The latest weekly gold survey highlights a slightly bearish sentiment among Wall Street analysts and retail investors on Main Street. According to some analysts, support around $1,900 per ounce may only be a matter of time.

However, despite the likelihood of gold declining in the near future, some analysts believe it's a good time for tactical investors to buy the precious metal as a hedge against potential stock market downturns and the growing threat of recession.

Phillip Streible, chief market strategist at Blue Line Futures, expressed disappointment with last week's prices, acknowledging that hawkish policies have intensified selling. However, he noted that now is the best time to buy gold and silver.

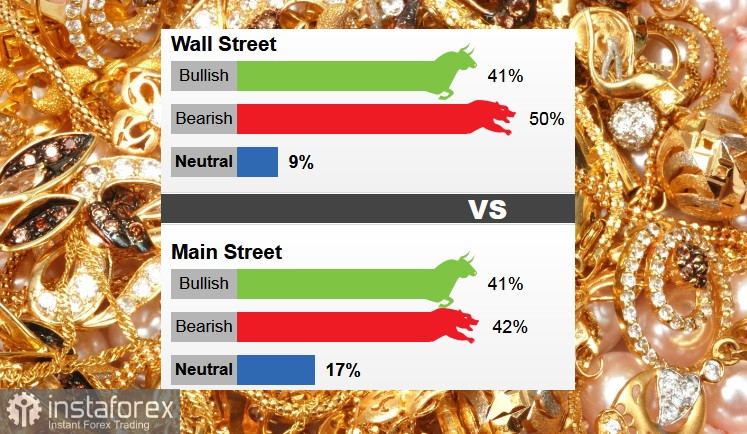

In a survey conducted last week, 22 analysts from Wall Street participated. Among the participants, 11 analysts, or 50%, took a bearish stance for the near term. Nine analysts, or 41%, held a positive view, while two analysts, or 9%, believed that prices were trading in a sideways range.

In online polls, a total of 966 votes were cast. Of those, 395 respondents, or 41%, anticipated price increases for the current week. Anoter 403, or 42%, believed that prices would decrease, while 168 voters, or 17%, expressed a neutral opinion.

Since mid-February, bearish sentiments among retail investors have been at their highest level. Similarly, participation in the survey last week reached its highest level since March.

Among analysts, despite the bearish sentiment, some remain optimistic. According to Alex Kuptsikevich, senior market analyst at FxPro, although rising interest rates have made bonds more attractive than gold, the hawkish bias continues to pose risks to global financial markets. In his opinion, if prices hold support around $1,910, bulls could recover to $1,940 and potentially reach $2,000 per ounce in the long term.

According to George Milling-Stanley from State Street Global Advisors, gold bulls should focus on long-term protection rather than short-term alternative costs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română