Leaders of the world's top central banks gave speeches on Wednesday: the Bank of England, the European Central Bank, and the Federal Reserve. The rhetoric of ECB President Christine Lagarde and BoE Governor Andrew Bailey deserved attention, but what they said was not exactly surprising. In essence, Lagarde and Bailey repeated the same things that they or their colleagues have already voiced multiple times. There are currently fewer questions and doubts about the ECB. The market expects a 25 basis point rate hike in July with a 100% probability and highly values the likelihood of further tightening in the autumn. However, discussions about it should occur at the end of the summer. We still need to see the next two inflation reports, which will receive a lot of attention from the ECB itself. Only after that can we confidently say what to expect in September and October.

The BoE remains a "dark horse." Last week, it made a very unexpected decision to raise the rate by 50 basis points, while most market participants expected the tightening process to conclude. Recall that rumors were circulating in the spring that the British central bank would take a pause. However, Bailey said that the UK economy has proven to be very resilient, which should be understood as a willingness to raise the rate further.

The market is now laying down at least two more 25 bps rate hikes. Such a hawkish stance from the ECB and the BoE could lead to forming new internal waves within the last ascending waves of the uptrend section of both instruments. It is worth noting that both wave patterns have a reserve scenario that involves another marginal increase (the formation of another upward wave).

Fed Chairman Jerome Powell was the most specific and directly stated that a majority of the Federal Open Market Committee (FOMC) members support two more 25 basis point rate hikes. This development is somewhat unexpected for the market since many market participants were anticipating a peak rate of 5.25%. Powell's words regarding two additional rate hikes should be taken very seriously, as the Fed chair rarely openly discusses the FOMC's plans. If he says how many more rate hikes it means that it is almost 100% the FOMC committee's plan. Probably because of specifics, there has been a significant increase in demand for the US dollar on Wednesday. If sellers grab the opportunity, both instruments may transition to forming larger downward waves.

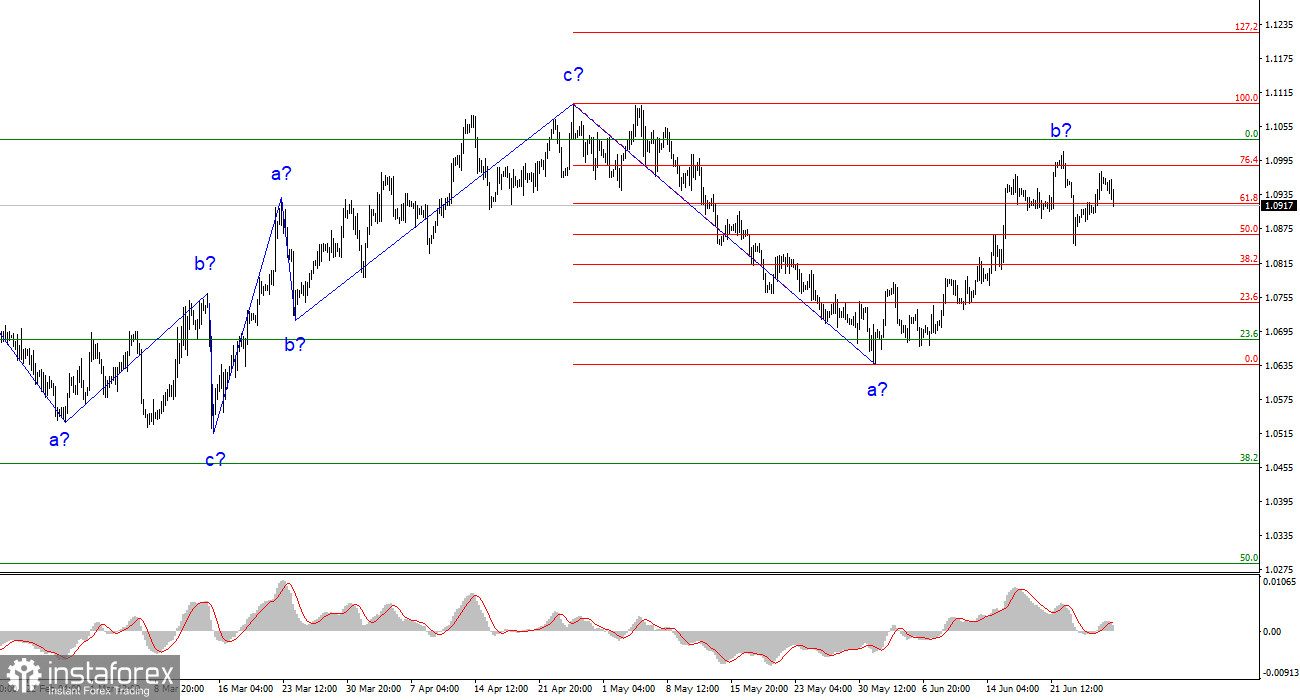

Based on the analysis conducted, I conclude that the downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument on "down" signals from the MACD indicator. I believe that there is a high probability of completing the formation of wave b. According to alternative wave count, the upward wave will be longer, but it should be followed by the start of a downtrend, so I do not recommend buying.

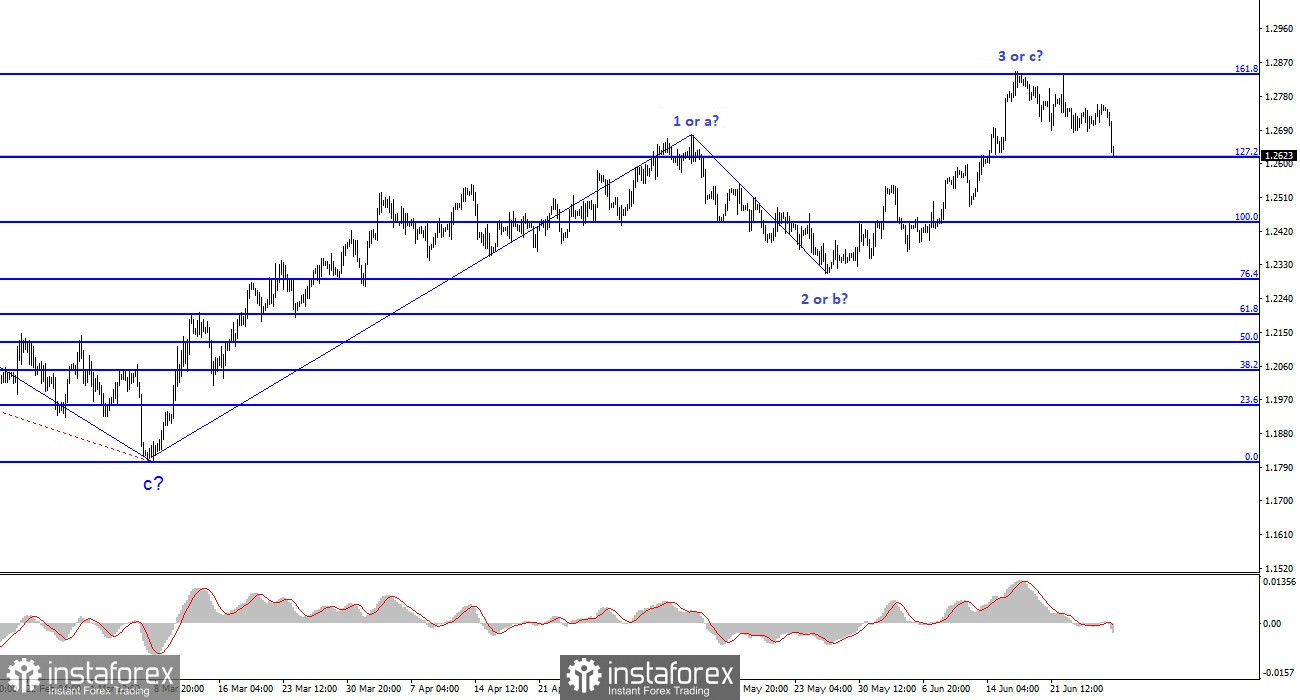

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward wave that can be completed at any time (or it is already completed). You can buy the instrument only if there is a successful attempt to break above the 1.2842 level. Selling appears more promising now, and I advise placing a stop-loss above the 1.2842 level. A successful attempt to break below 1.2615 will indicate the market is ready to sell further with targets near the lows of wave 2 or b.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română