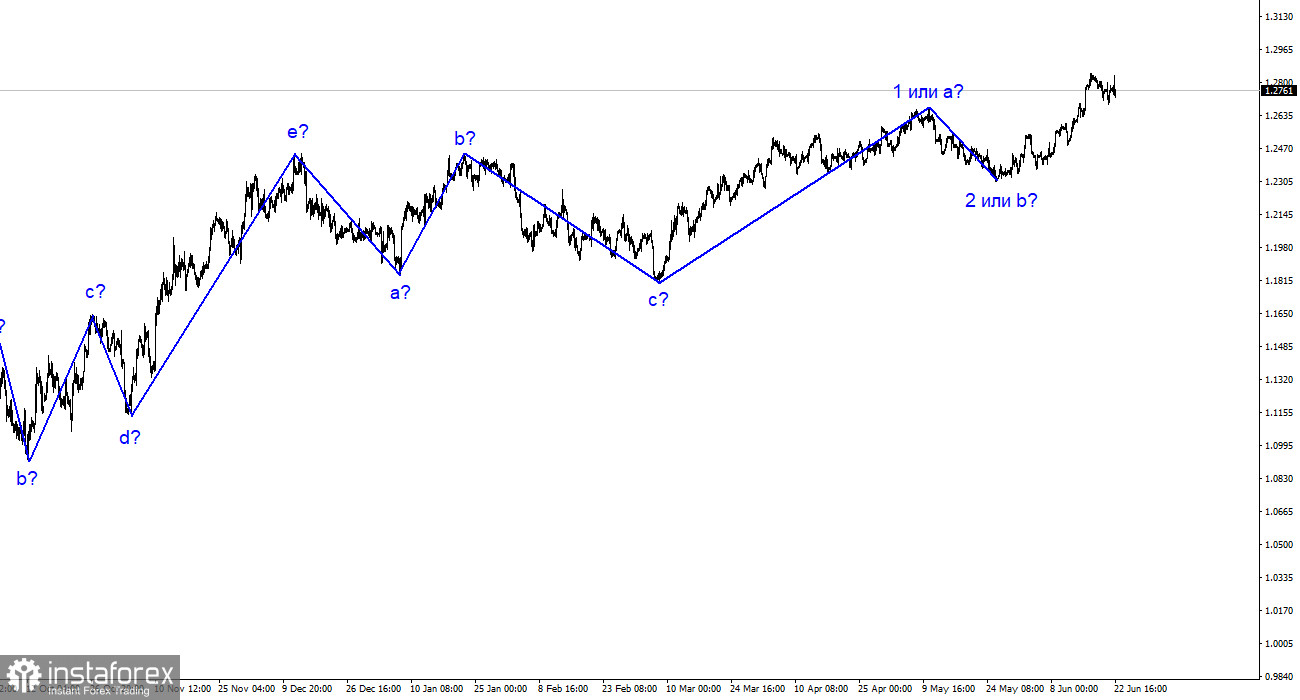

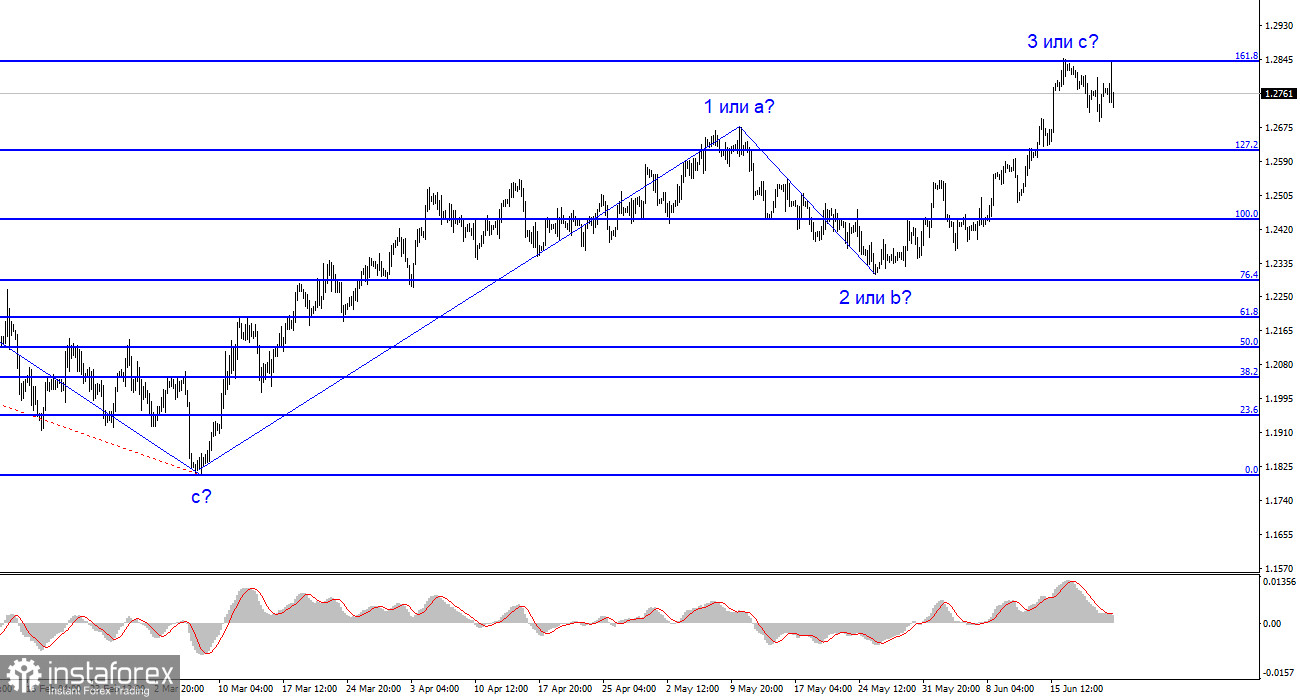

The wave analysis for the pound/dollar pair has unexpectedly changed to a simpler and more understandable pattern. Instead of a complex corrective phase, we now observe either an impulsive ascending wave or a simpler one. The upward wave 3 or c is still in progress, allowing the pound to rise to the 30th figure. It is important to assess the justification for this based on the current news background. The pound lacks sufficient grounds to sustain the rise towards the 30 or 35 figures (which is possible if it is an impulsive segment of the trend). Moreover, the presumed wave 3 or c might have already been completed. While wave analysis can evolve into a more complex pattern, I prefer relying on simpler manifestations for easier analysis.

It is worth noting that the wave analysis for the EUR/USD pair differs significantly from that of the GBP/USD pair, which is a rare occurrence. The euro is expected to form a descending set of waves, but its wave analysis could still transform into a pattern similar to the pound, aligning the two scenarios. Meanwhile, the pound is in an ascending phase of the trend. The Fibonacci level of 161.8% and the two failed attempts to break through it suggest a potential decline.

Demand for the pound has slightly decreased.

On Thursday, the pound/dollar exchange rate declined by 30 basis points. Its movement was contingent on market participants' interpretation of the Bank of England's meeting outcomes, which they interpreted rather peculiarly. The British regulator surprised the market with a 50 basis point interest rate hike. It is worth recalling that over the past year, no central bank has caught analysts off guard with an unexpected decision. This is the first instance where a central bank has deviated from market expectations in its rate change. The 50-point increase was unexpected, given the gradual tightening of 25 points in previous meetings. Consequently, the Bank of England acknowledged its mistake of prematurely slowing down policy tightening. However, the Bank of England has been prone to making several mistakes lately.

Let us remember that last year, no one anticipated inflation rising to 11%, and this year, officials expected a decline in inflation amidst falling energy prices. However, these expectations have yet to materialize so far. The interest rate has reached 5%, and inflation remains close to 10%. Today, demand for the pound has slightly decreased, and the market has yet to demonstrate its response to this "surprise." If the market is content with it, why didn't the pound continue to rise? If it is dissatisfied, why is the decline so weak? We should still anticipate the completion of the third wave and rely on the 161.8% Fibonacci level.

In general, the wave pattern of the pound/dollar pair has changed, indicating the formation of an upward wave that could conclude soon. Consider buying the pair only if it successfully breaks through the 1.2842 level. Alternatively, selling can be considered since previous attempts to breach this level have been unsuccessful. Placing a stop-loss above this level is recommended.

The picture resembles the euro/dollar pair on a larger wave scale, but there are still some differences. The descending corrective phase of the trend has concluded, and the formation of a new ascending phase is ongoing, which could conclude as early as tomorrow or develop into a full five-wave pattern. Even if it is a three-wave pattern, the third wave could be extended or shortened.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română