EUR/USD

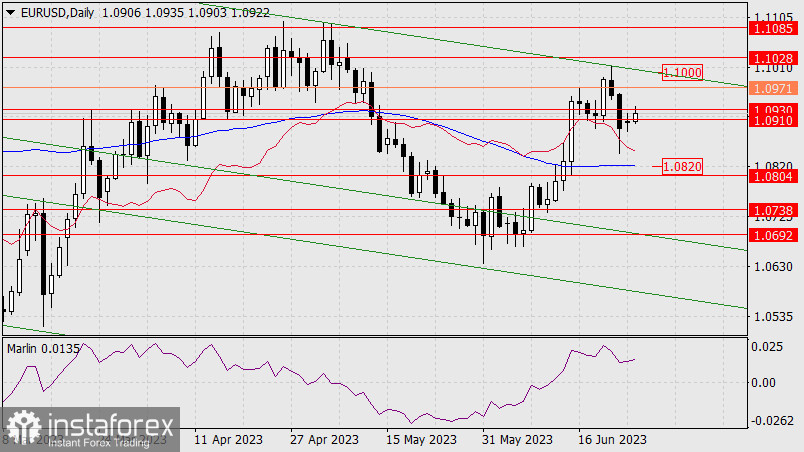

Yesterday was a calm day for all major currency pairs. The euro spent the day below the lower band of the 1.0910/30 range. There was simply no reason for it to rise, as weak IFO indicators for business climate, business expectations, and current assessment were released for Germany. Formally, the daily candlestick closed below this range, which indicates a bearish choice for now.

The target for the downward movement is the 1.0804/20 range, defined by the linear support level and the MACD indicator line on the daily chart. If the price manages to climb above 1.0930, the first growth target would be the intermediate level at 1.0971. The price could further rise towards 1.1000.

On the four-hour chart, the price is developing below the balance and MACD indicator lines. The Marlin oscillator is moving sideways within a downtrend. Today, the US will release data on new home sales for May and consumer confidence for June (forecasted at 103.7 versus 102.3 in May). If the indicators turn out to be positive, the euro will weaken its positions even further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română