Thursday marked the final of the three central bank meetings, and we can summarize the overall outcome. The Federal Reserve did not raise rates in June but may do so in July and October. The European Central Bank raised rates by 25 basis points, bringing it to 4%, and another increase in July is almost guaranteed. The future of the interest rate remains uncertain. The Bank of England unexpectedly raised rates to 5% and, judging by its determination and the high values of headline and core inflation, may raise them in the next 2-3 meetings. Based on this, it can be concluded that the British pound is currently in the best position. Its central bank may raise rates even higher than the Fed's, although just a week ago it seemed that it was preparing to complete the tightening cycle. Interestingly, despite the BoE making the most hawkish decision possible today, the demand for the British pound did not increase.

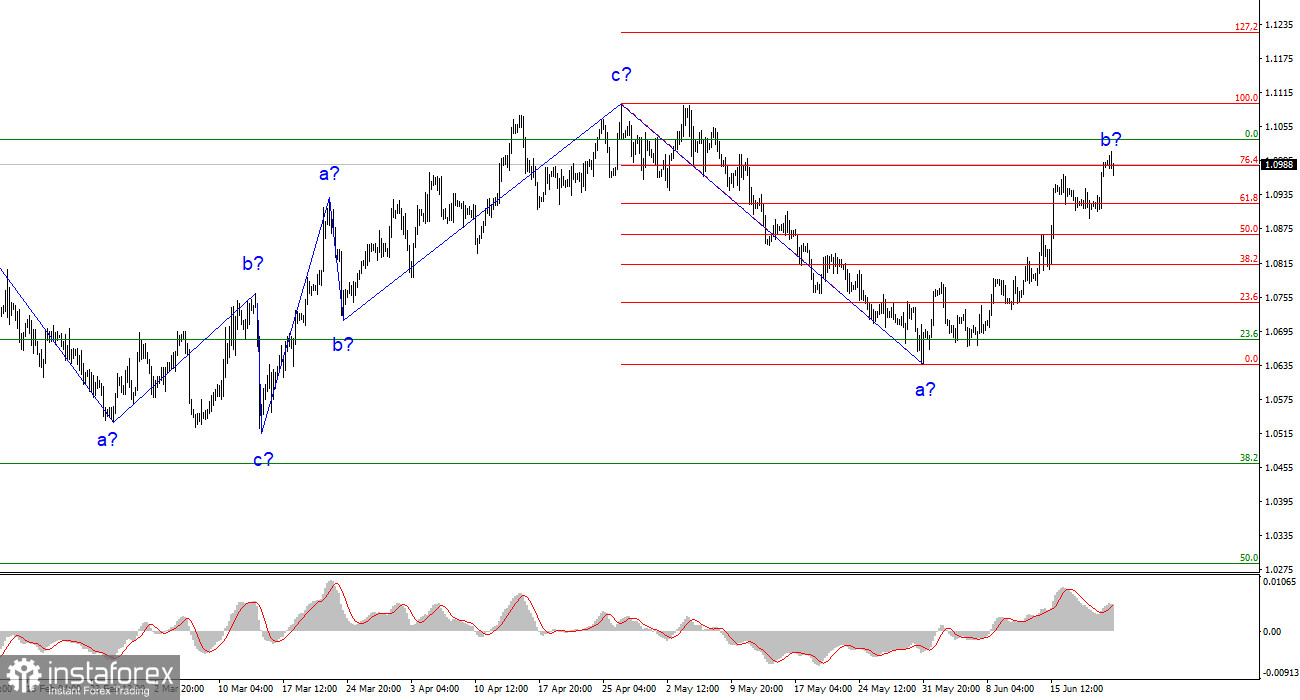

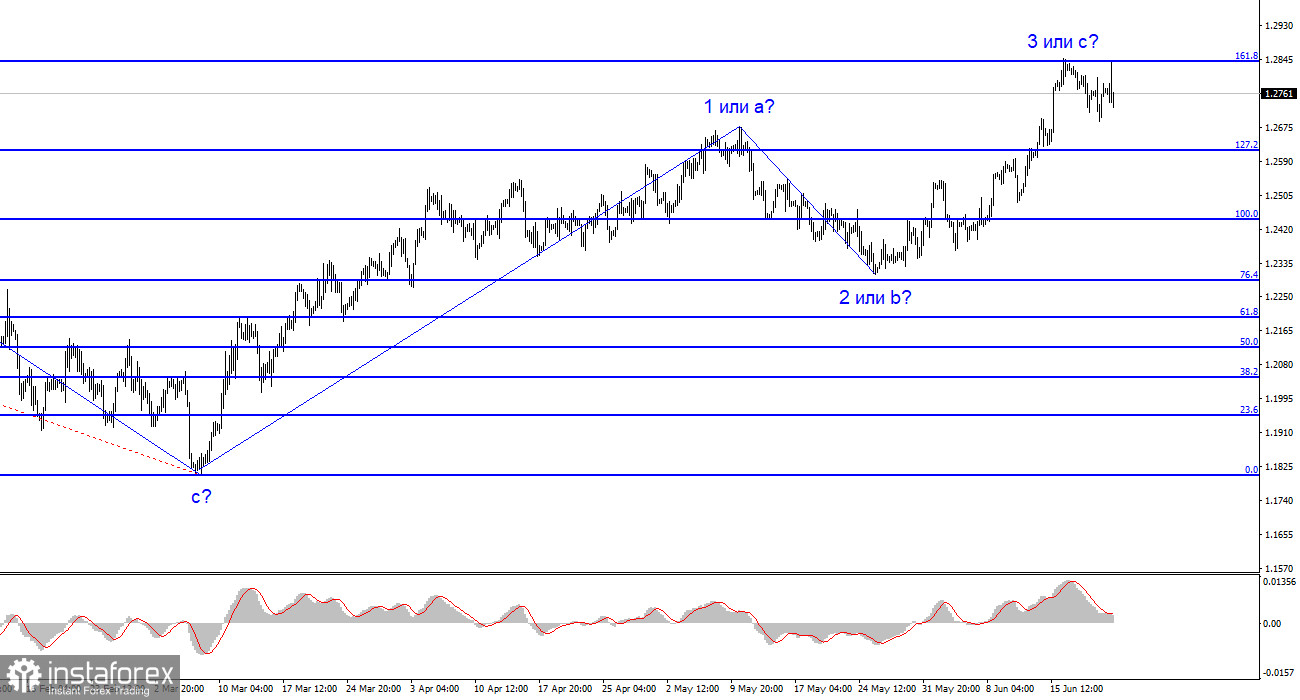

The wave structure of the British pound and the euro differs at the moment, but for the euro, it may change to an upward phase of a trend if the single currency continues to rise above the previous peak around 1.1095. If that's the case, the euro can trade higher in the near future, regardless of whether the news background supports buying the instrument. The British pound may continue to build an upward Wave 3 or Wave C, but it is currently facing strong resistance at the 161.8% Fibonacci level. Personally, I believe that it would be best not to buy the euro and the pound right now, but a successful attempt to break above 1.2842 in the British pound will indicate the market's readiness to continue buying the pound. And if the pound continues to rise, it is likely that the euro will follow suit.

Economists at Commerzbank believe that the BoE is ready to follow in the footsteps of the Fed and raise rates as much as necessary. The BoE's decision makes me agree with this opinion. The BoE expects inflation to start decreasing rapidly, as BoE Governor Andrew Bailey mentioned back in May, but today's 50 basis points rate hike indicates uncertainty about that statement. We may easily witness a new acceleration of inflation (at least core inflation) in the next couple of months, as the impact of changes in monetary policy parameters on inflation takes time.

Previously, BoE officials mentioned that it would be very challenging to bring inflation back to 2% with wage growth rates above 4%. However, for now, the goal is to bring it back to at least 4% before considering further actions.

Based on the analysis conducted, I conclude that a new downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. I believe that there is a high probability of completing the formation of wave b, and the MACD indicator has formed a "downward" signal. Under an alternative scenario, the current wave would be more prolonged, but it would be followed by a downward phase of the trend, so I do not advise buying.

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward wave that can end at any moment. It would be advisable to consider buying the instrument only if there is a successful attempt to break above the 1.2842 level. You can also consider selling since two attempts to break through this level have failed, and a stop loss should be set above it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română