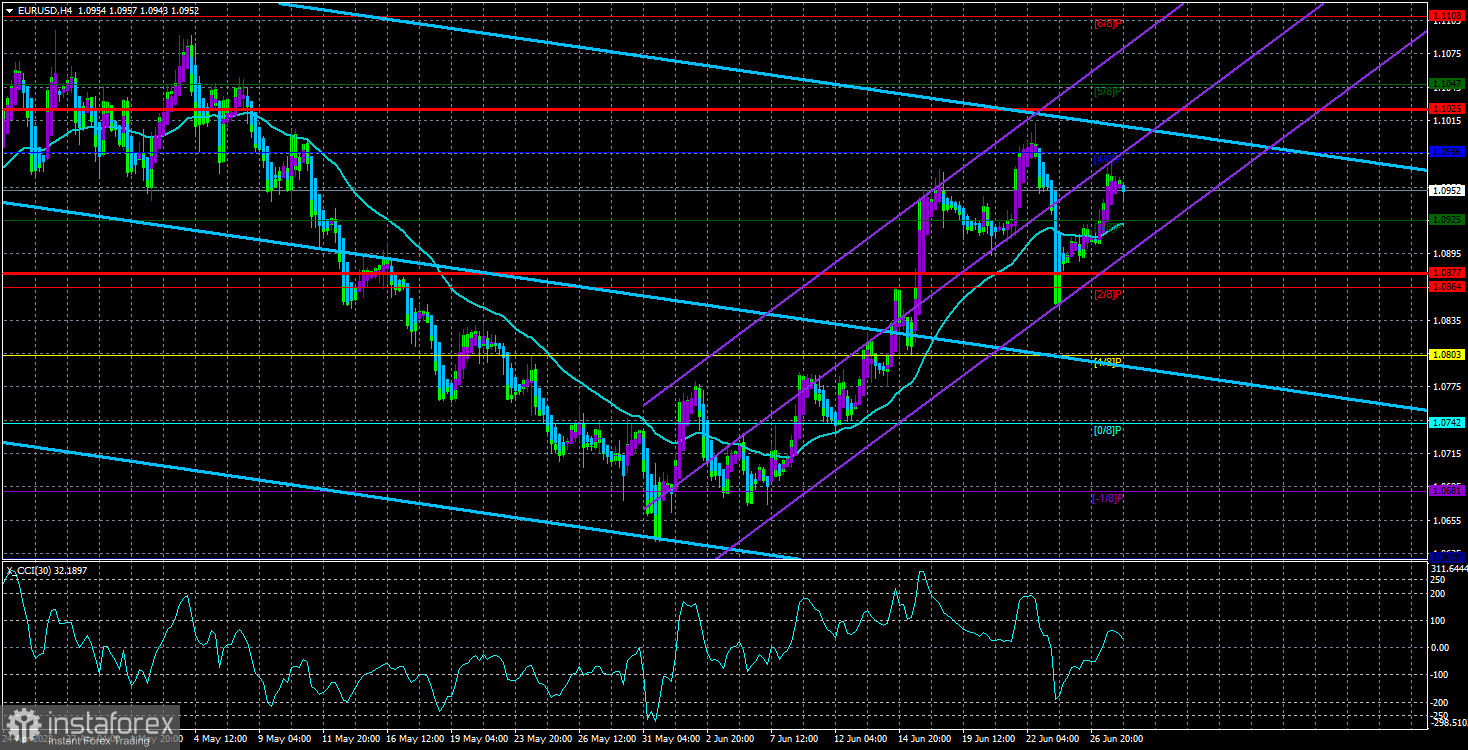

Once again, the pair consolidated above the moving average line, which could lead to a resumption of the upward trend that has been forming over the past couple of weeks. However, this trend is primarily a correction against the previous monthly decline of the pair. Additionally, a "head and shoulders" pattern is emerging in the 4-hour timeframe, which, if successfully formed, could indicate a continuation of the European currency's decline—a logical development from our perspective.

It's important to note that the ECB continues to raise rates, which may support the euro in the medium term. However, the question of how much the rate will ultimately increase remains uncertain. We have long believed that the rate would not exceed 4.25% (which implies another 0.25% increase) due to concerns about the EU economy entering a recession at higher rates. Furthermore, the possibility of a banking collapse remains. Higher rates negatively impact the banking system, leading to liquidity problems for banks. Therefore, the ECB is unprepared to raise the rate to 5% or 5.5%.

Nevertheless, the European Central Bank releases information indicating its readiness to continue tightening monetary policy. The euro has been trading between 1.05 and 1.11 for the past six months, essentially moving sideways. While it has not shown significant growth during this period, it remains relatively high and does not exhibit a strong inclination to decline. Meanwhile, the Federal Reserve is also preparing for two more rate hikes.

The forum commenced with Lagarde's speech

The ECB organized this economic forum in Portugal, where several central bank representatives will deliver speeches. While we should not expect every speech to contain "loud" statements, we may receive certain information. Lagarde stated recently that the ECB's key rate should be raised to a "more restrictive level." She emphasized that inflation in the European Union remains too high and that stricter measures will be necessary to address it. Lagarde also acknowledged that the factors driving the inflationary spiral are still in effect, indicating an ongoing fight against high price growth.

Lagarde did not reveal anything new, but her rhetoric expressed a stronger conviction for the need to continue tightening. It's worth recalling that the past rhetoric of many ECB representatives needs to be more specific and consistent. Some monetary union members did not see the need for further tightening in the autumn, while others insisted on additional rate hikes. The balance is shifting towards tightening in the autumn and winter of 2023. Therefore, the European currency may gain new growth factors.

However, it's important to remember that the euro has already experienced significant appreciation over the past ten months. Even if the ECB continues to raise rates to 5%, the market has already priced in some rate increases. Therefore, expecting a new rise of 500–1000 points in the euro is not advisable. The pair is consolidating, indicating limited growth or a sharp decline. In the 24-hour timeframe, it is clearer what we mean.

Thus, the pair appears to continue moving within a narrow range. It is currently approaching the upper boundary of this range, suggesting a potential new downward wave towards the 1.0500–1.0600 area.

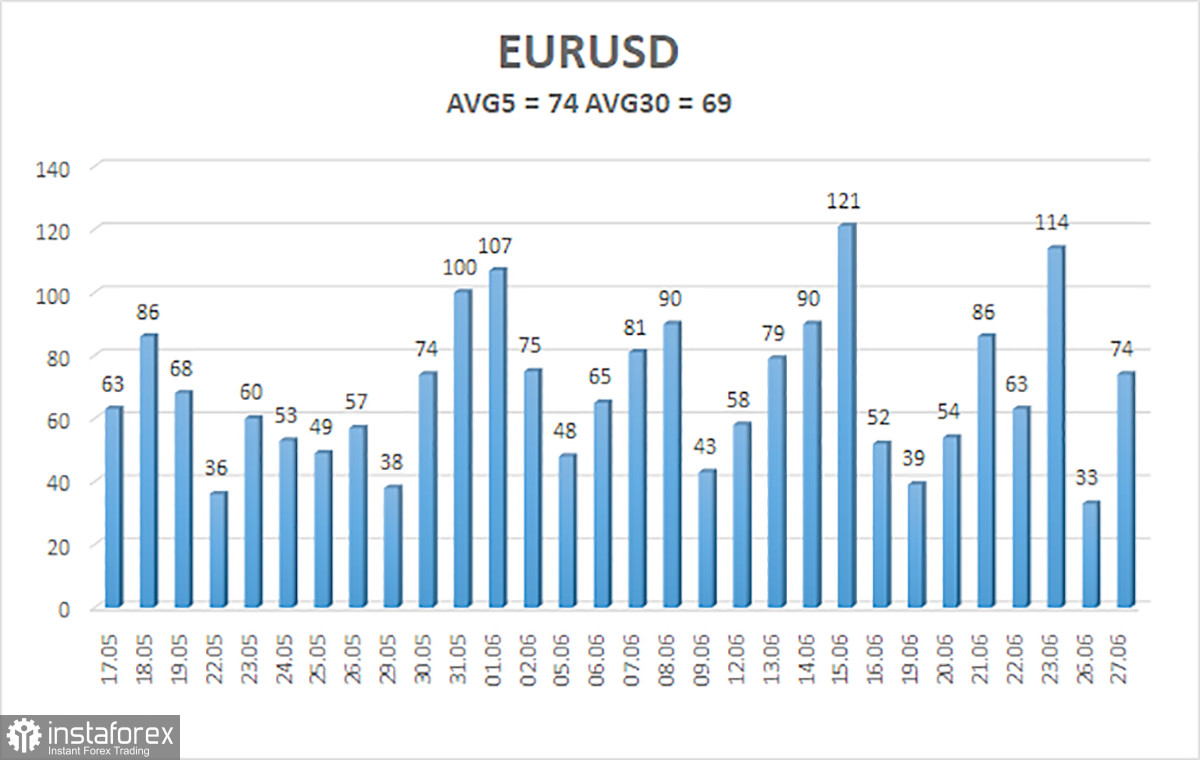

The average volatility of the euro/dollar currency pair for the last five trading days as of June 28 was 74 points, characterized as "average." Therefore, we expect the pair to trade between the levels of 1.0877 and 1.1025 on Wednesday. If the Heiken Ashi indicator reverses downward, it may indicate a possible resumption of the downward movement.

Nearest support levels:

S1 - 1.0925

S2 - 1.0864

S3 - 1.0803

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1047

R3 - 1.1108

Trading recommendations:

The EUR/USD pair has consolidated above the moving average, but it is possible to return below if a "head and shoulders" pattern emerges. It is advisable to maintain long positions with targets at 1.0986 and 1.1025 until the Heiken Ashi indicator shows a downward reversal. Short positions will regain relevance only if the price consolidates below the moving average line, with targets at 1.0877 and 1.0864.

Explanation of illustrations:

Linear regression channels assist in determining the current trend. When both channels point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and trading direction.

Murray levels serve as target levels for price movements and corrections.

Volatility levels (red lines) represent the probable price channel within which the pair is expected to move in the next 24 hours based on current volatility indicators.

The CCI indicator's entry into the oversold zone (below -250) or overbought zone (above +250) suggests an upcoming trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română