EUR/USD

Higher timeframes

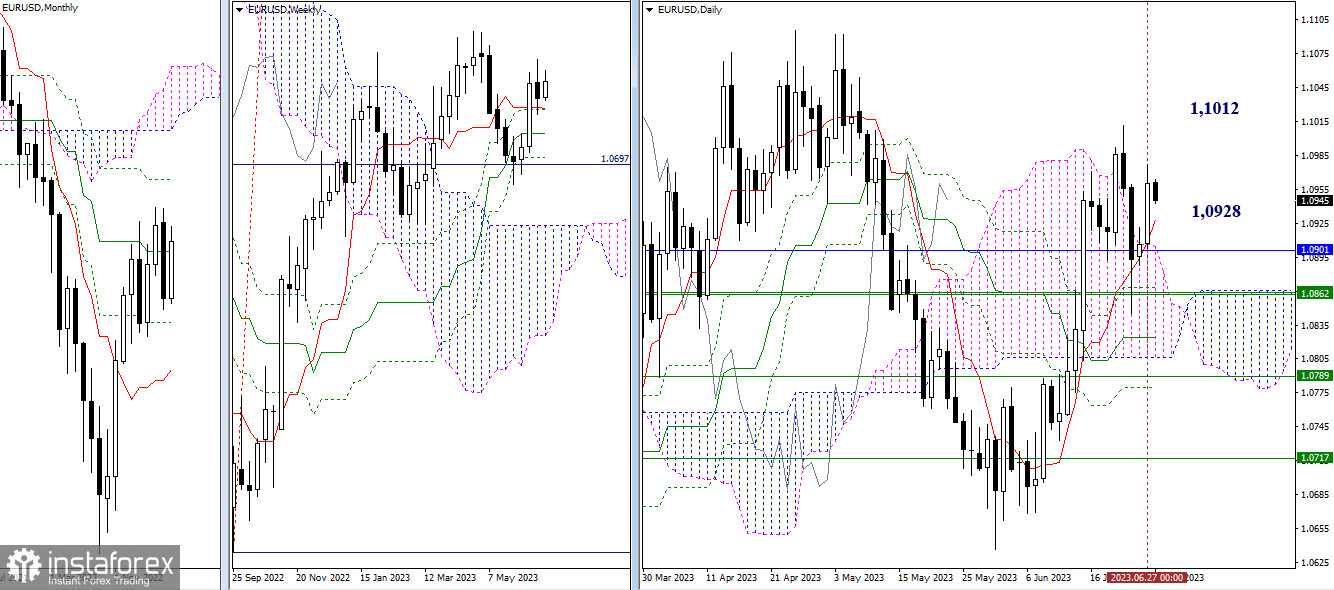

Buyers were able to close above the daily Ichimoku cloud yesterday. Confirmation of the result and continuation of the upward movement will shift the focus to the established target for breaking the daily cloud. For now, the nearest bullish targets remain the highs at 1.1012 and 1.1096. In the current situation, the support levels are 1.0928 (daily short-term trend), 1.0901-04 (upper boundary of the daily cloud + monthly medium-term trend), and 1.0864-62 (weekly levels).

H4 - H1

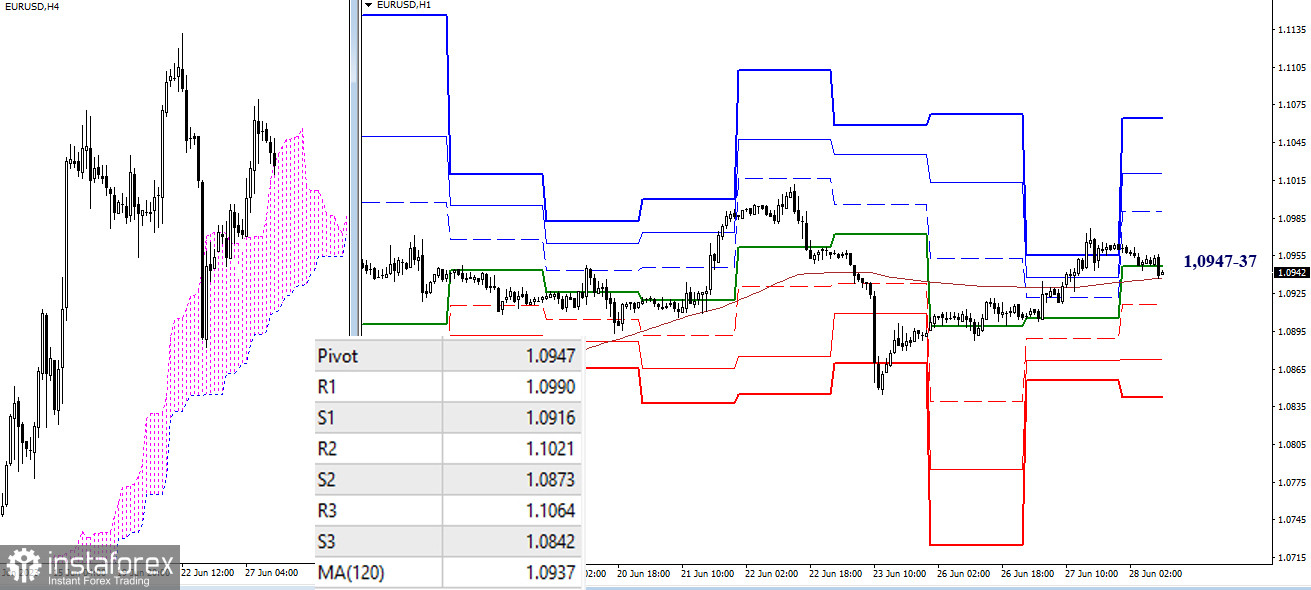

Buyers have risen above the weekly long-term trend (1.0937) and have the advantage. However, actively continuing the ascent is not yet possible. The pair is once again testing key levels on lower timeframes, which are converging around 1.0947-37 (central pivot points + weekly long-term trend). Trading above these key levels indicates the advantage of buyers, while a sustained move below them would give a chance for bearish sentiment to develop. In case of increased activity within the day, the classic pivot points will serve as reference points. For buyers, the resistances at 1.0990, 1.1021, and 1.1064 will be of importance, while the supports at 1.0916, 1.0873, and 1.0842 will be for the sellers.

***

GBP/USD

Higher timeframes

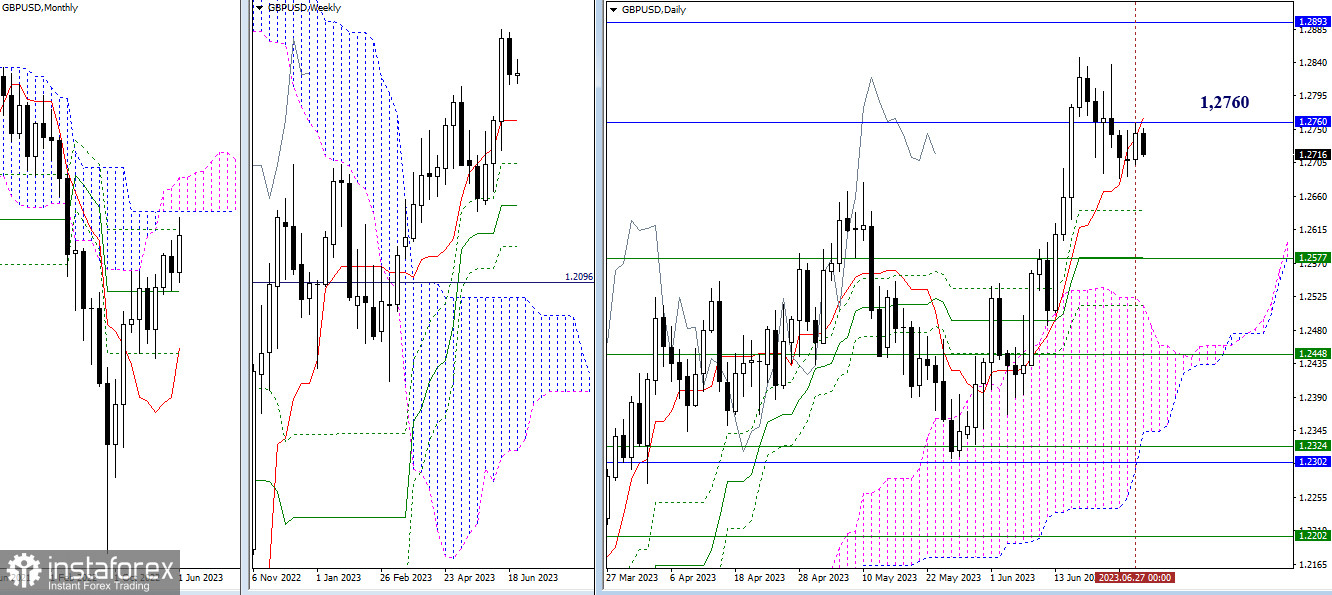

Yesterday, buyers came close to the monthly resistance (1.2760). The outcome of this interaction will determine further developments. A sustained move above it may contribute to the recovery of the buyers' position. Their targets will still be the current daily correction high (1.2847) and the lower boundary of the monthly cloud (1.2893). A rebound and further decline will bring back the relevance of supports at 1.2641 (daily Fibonacci Kijun) and 1.2577 (daily medium-term + weekly short-term trend).

H4 - H1

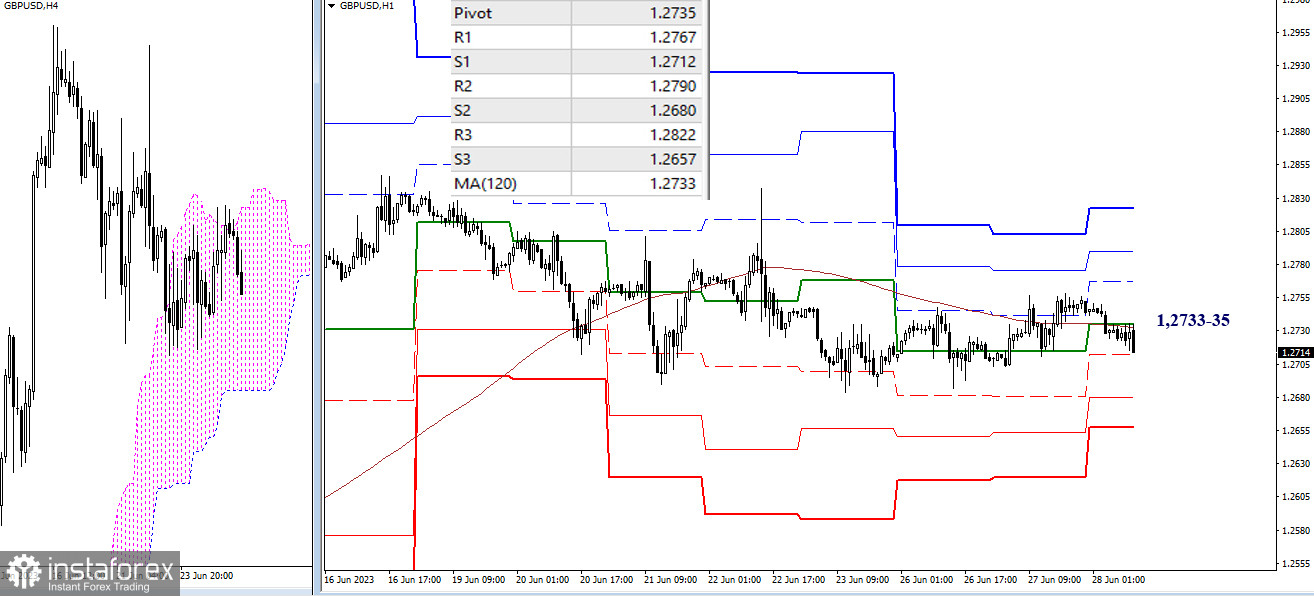

On lower timeframes, the pair is currently demonstrating more uncertainty, alternating between holding above and below key levels, which are currently around 1.2733-35 (central pivot point + weekly long-term trend). In case one side strengthens, the support levels (1.2712, 1.2680, 1.2657) and resistance levels (1.2767, 1.2790, 1.2822) of the classic pivot points will come into play for intraday trading.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română