An increase in volatility in Canadian dollar quotes and the USD/CAD pair is expected at 12:30 and 14:00 (GMT). At that time, Statistics Canada will release data on the dynamics of inflation in Canada (consumer prices account for a large part of overall inflation), while fresh data on the dynamics of durable goods orders from the U.S. will be available (a decrease of 1.0% is expected after a growth of 1.1% in the previous month). At 14:00, data on the dynamics of new home sales in the U.S. will be published (a relative slowdown in growth of 0.5% is also expected after a growth of 4.1% in April), as well as the consumer confidence level for June.

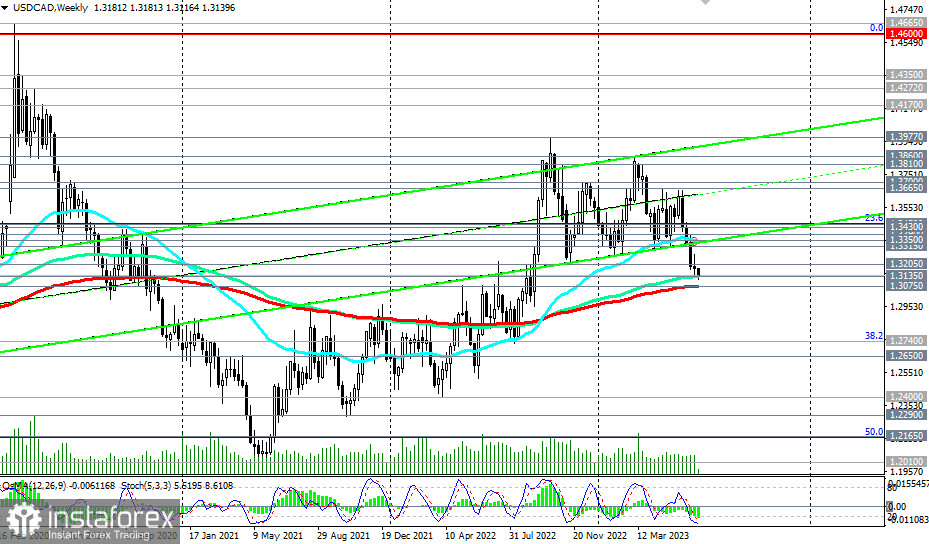

Breaking through the key support level at 1.3075 (200 EMA on the weekly chart) downward would indicate a breakdown of the long-term bullish trend of USD/CAD with the prospect of further decline towards the strategic support level at 1.2650 (200 EMA on the monthly chart), which separates the global bullish market from the bearish one.

The signal to open (or increase) short positions would be a break of the important long-term support level at 1.3135 (144 EMA on the weekly chart) and today's low at 1.3117.

In an alternative scenario, after a breakout of the important short-term resistance level at 1.3205 (200 EMA on the 1-hour chart), USD/CAD will resume its upward movement towards key medium-term resistance levels at 1.3390 (200 EMA on the daily chart), 1.3430 (144 EMA on the daily chart), 1.3450 (23.6% Fibonacci level of the previous upward wave from 0.9700 to the level of 1.4600 reached in January 2016). A breakout of these levels will bring USD/CAD back into the medium-term bullish market zone and resume the positive dynamics of the pair within the long-term and global bullish markets.

Support levels: 1.3135, 1.3075, 1.3000, 1.2740, 1.2650

Resistance levels: 1.3205, 1.3315, 1.3350, 1.3390, 1.3430, 1.3450, 1.3600, 1.3665, 1.3700, 1.3810, 1.3860, 1.3900, 1.3970, 1.4000

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română