The GBP/USD currency pair exhibited significant volatility on Thursday, which is not surprising given the importance of the Bank of England's meeting. An increase in volatility was expected. Surprisingly, the BOE raised the rate by 0.5% instead of the anticipated 0.25%. This decision caught many analysts off guard, especially considering the recent disappointment in UK inflation figures that raised doubts about Andrew Bailey's optimistic projections of halving inflation by year's end.

In our previous discussion on EUR/USD, we analyzed how Jerome Powell's statements impacted the dollar. The current market sentiment offers little opportunity for the US currency to appreciate. Market participants now demand exceptional data, news, or scenarios from the US, the Federal Reserve, or Powell to consider buying the dollar. The US currency only experiences modest growth during minor corrections as buyers take profits. This is an important aspect to keep in mind.

Before the Bank of England meeting, the pound had experienced a strong upward trend without significant fundamental support. However, this bullish momentum stalled for three days, coinciding with a disappointing inflation report. The market expected the pound to rise if it truly believed that the Bank of England possessed the power to raise rates as needed. Nevertheless, the pound failed to rise on Wednesday. The Bank of England's decision to raise the rate for the thirteenth consecutive time exceeded all market rate forecasts and demonstrated the most hawkish stance among available options. Surprisingly, the pound reacted by falling against the dollar despite its recent upward movement lacking solid justifications.

Some may argue that the market had already priced in a 0.5% rate hike or anticipated an even higher increase of 0.75% or 1.5%. However, until Wednesday, there were no indications of such a significant tightening, as the April inflation report revealed a notable slowdown, instilling optimism in the Bank of England. After Wednesday, the pound did not experience any substantial gains. Therefore, the market could not have predicted the 0.5% hike, and subsequently, it could not have factored it into the pricing beforehand. So, why did the pound fall? Or it is now remembered that Powell's speech was indeed hawkish, leading to the dollar's rise.

What can we expect from the Bank of England in the future? In reality, the British regulator has already exceeded its program. The current 5% rate is no longer just a "limiting level"; it is now considered a "very limiting" level. Given the lack of growth in the economy for four consecutive quarters, a recession is now the expected outcome. Andrew Bailey's forecasts are proving to be astonishingly accurate. At the start of the year, the BOE governor repeatedly stated that a severe recession had been avoided. Instead of a two-year depression, only a few quarters of contraction should be expected. It remains to be seen how accurate this forecast will be. Inflation stands at 8.7%, with core inflation continuing to rise. Considering the current trajectory, how long will it take to bring it down to 2% if it has already decreased by 2.4% in the last seven months? What are the market's expectations regarding the Bank of England's rate? Could it reach 6%? These questions are rhetorical.

Given the prevailing market sentiment, it would not be surprising if the pound eventually resumed its upward movement. Concrete factors support this notion, such as the rate already reaching 5% and the persistently high inflation, suggesting further monetary policy tightening. The fact that the pound is overbought and has already gained 2500 points with minimal corrections over the 24-hour timeframe only concerns a few participants.

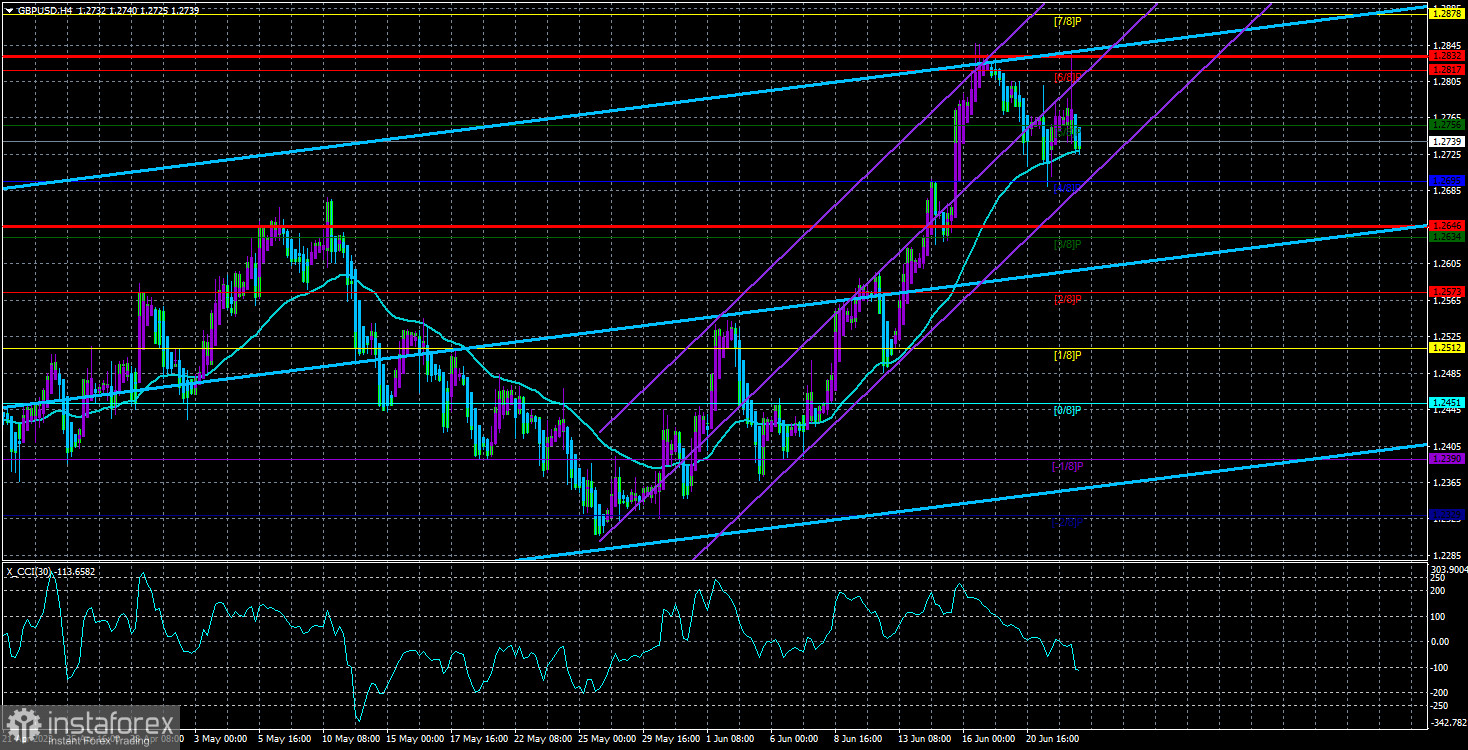

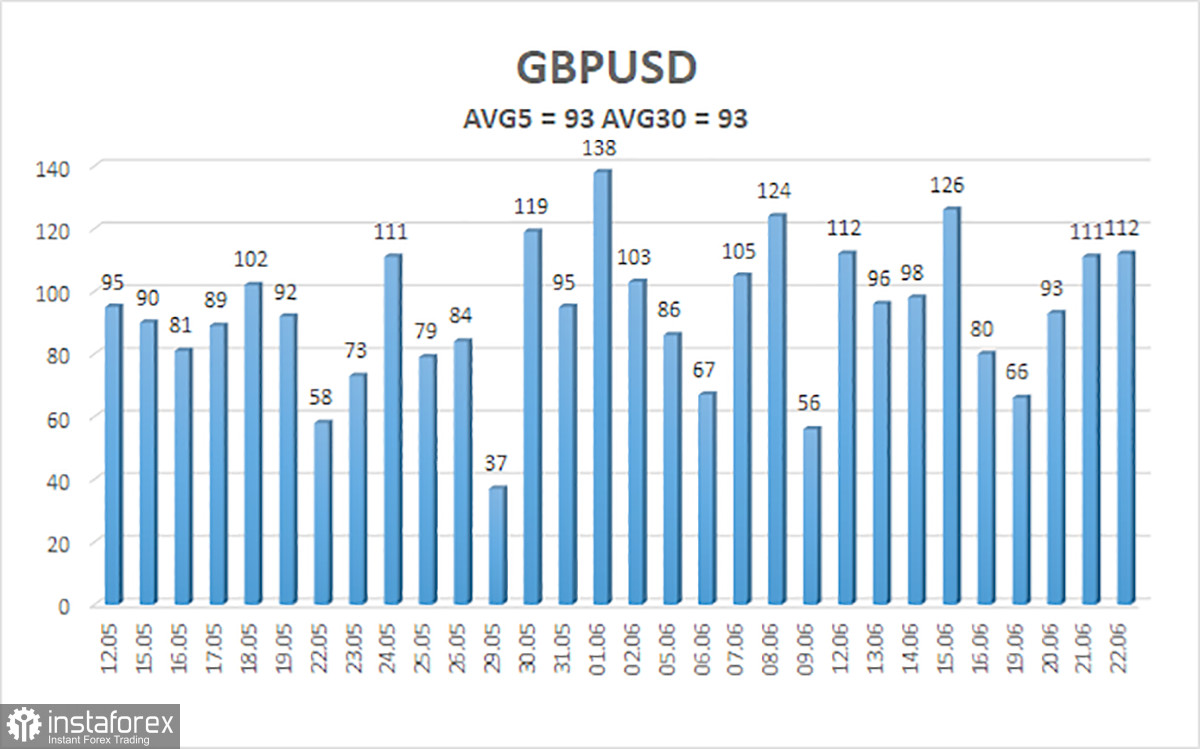

The average volatility of the GBP/USD pair over the past five trading days stands at 93 pips, considered "average" for this currency pair. Therefore, on Friday, June 23, we anticipate movements between 1.2646 and 1.2832. A reversal of the Heiken Ashi indicator to the upside will indicate a resumption of the upward movement.

Nearest support levels:

S1 - 1.2695

S2 - 1.2634

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2817

R3 - 1.2878

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to correct. Currently, long positions with targets at 1.2817 and 1.2832 remain relevant. They should be opened if the Heiken Ashi indicator is reversed upwards or a price rebounds from the moving average. Short positions can be considered if the price consolidates below the moving average with targets at 1.2695 and 1.2646.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings: 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will likely move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an upcoming trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română