Both the euro and the pound sterling showed a slump after the meeting held by officials of the leading central banks. They said that the global economy and inflation remained resilient to numerous key interest rate hikes. This made some traders revise their views on future monetary policy.

Speaking in Sintra, the Chairman of the Federal Reserve, Jerome Powell, the President of the European Central Bank, Christine Lagarde, and the Governor of the Bank of England, Andrew Bailey, stated that they would continue to fight against overly high inflation by all available means. "Although policy is restrictive it may not be restrictive enough and it has not been restrictive for long enough," Powell said in a panel discussion organized by the ECB, which also included Bank of Japan Governor Kazuo Ueda.

Noting that most Fed officials expect to hike rates at least two more times this year, Powell intends to raise the cost of borrowing at two consecutive meetings after taking a break at the meeting earlier this month.

Lagarde suggested that the ECB rate hike next month was inevitable. However, speaking about the September meeting, the ECB President was less certain in her statements, noting that new data would be needed for this.

Bank of England Governor Andrew Bailey was more assertive in his statements, promising to do everything necessary to bring inflation back to 2% after the Bank of England surprised investors by raising rates by half a percent this month.

Only the head of the Bank of Japan, Ueda, was soft in his statements, emphasizing that rates in Japan will not rise because the core inflation remains below the 2% level. Nevertheless, he pointed to possible changes if the regulator suspects any signs of price increases next year.

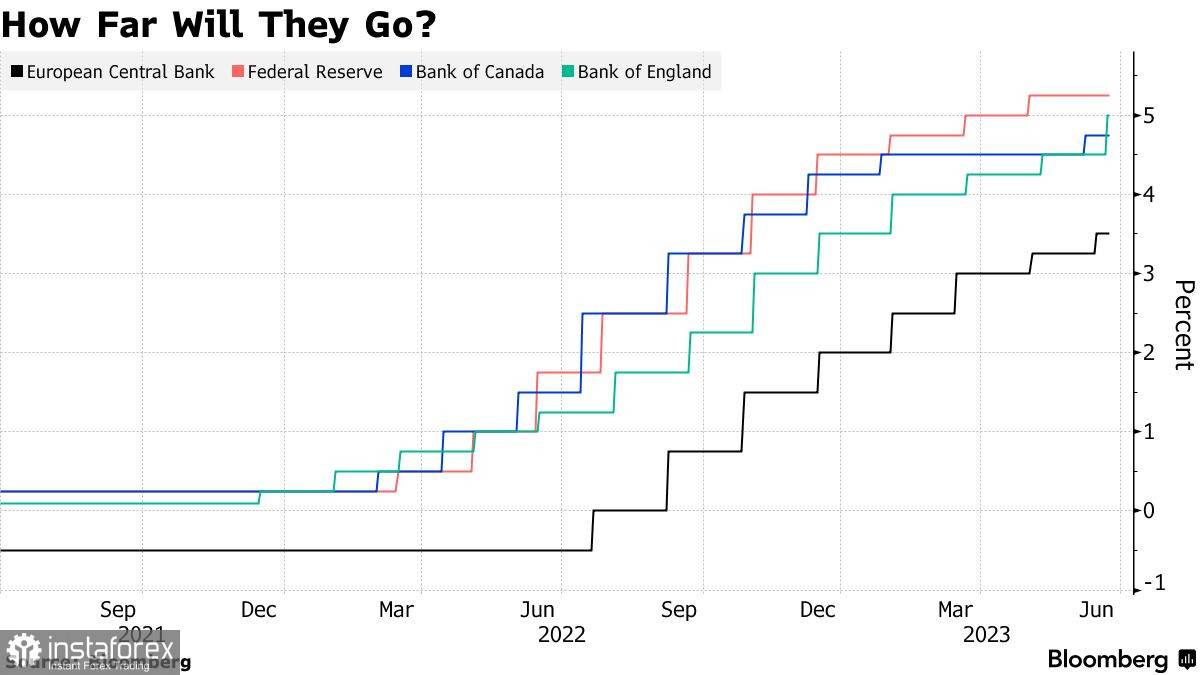

Notably, since last year, the Federal Reserve, the ECB, and the Bank of England have been stuck to the most aggressive tightening of monetary policy in recent decades in an attempt to lower inflation to their 2% targets.

According to forecasts, overall inflation in the US will slacken to 3.8% from 4.4% largely due to lower gasoline prices. However, core inflation, which excludes food and energy prices and which politicians consider more indicative of the underlying trend, will remain unchanged at 4.7%. Powell recently stated that the main indicator would drop to 2% only by 2025. He is also concerned that the longer inflation remains high, the higher the risk that it will not decline is.

In conclusion, the leaders of the central banks made it clear that their number one goal is to curb inflation even if it means that their economy will have to see difficult times.

The technical picture of EUR/USD is showing that buyers need to climb above 1.0925 and settle there to regain control over the level. This will allow them to reach 1.0960 and 1.1010. From this level, it will be possible to climb to 1.1060. However, it will be difficult to do this without positive data from the eurozone. If the pair declines, large buyers will become active only around 1.0880. Otherwise, it will be better to wait until the price touches the low of 1.0850 or to open long positions from 1.0800.

Meanwhile, demand for the pound sterling dropped sharply, indicating the formation of a correction. One can count on the growth in the pair if buyers gain control over the level of 1.2650. A breakout of this range will strengthen hopes for further recovery to around 1.2700. After that, the pound sterling may surge to around 1.2745. If the pair drops, bears will try to take control over 1.2600. In the event of this, a breakout of this range will affect bulls' positions and push GBP/USD to a low of 1.2570 with the prospect of falling to 1.2530.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română