Markets rise at the moment when the crowd is sure that they will fall. When the regulatory temperature towards the crypto industry is icy, major players exit the market, and liquidity decreases, the decline in BTC/USD quotes seems logical. However, as soon as the largest asset manager BlackRock challenged the unfavorable external environment, Bitcoin soared above $30,000 for the first time since April. It is set to mark one of the best weeks of the year, and yesterday's pessimists are buying tokens like hotcakes.

BlackRock, which manages assets worth $9 trillion, has filed documents with the Securities and Exchange Commission (SEC) for the creation of a specialized exchange-traded fund called iShares Bitcoin Trust, backed by cryptocurrency. This happened despite the fact that the SEC has repeatedly rejected applications for the creation of ETFs in the past. The main reasons for the rejections were fraud and manipulation in the token spot market. However, BlackRock's position and its thorough approach to the matter have sparked rumors that, this time, the documents will be approved.

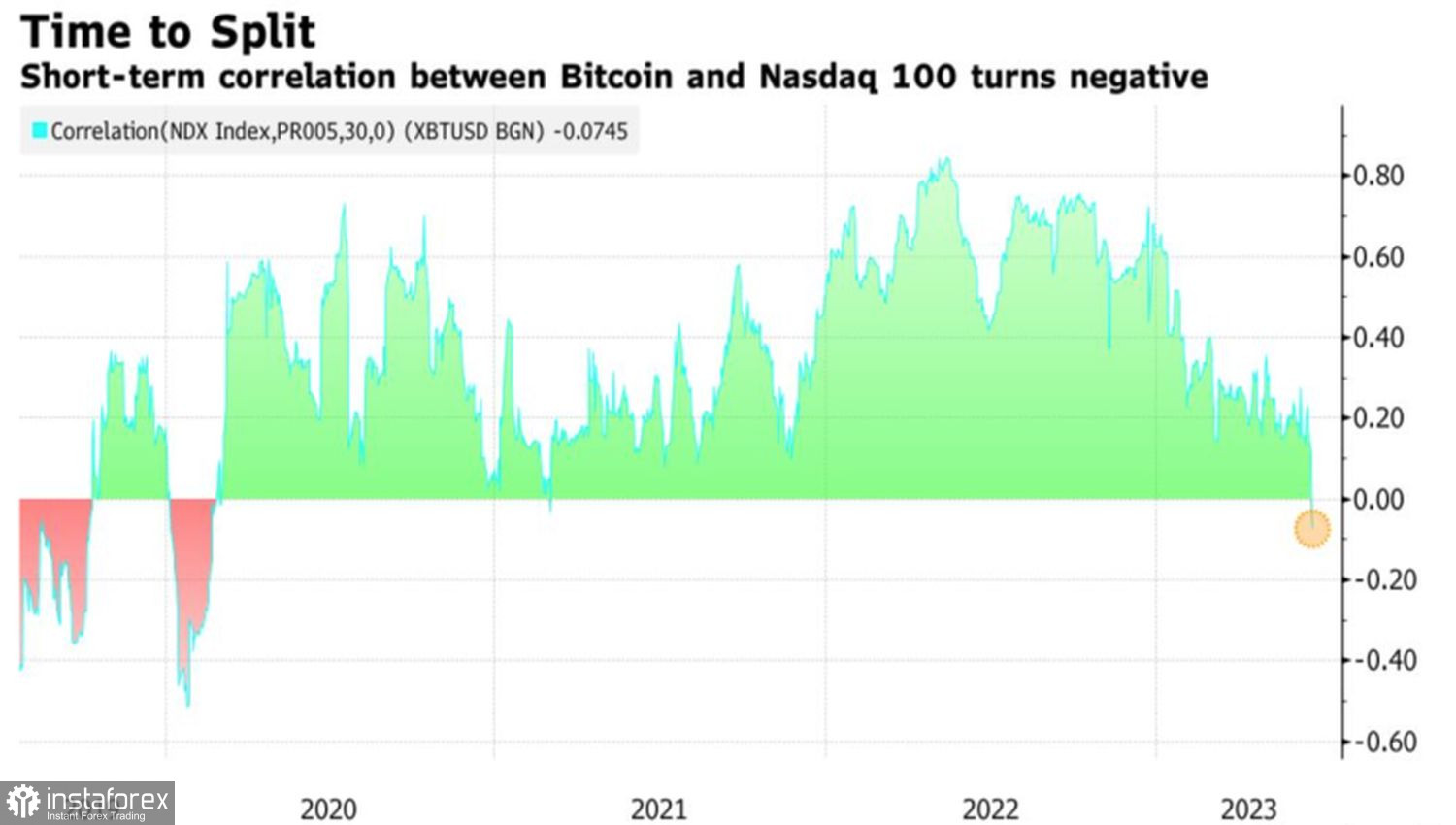

Other asset managers in the world are ready to follow suit. In the second half of June, Invesco, WisdomTree, and Bitwise presented similar plans to create ETFs. If even a portion of these projects is approved by the SEC, access to the cryptocurrency market for large investors will be simplified. This will lead to a capital influx and contribute to price growth. At the same time, Bitcoin will once again be perceived as a risky asset, restoring its correlation with U.S. stock indices.

Correlation dynamics between Bitcoin and Nasdaq

The current conditions are favorable for the U.S. stock market. The American economy is strong, inflation is slowing down, the Federal Reserve is on the verge of ending its cycle of tightening monetary policy, companies are actively implementing artificial intelligence, and their corporate earnings exceed expectations. In addition, the continuation of rate hikes in Europe leads to capital outflow from the Old World to the New.

Stock indices are rising. If it weren't for the SEC's lawsuits against Binance and Coinbase, Bitcoin would likely follow suit. The sector leader has accumulated hidden potential, and BlackRock's application for creating an ETF will help unleash it. While the SEC has previously rejected similar ideas, this time, things could be different. Perhaps there is something that BlackRock knows that we don't. In any case, the clouds over the crypto industry are gradually dissipating, giving a new impetus to BTC/USD.

Technically, on the daily chart, Bitcoin's breakout from the descending trading channel became a catalyst for the rally. Buyers intend to restore the upward trend. At the same time, the formation of an inside bar allows us to determine the entry point for a position. Typically, pending orders are placed at the bar's high near 30,530 for buying and at the low near 29,580 for selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română