The euro and pound continue to enjoy a fairly high demand in the foreign exchange market. In my opinion, this is happening because the European Central Bank and the Bank of England signal that they are both likely to raise interest rates and keep them high for some time. Many analysts were mistaken a few months ago when they assumed that the rates of these central banks would increase only slightly. In the summer of 2023, it seems that they are ready to raise rates as long as it is necessary to suppress inflation. And if that's the case, rates may rise to the level of the Federal Reserve or close to it. Considering that the Fed began raising rates earlier and did so more quickly, the euro and pound are currently in higher demand as it is evident that the Fed will be the first to complete this process.

The ECB Symposium in Sintra started on Monday, with an introductory speech by President Christine Lagarde. Other central bank officials like Fed Chair Jerome Powell, and BoE Governor Andrew Bailey are also set to participate in the economic forum. Lagarde's stance has not changed compared to earlier speeches. She reiterated that inflation in the eurozone is too high, and the central bank will not deviate from its 2% target and will do whatever is necessary to lower it. She also said that the ECB cannot afford to pause and cannot declare victory. "Setting the right "level" and "length" will be critical for our monetary policy as we continue our tightening cycle," said the ECB president. Lagarde also believes that the second phase of the inflation process has begun, which may reignite the inflation spiral.

"We will have to bring rates to "sufficiently restrictive" levels and keep them there "for as long as necessary," Lagarde believes. She also mentioned that rising wages have been amplified, which undermines the Bank's efforts. There was a slight increase in demand for the euro after her speech, but the overall condition of the currency market is more important now. And the current state indicates that the high demand for the euro may persist.

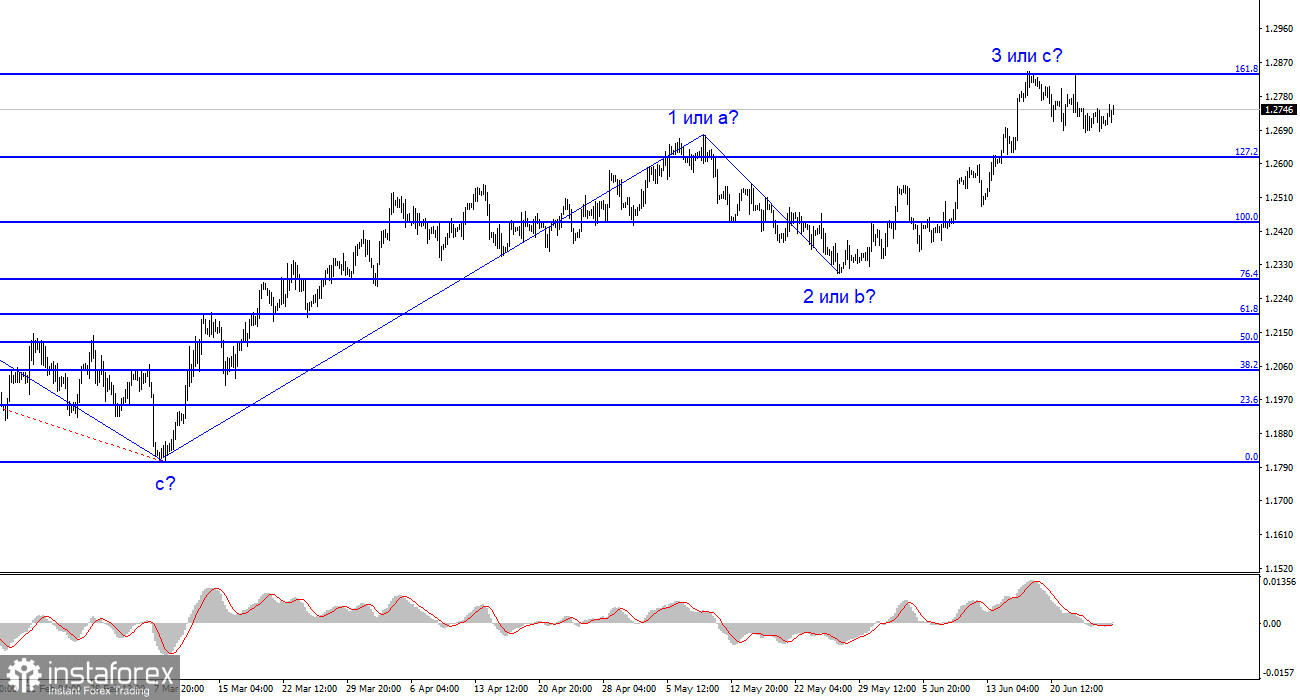

The situation with the pound is similar. Despite the lack of a corresponding reaction to the 50 basis point rate hike, the pound remains near its peak levels overall. The wave analysis allows for the possibility of another upward wave in the form of 3 or C. The same pattern is observed with the euro. Based on the above, both instruments may continue to rise for some time. However, it is up to you whether you choose to buy them at levels close to the peaks.

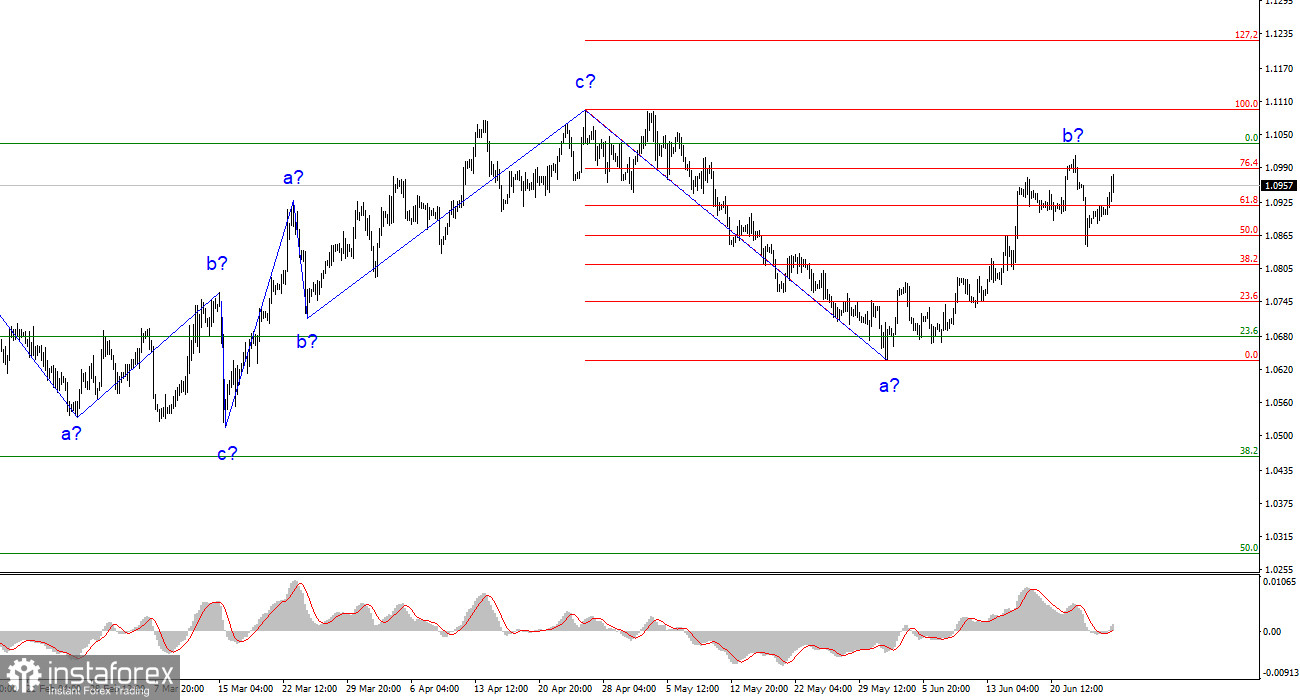

Based on the analysis conducted, I conclude that a new downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument on "downward" signals from the MACD indicator. I believe that there is a high probability of completing the formation of wave b. According to the alternative scenario, the upward wave will be longer, but after that, a descending part of the trend should begin, so I do not recommend buying.

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward wave that can end at any moment. It would be advisable to consider buying the instrument only if there is a successful attempt to break above the 1.2842 level. You can also consider selling since two attempts to break this level have been unsuccessful, and the Stop Loss can be set above it. However, wave 3 or C may take on a five-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română