When central banks' fight against inflation continues, the rise of geopolitical risks is merely a temporary supportive factor for gold. The mercenary uprising in Russia seemed to bring it back to life. However, the rebellion quickly subsided, and the level of uncertainty decreased. It is not surprising that XAU/USD quotes continued to decline.

The precious metal does not generate interest income. In this sense, it is similar to the Japanese yen, whose issuing central bank keeps yields at a low level. As a result, the yen is clearly an outsider in the G10 amid the rally in global debt market rates. Gold is also doomed to fall.

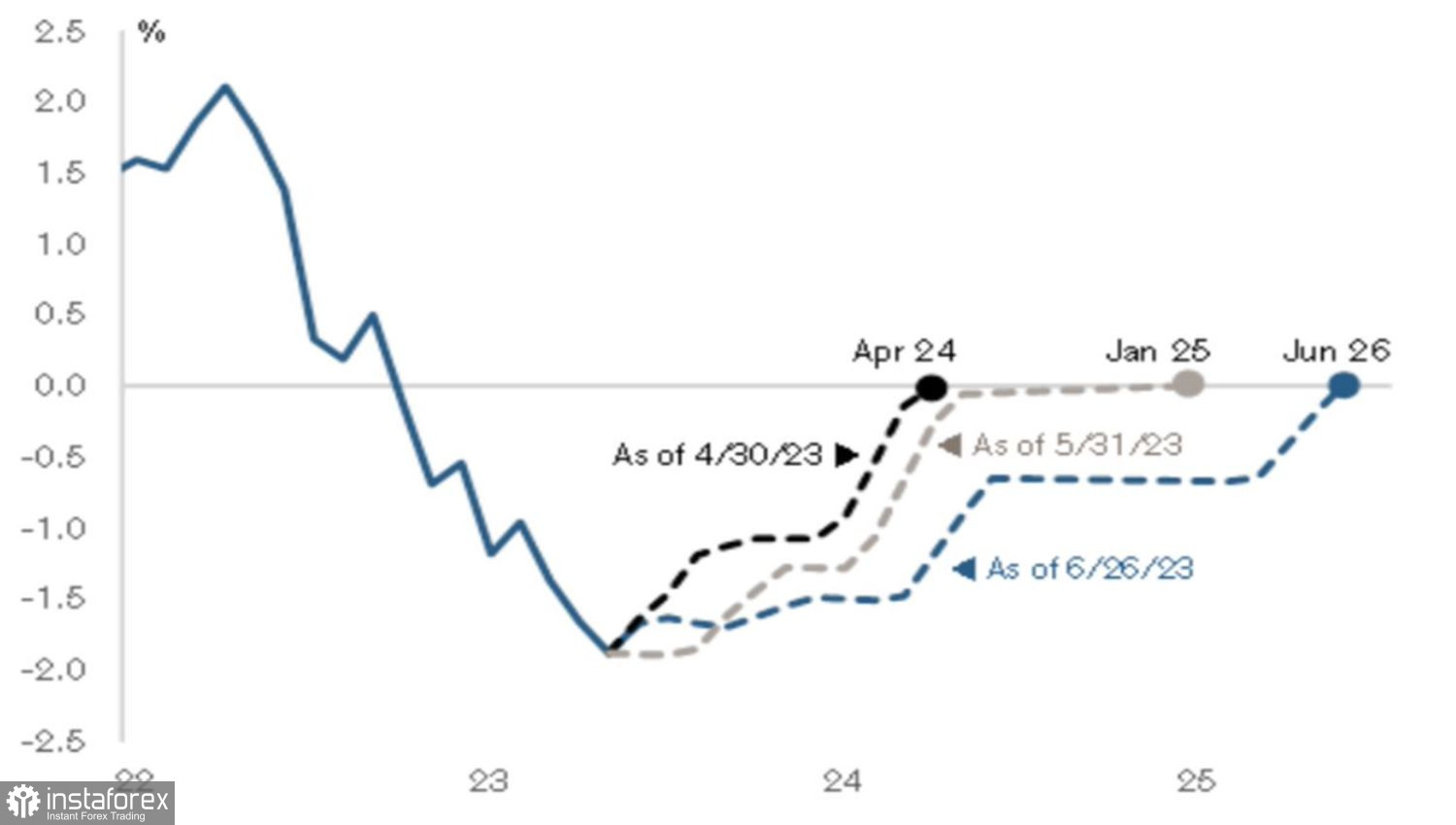

The reasons for its downfall in June are the unmet expectations of an imminent recession in the U.S. economy and the determination of central banks to fight inflation. Previous yield curve inversions signaled an impending downturn. On average, it arrived 11 months after the inverted curve began. It is no wonder that many Bloomberg experts bet on September.

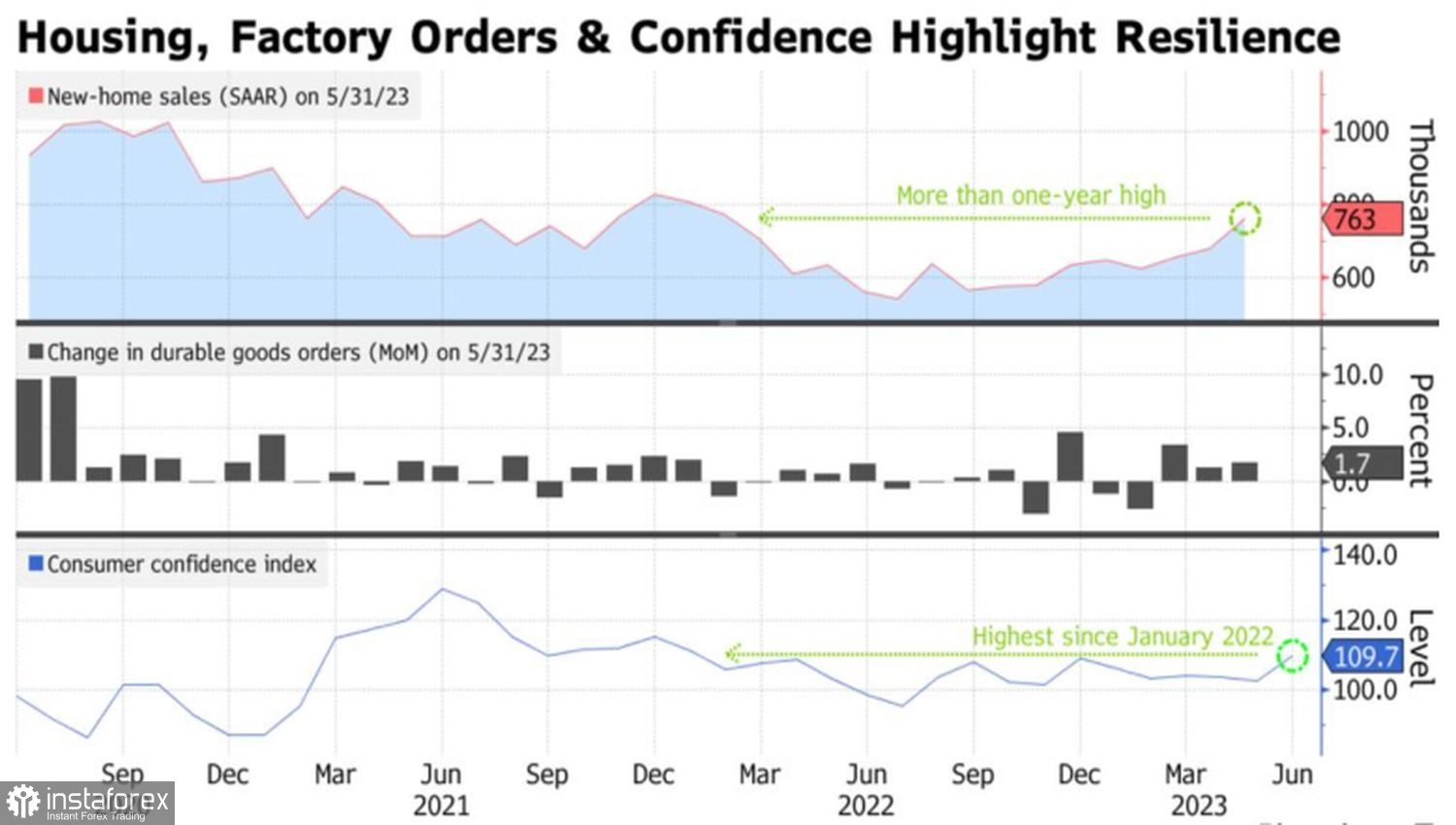

Credit Suisse Group AG, on the other hand, believes that recessions occur when the indicator starts returning to a normal state. This is only expected to happen in 2026. Indeed, the latest statistics on new home sales, orders for durable goods, and consumer confidence are pleasing. The U.S. economy is standing firm, and the Federal Reserve can afford to continue raising the federal funds rate.

Dynamics of the U.S. yield curve

The pressure on gold comes not only from the Federal Reserve but also from other central banks of the world. Australia and Canada have resumed cycles of tightening monetary policy. The Eurozone intends to raise deposit rates to 4%, and the Bank of England to 6.25%. In such conditions, the rally in bond yields on the global market appears logical. Gold—which does not generate interest income—feels out of its element. It is not even helped by the weakening of the U.S. dollar against the euro amid "hawkish" comments from members of the Governing Council led by Christine Lagarde.

What can save gold? It is difficult to answer that question now. It has become a victim of investors' excessive fears about an impending recession in the United States and hopes for a rapid slowdown in inflation. All this has increased the risks of the Fed's "dovish" pivot in 2023. Currently, investors are not even thinking about it. They are more concerned about how high the federal funds rate will rise.

Dynamics of U.S. indicators

The futures market indicates a 77% probability of a 25 bps rate hike to 5.5% in July and only a 20% chance of an increase to 5.75% in December. If the latter figure continues to increase, the U.S. dollar will strengthen, Treasury bond yields will rise, and XAU/USD quotes will continue to peak.

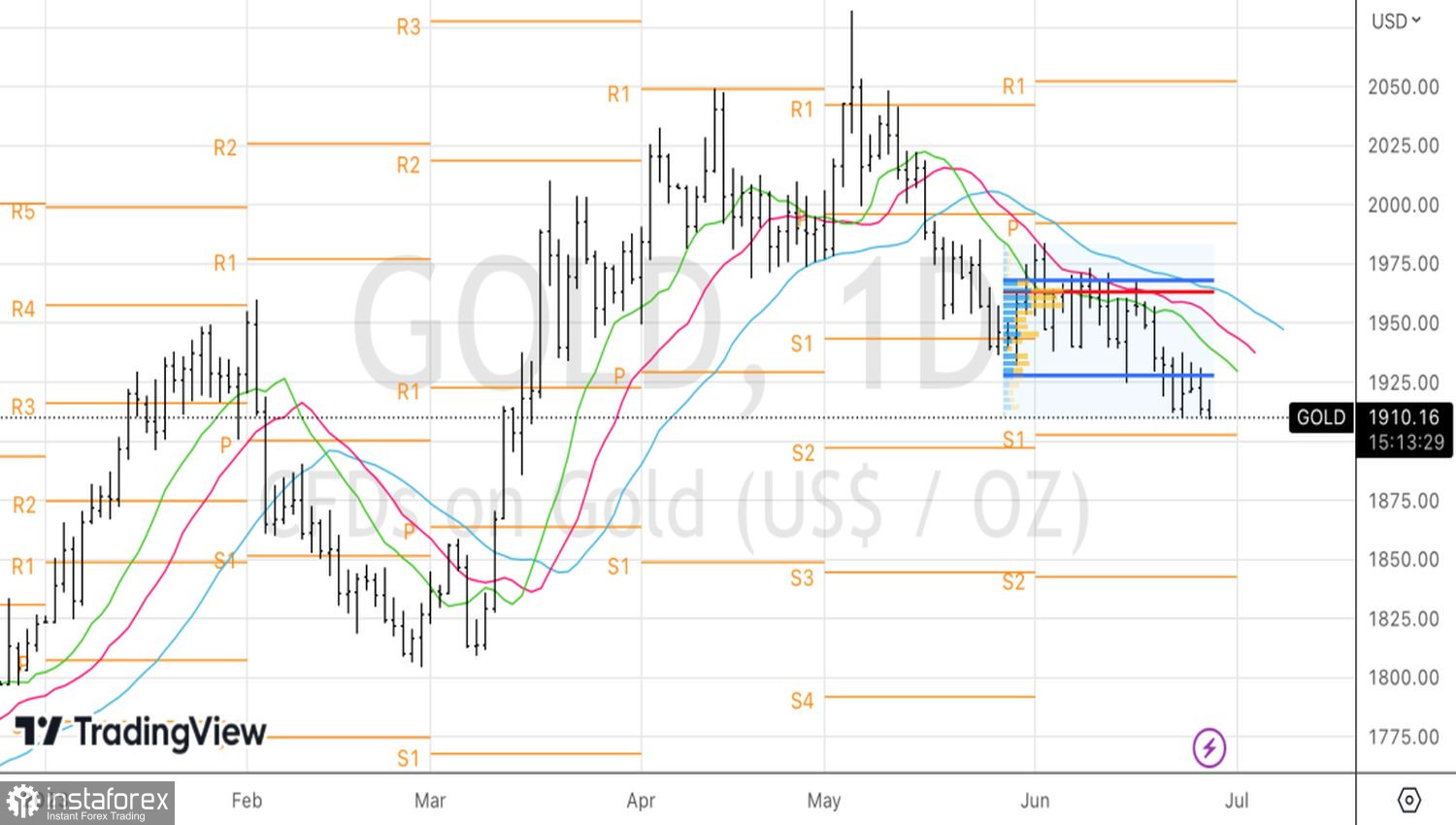

Technically, on the daily chart of gold, the Spike and Ledge pattern was clearly realized. Breaking its lower boundary at $1,930 per ounce allowed us to establish short positions. Let's build them up with targets at $1,865 and $1,845.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română