The Australian dollar faced a rough session today, weighed down by an underwhelming inflation report. The CPI data missed expectations and landed in the red, leading to a wave of disappointment among AUD/USD bulls. The inflation data, released during today's Asian trading session, came up short of its forecast, pushing the Australian dollar into hazardous territory. This less-than-rosy scenario could spell trouble for the Reserve Bank of Australia's (RBA) upcoming July meeting. It seems the prospect of a rate hike next month has dwindled dramatically, with some experts flagging the possibility of it plunging to zero. Before the report, many fundamental indicators were already hinting at a likely pause in July. The May inflation report has further solidified this forecast.

Inflation - new adversary of AUD

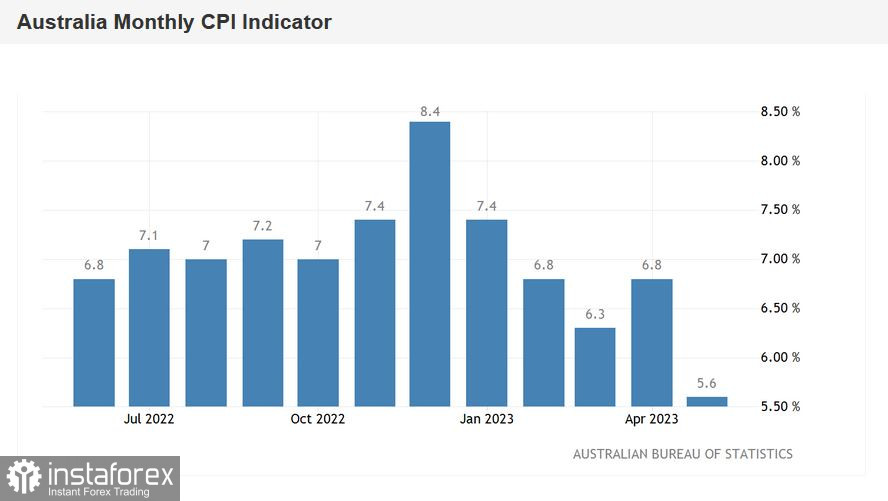

From a numbers perspective, the situation looks bleak. Between December 2022 and March 2023, the Consumer Price Index (CPI) trended downward, dropping from 8.4% to 6.3%. It was expected to decrease to 6.1% in April, but defying the majority of expert forecasts, it climbed to 6.8%. This trend was a major factor influencing the RBA's decision to hike the rate by 25 basis points in June. Now, today's inflation print could influence the July meeting in a similar fashion, as the CPI, instead of an expected drop to 6.1%, fell to 5.6%, marking the smallest increase in the index since spring 2022.

A detailed look at the data reveals that inflation growth in May can be largely attributed to soaring housing (+8.4%) and food and non-alcoholic beverages prices (+7.9%). However, these sharp increases were counterbalanced by a notable decrease in auto fuel prices (-8.0%).

What does it mean for AUD/USD? Today's release takes some wind out of the hawkish sails concerning the RBA's future actions. After the June meeting, market estimates for another July rate hike stood at an even 50/50. Although the RBA maintained a moderately hawkish stance in its statement, suggesting potential policy tightening due to persistent high inflation, the subsequent June meeting minutes painted a cooler picture.

The minutes revealed the central bank's dilemma: maintain the status quo or push for a 25 basis-point rate hike. Eventually, they chose the latter, but with the committee noting that the arguments were finely balanced. This tone suggests that the RBA may opt for a rate-hike pause again – unless a significant uptick in inflation forces a reassessment of policy tightening.

Aftermath of CPI data release

Inflation has delivered a blow to the Australian dollar. Following today's data release, AUD/USD plunged to a three-week low, bottoming out near 0.6600. In essence, AUD bulls have played their last hand. The only path left for an upturn would be a weaker US dollar, which itself is holding its breath for today's speech from Jerome Powell and the release of the PCE index on Friday.

Should the Fed Chair double down on his previous statements, the southward trend could accelerate due to the divergence of Fed and RBA policy tracks. Earlier, Powell suggested another rate hike or maybe even two before year's end during his testimony in the US Congress last week. The market is almost completely assured a rate hike from the Fed in July is coming, but further monetary tightening still leaves some room for doubt. If Powell's stance veers further hawkish post-July, it could push up the US dollar greenback across the board, particularly against its Australian counterpart.

The so-called "Australian NFPs" make a compelling argument for maintaining the status quo at the RBA's July meeting. Fresh data has revealed Australia's unemployment rate has crept up to 3.7%, beating forecasts of 3.5%, while April's employment figures shrunk by 4,000, despite expert predictions of nearly 30,000 growth. Employment has decreased for the first time since January 2023.

Today's inflation report is yet another blemish on the AUD/USD's fundamental canvas, spelling bad news for the Aussie dollar.

On the technical side, AUD/USD has found itself trapped between the Bollinger Bands' middle and lower lines on the daily chart and beneath all lines of the Ichimoku indicator, including the Kumo cloud. Additionally, the bearish 'Line Parade' signal formed by the Ichimoku cloud suggests further price decreases. This indicates that going short on the pair might be an option at current positions (or during correctional pullbacks) towards the closest support level of 0.6550 - the lower line of Bollinger Bands on the same timeframe.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română