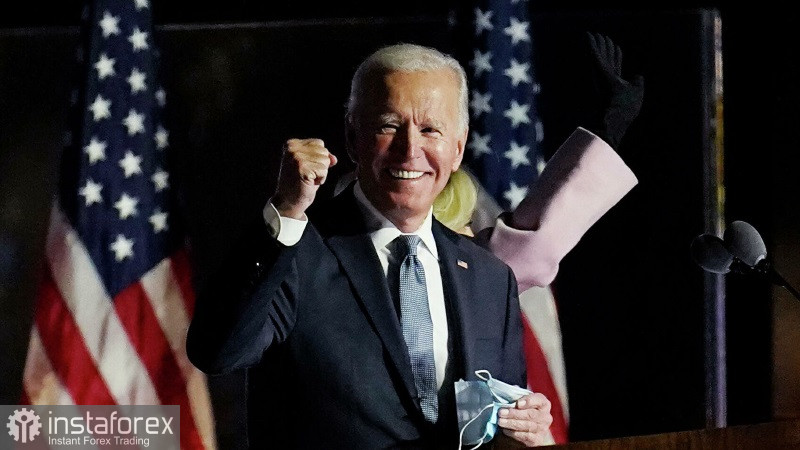

As the world watches central banks fiercely battling towering inflation, potentially the longest-lasting in decades, US President Joe Biden is confident that the US will sidestep the recession that economists and banks have been forecasting for some time.

The US President says that economists predict a recession next month. However, they have been saying that for the last 11 months. The US leader also assured that recession is unlikely to happen, citing the still-strong labor market and efforts to curb inflation.

Recent figures for the housing market, sales, production, and consumer confidence have outperformed expectations, painting a picture of a resilient economy. Yesterday's report revealed that new housing purchases have soared to a year-high, while orders for durable goods have surpassed estimates. The fact that US consumer confidence has reached its highest level since the beginning of 2022 also indicates positive household sentiment.

Although the data does not rule out the possibility of a recession next year, they offer reasons to believe a downturn is not inevitable. According to the latest monthly survey of economists, it is expected that the economy will dodge a recession this year, but core inflation will end up higher than initially projected.

Biden's various appearances can be seen as attempts by the White House administration to boost its public image ahead of the 2024 elections. Earlier this week, Biden announced plans to allocate over $40 billion to finance high-speed internet infrastructure, presenting it as an example of how his administration is striving to assist all Americans, even those who did not vote for him.

Recent polls reveal that, despite low unemployment levels and the passing of a bill addressing the pandemic, infrastructure expenses, and climate, voters generally view Biden's handling of the economy as poor.

Some economists and political scientists note that if a recession were to hit within the next 12 months, Biden would hope it comes sooner rather than later, preferably before the election race heats up.

As for the EUR/USD pair, bulls control the market and need to push the price above 1.0980 and settle above it. This could pave the way towards 1.1010. From that point, a climb to 1.1060 is possible, but it will be challenging without fresh positive data from the eurozone. If the trading instrument declines, bulls should protect 1.0930. If we see a lack of bullish activity there, it might be worth waiting for a retest of the low of 1.0890 or opening long positions from 1.0840.

As for the GBP/USD pair, the demand for the pound remains even despite a slight correction. Growth in the pair will be possible after control over 1.2760, as a breakout of this area will strengthen hopes for further recovery to 1.2820, after which it will be possible to talk about a recovery of the pound to 1.2880. If the pair falls, bears will try to take control of 1.2690. If they manage to do so, the breakdown of this area will deal a blow to the bulls' positions and push the pair to the lows of 1.2630 and 1.2570.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română