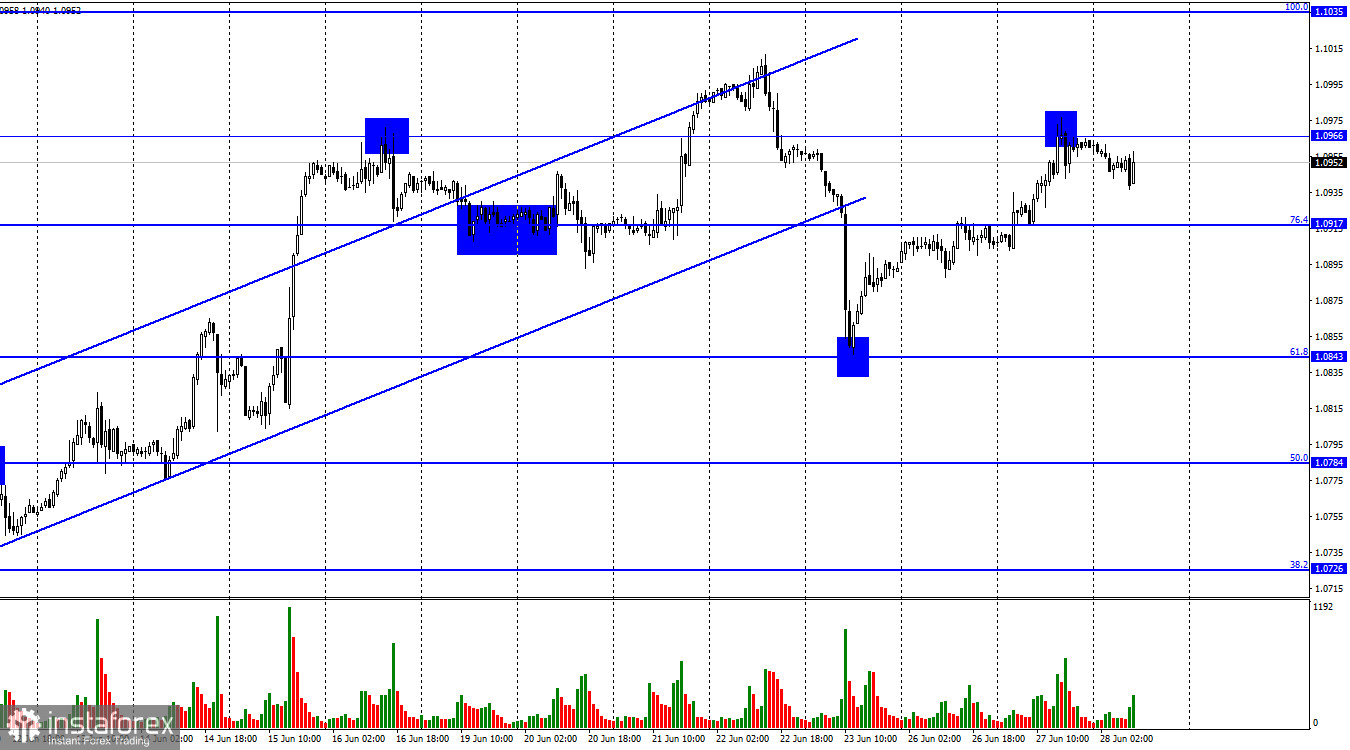

Good day, dear traders! On Tuesday, after settling above the 76.4% retracement level of 1.0917, EUR/USD extended growth and tested the 1.0966 mark. A pullback occurred and the pair headed toward 1.0917. The close of the price above 1.0966 will increase the likelihood of growth to the 100.0% retracement level of 1.1035.

Yesterday was not the most interesting day in terms of fundamentals. Christine Lagarde opened a forum in Sintra where she said the regulator was considering continuing tightening for a longer period than previously anticipated. She also noted that inflation remained high, leaving the ECB no choice but to raise interest rates. Her remarks could provide support for the euro during the day.

In recent weeks and months, the ECB has repeatedly shown that interest rates will be raised higher than 4%. The consumer price index is declining at a good pace. However, the impact of tightening will reduce over time, and inflation will be falling at a slower pace. Still, the indicator is too far from the target level to expect the end of tightening. Therefore, the ECB chooses the most cautious, yet hawkish approach, – to continue raising rates at a moderate pace, without spikes like in the case of the Bank of England, in order to avoid market and banking shocks.

Thus, the euro may continue strengthening if the ECB remains hawkish. Today, Philip Lane, Luis de Guindos, and Christine Lagarde will speak. They are all expected to show their readiness to raise rates at the next meetings. Therefore, the euro may edge higher.

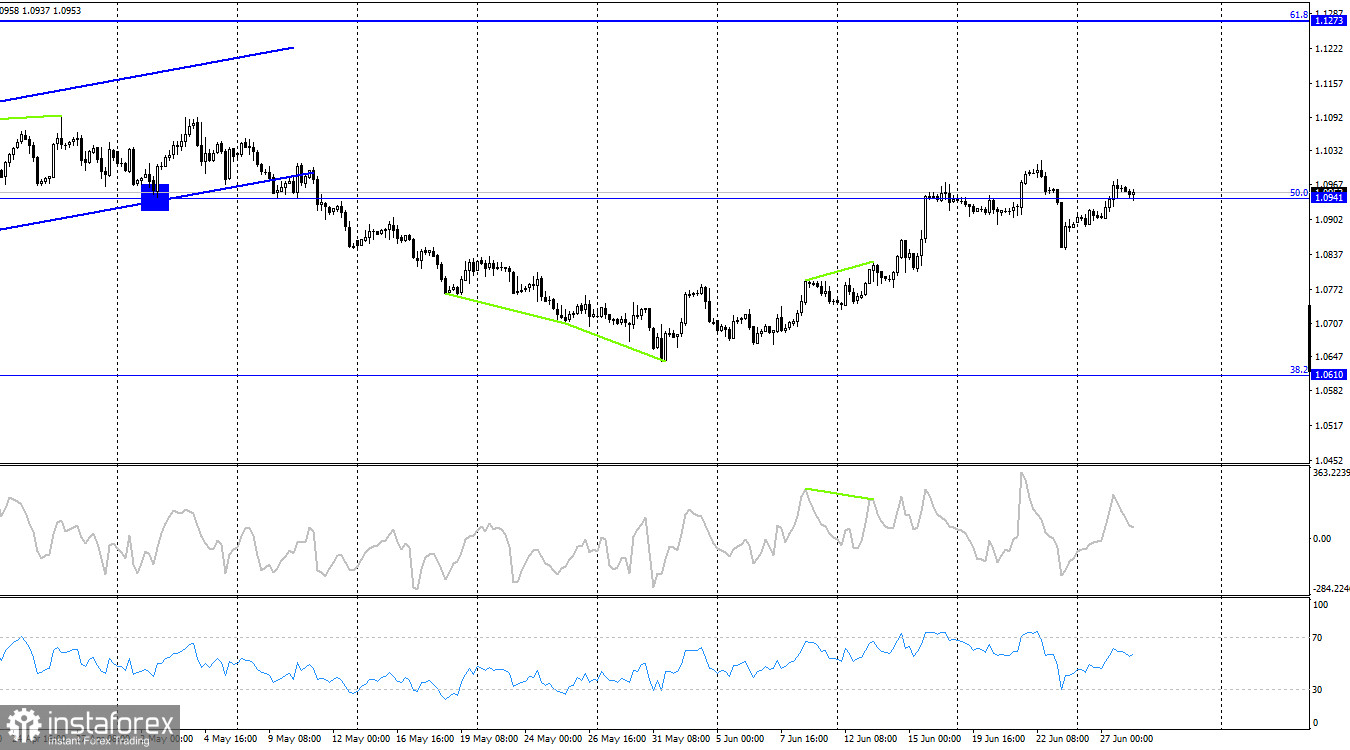

In the 4-hour time frame, EUR/USD reversed to the upside and consolidated above the 50.0% retracement level of 1.0941. Growth may extend to the 61.8% Fibonacci level of 1.1273. Neither of the indicators shows divergence. Consolidation below 1.0941 will trigger a reversal to the downside to the 38.2% retracement level of 1.0610.

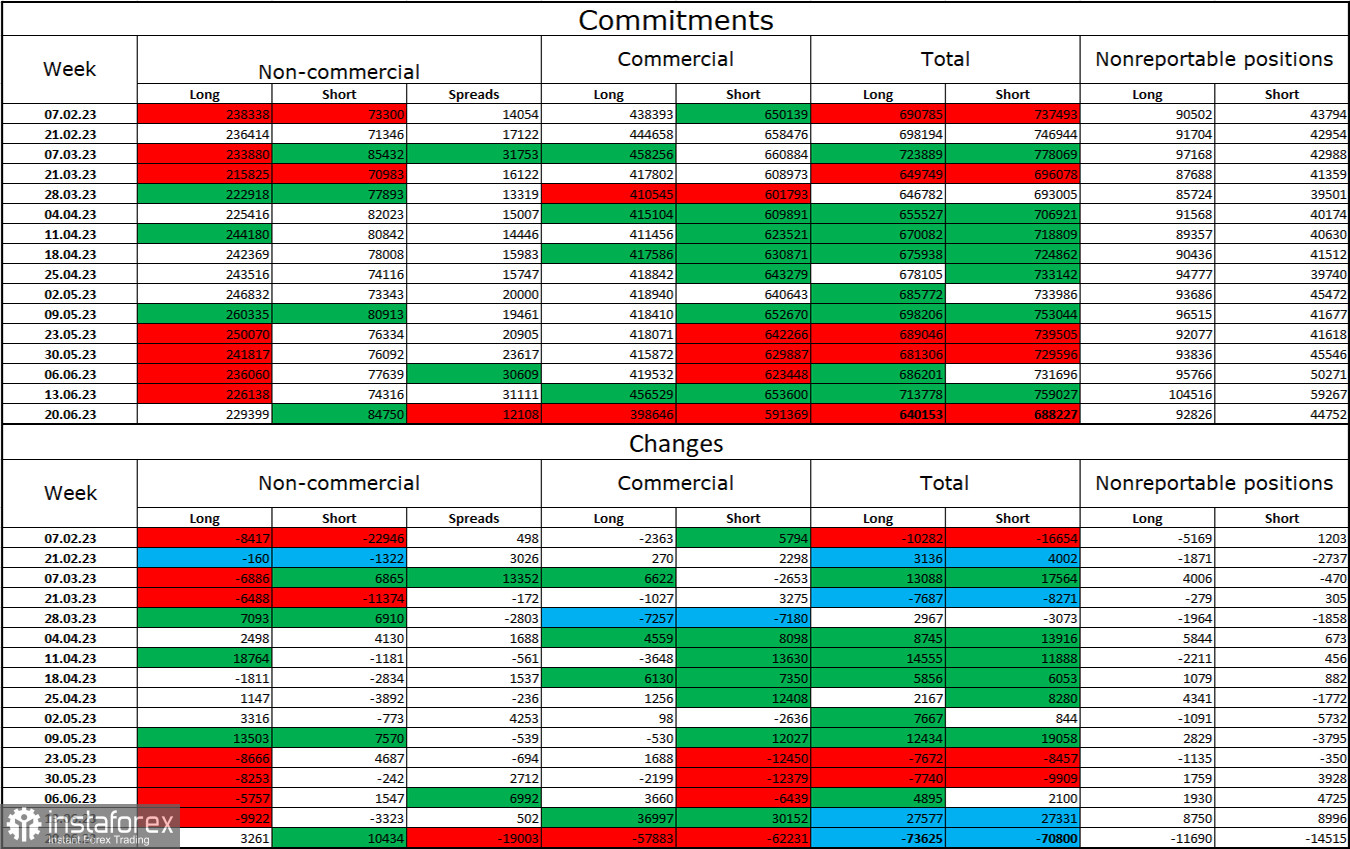

Commitments of Traders (COT):

In the reporting week, speculators opened 3,261 long positions and 10,434 short ones. Sentiment is still bullish among large traders but has begun to decrease slowly. Overall, speculators hold 229,000 long positions and 85,000 short ones. Although sentiment is bullish, the situation may change soon. Over the past two months, the euro has been bearish more often than bullish. A large number of long positions indicates that buyers may soon begin to close them (or have already started as seen from the latest COT report). I expect the euro to fall in the near term.

Macroeconomic calendar:

Eurozone: ECB President Lagarde speaks (13-30 UTC).

US: Fed Chair Powell speaks (13-30 UTC).

On June 28, the macroeconomic calendar contains three important events. The heads of the ECB and the Fed as well as some other policymakers will speak. The fundamental backdrop may influence trader sentiment in the second half of the day.

Outlook for EUR/USD:

We sell after consolidation below 1.0917 on the 1-hour chart, with targets at 1.0843 and 1.0784. Previously, I said it would be wiser to buy after the close above 1.0917, with targets at 1.0966 and 1.1035. The price reached the first target. Now we buy after closing above 1.0966.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română