The market is re-evaluating things. With inflation slowing at the beginning of the year, investors thought the tightening cycles of leading central banks were nearing. With time, it became clear that prices hold steady and may accelerate. This means that central banks will have to keep hiking rates. This is a warning signal for national economies and their currencies, including the pound sterling.

The Bank of England's decision to increase interest rates by 50 basis points surprised not only Bloomberg analysts but also the derivatives market. Ahead of the MPC meeting, there was a 40% probability of such an outcome. Surprises like this one usually trigger market jitters. This time, the reaction of GBP/USD was subdued. After a brief rally, the pair dropped in value. All this shows how acute the inflation problem is in the UK.

An increase in consumer prices in May to 8.7% disappointed the Bank of England. Andrew Bailey said at the end of the June meeting that the economy was doing better than expected, but inflation was still too high. He stressed that the Bank of England had to deal with that. Yes, it would be a painful blow to many people with mortgages, but if the regulator did not raise rates, things would only worsen in the future.

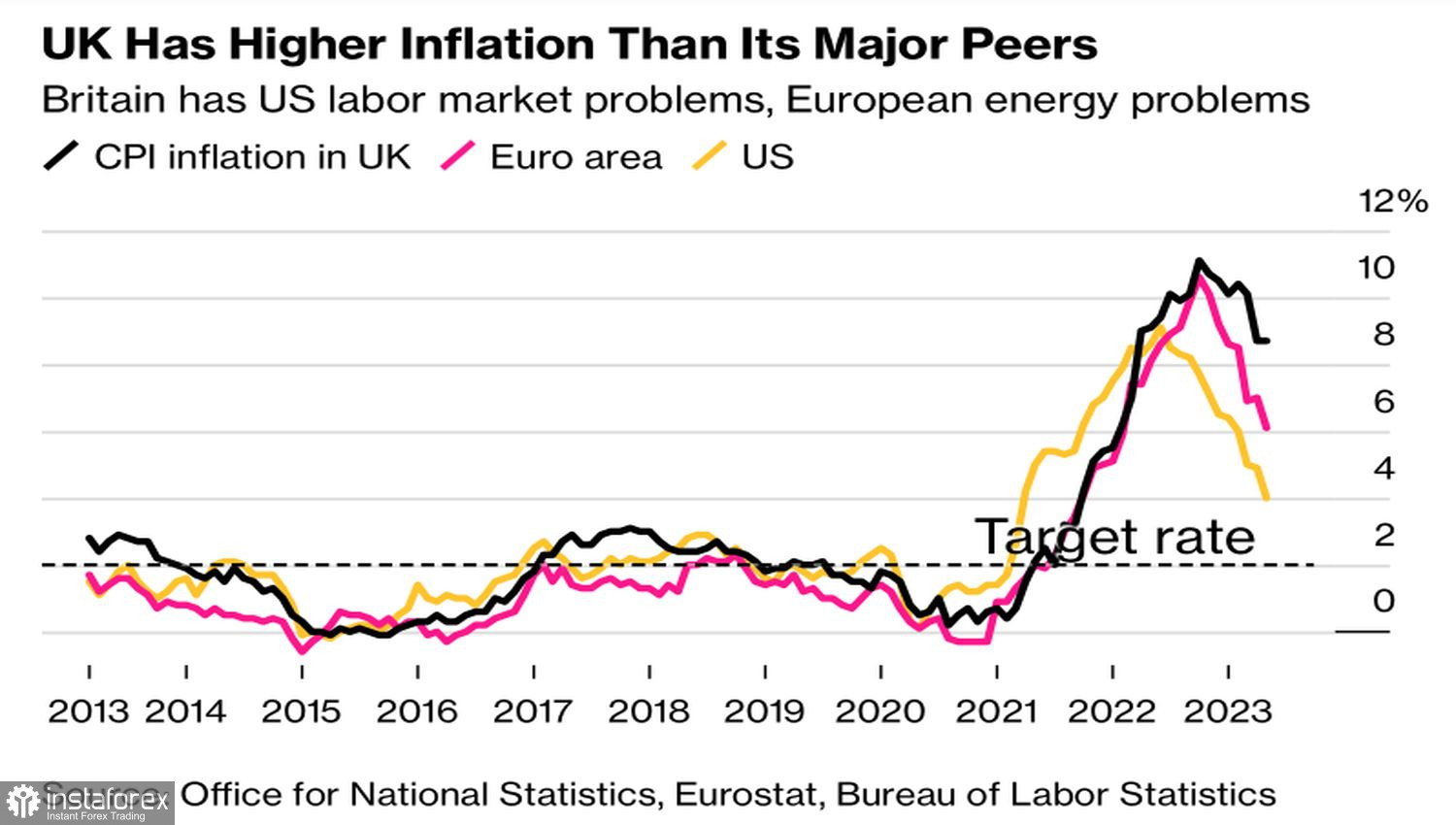

Inflation in the UK and other countries

Consumer prices in the UK are among the highest in G7. The economy is balancing on the edge of a recession. Fears of a downturn in the UK have triggered a fall in GBP/USD. The higher the cost of borrowing, the greater the likelihood of a contraction in GDP. Markets now expect an increase in the repo rate to 6.25%. Meanwhile, Bloomberg experts call the 6% mark a guarantee of a deep recession.

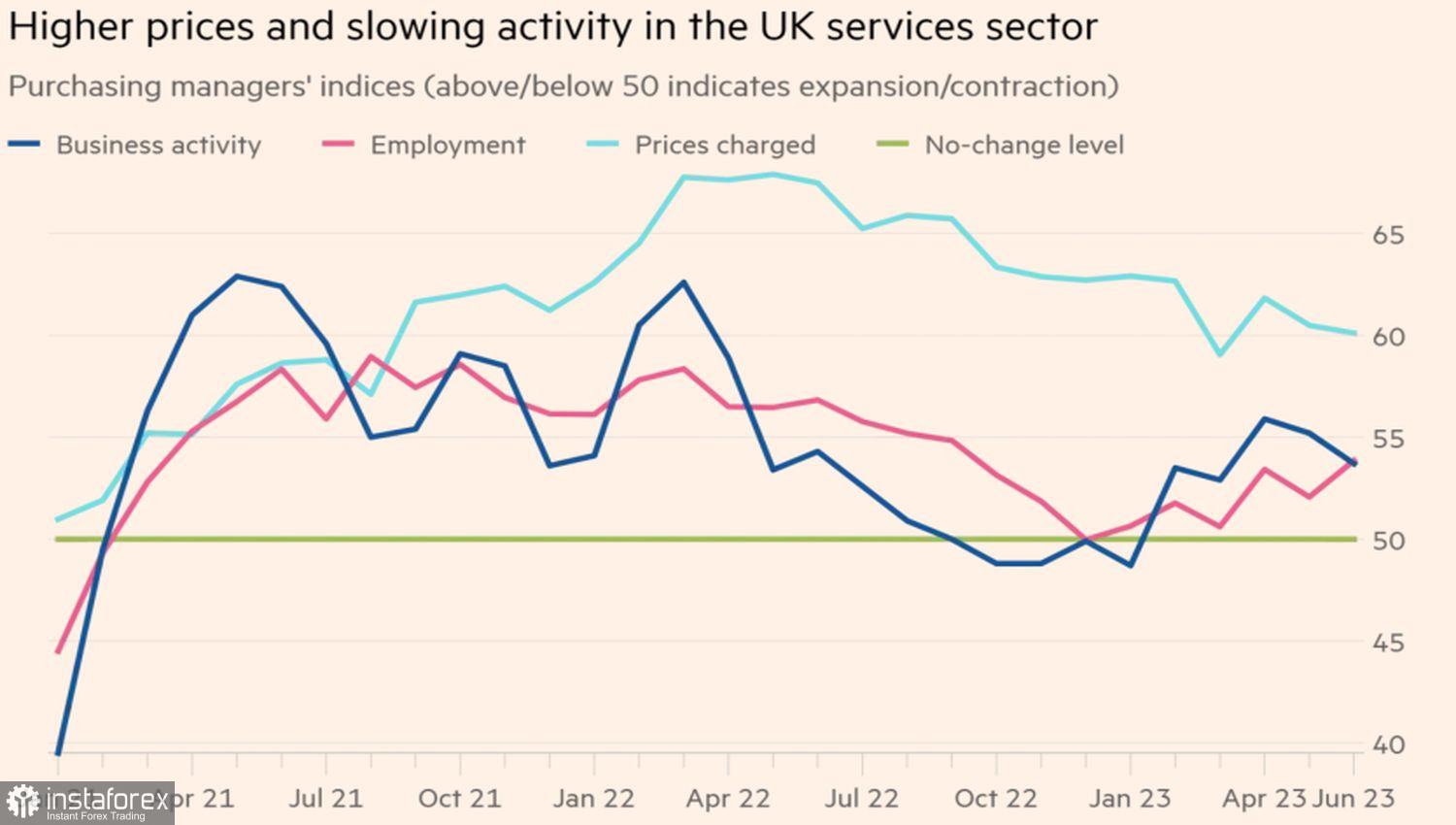

The business activity report in the UK also disappointed, showing that 25% of companies in the services sector raised prices. Only 4% of them lowered prices. Some 40% said their costs have increased due to higher wages. It seems the Bank of England will have to fight inflation to the death, and that the economy will hardly avoid a serious recession. Therefore, demand for GBP/USD will likely decrease.

PMI, employment, and prices in the UK services sector

Meanwhile, the US economy is resistant to the Federal Reserve's aggressiveness. So, if it wants to, the regulator can raise rates not fearing to somehow damage the economy. Still, a lot depends on macro data, including personal spending, which is set for release this week.

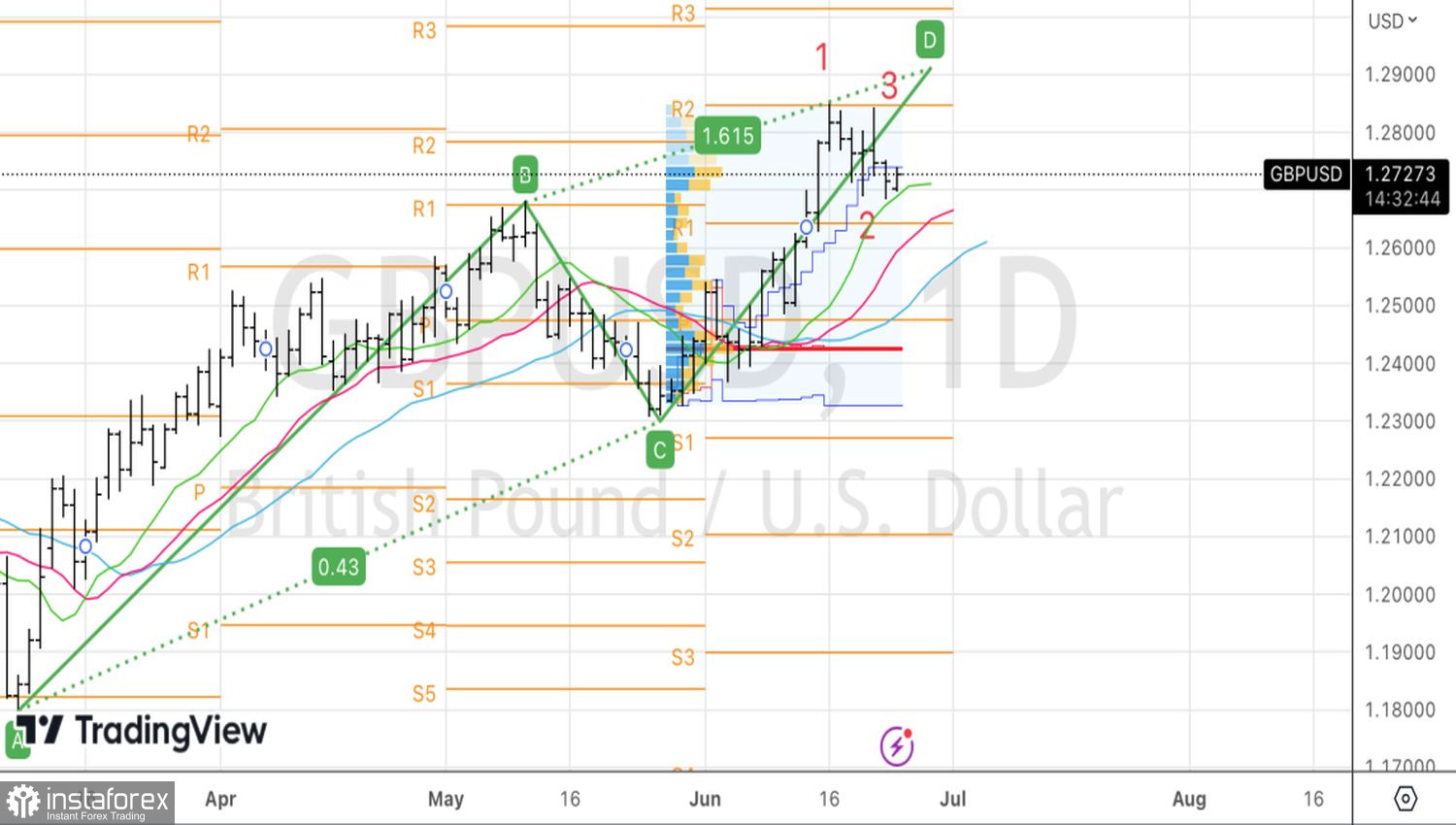

Technically, on the chart of GBP/USD, we may see a reversal pattern 1-2-3 or the AB=CD pattern with the target at the 161.8% level of 1.29. Therefore, it makes sense to set two pending orders: sell at 1.269 and buy at 1.284.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română