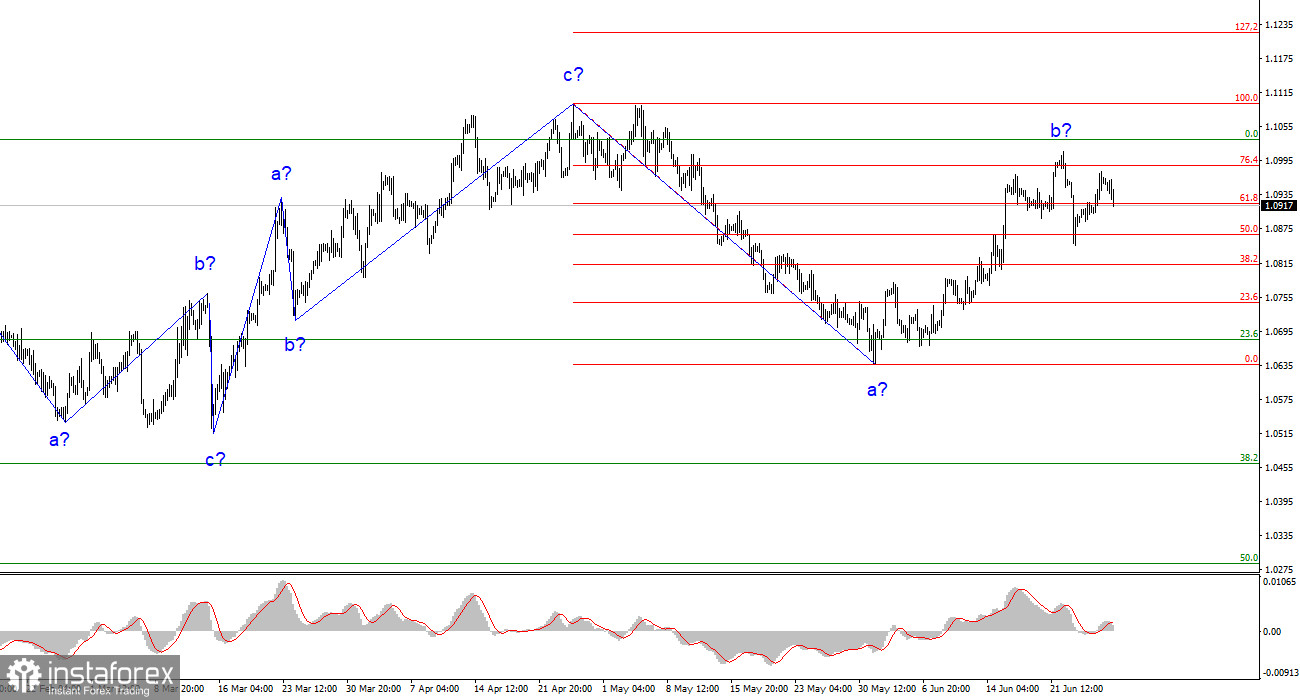

The wave analysis of the 4-hour chart for the euro/dollar pair is somewhat unconventional but reasonably clear. The ascending trend segment that started on March 15th could have a more complex structure. However, I anticipate forming a three-wave downward trend segment. I have consistently expressed my expectation for the pair to approach the 1.05 figure, where the upward three-wave structure began. I still hold this view. The presumed wave b may have completed its formation this week, indicated by the subsequent decline in quotes from the reached peaks.

Considering recent events, particularly the GBP/USD pair movements, I have developed an alternative wave analysis. The entire trend segment between March 15th and April 26th is a single wave a. If this is the case, the next wave would be b, and currently, we are witnessing the formation of an upward wave c. In this scenario, the wave analyses of the British pound and the euro align, suggesting a continuous movement of the euro towards the 1.11 figure and beyond.

Christine Lagarde's speech did not bring any new information. Today, at an economic forum in the Portuguese city of Sintra, all three key officials of the central banks delivered speeches. While we will analyze Christine Lagarde's statements in this review, it is important to note that her remarks are similar to her previous ones.

Lagarde mentioned that there is still much work to be done at the European Central Bank, inflation remains unacceptably high, and there is a high probability of a 25 basis point rate increase in July. These statements do not provide any new information as the market already had confidence in the expected rate hike at the upcoming meeting. It is important to remember that central bank presidents' statements primarily influence market rate expectations. Lagarde's remarks about high inflation and rising rates suggest that the market may be preparing for further tightening of monetary policy.

However, there may not be a significant reaction if the market had been aware of this tightening before Lagarde's speech. Today, we observed a decrease in demand for the euro currency, which may seem surprising considering Lagarde's comments. However, the wave pattern suggests this scenario. The possibility of a more complex upward trend segment remains reserved for now, and we can expect the formation of a downward wave at present.

In conclusion, based on the conducted analysis, it is evident that the formation of a downward trend segment is ongoing. There is still significant room for the pair to decline. Targets around 1.0500-1.0600 are considered realistic, and selling the pair based on MACD signals pointing "down" is recommended. There is a high probability of completing the formation of wave b. According to the alternative wave analysis, the upward wave would be more extensive but followed by the formation of a downward trend segment. Therefore, buying at this time is not recommended.

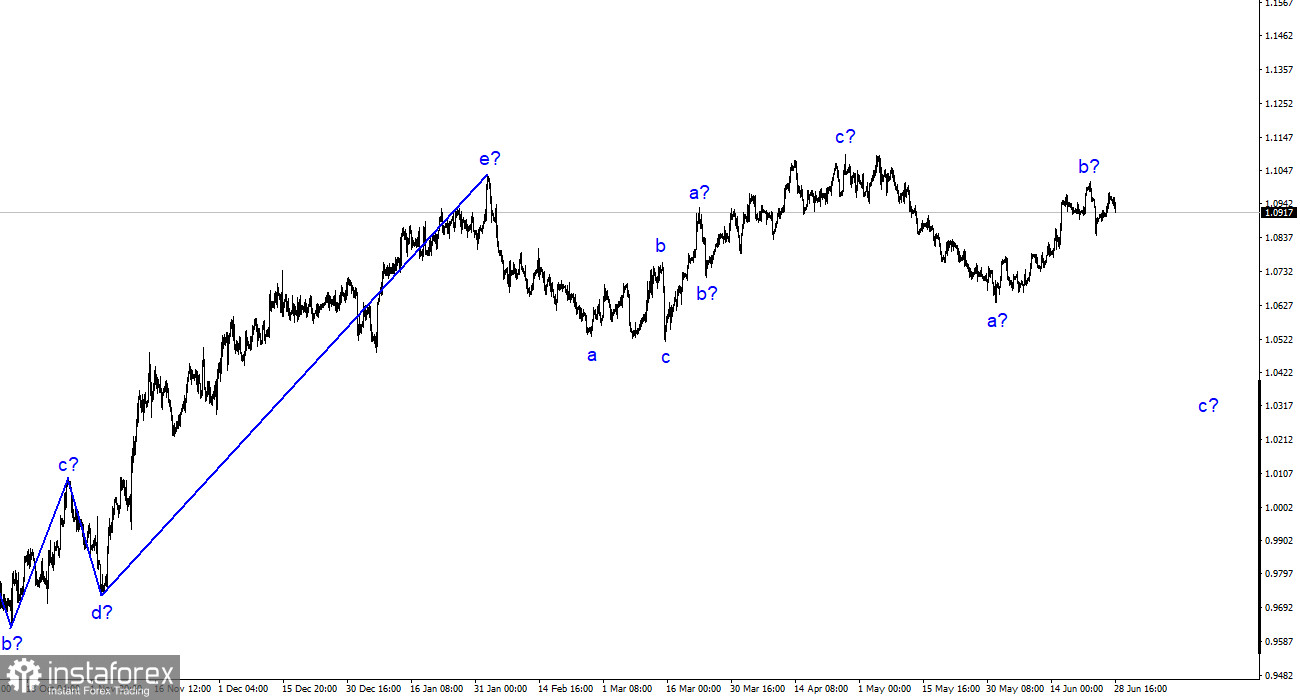

On a larger wave scale, the wave analysis of the upward trend segment has taken on an elongated form and is likely completed. We have observed five upward waves, which likely constitute the structure of a-b-c-d-e. Subsequently, the pair formed two three-wave structures, one downward and one upward. It is likely in the process of constructing another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română