3 pattern continues for EUR/USD. The inability of the "bulls" to push quotes above the 23.6% Fibonacci level of the last upward wave has become a sign of their weakness and a reason to increase previously formed shorts. We continue to sell the euro towards $1.0825 and $1.0800.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română