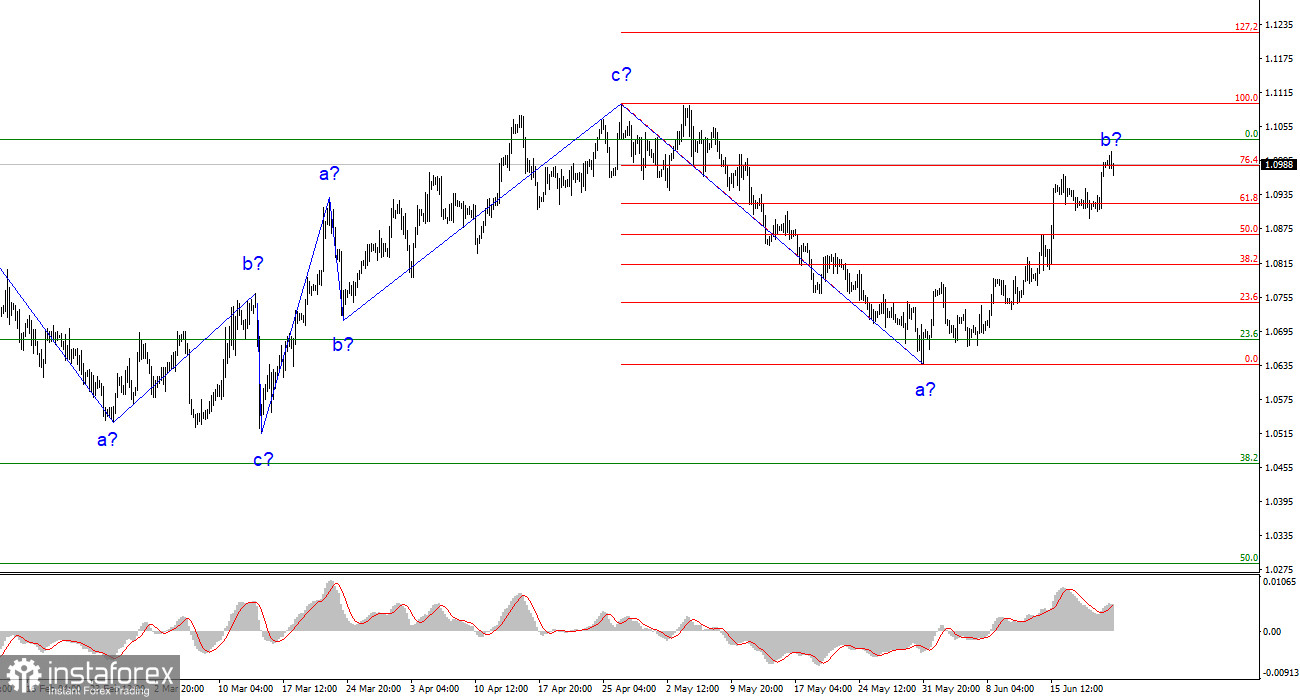

The wave analysis on the 4-hour chart for the euro/dollar pair is somewhat unconventional but understandable. The quotes are moving away from the previous lows, likely within wave b. The upward trend that began on March 15 could still take on a more complex structure, but I anticipate a downward phase consisting of three waves for now. I have consistently mentioned the possibility of the pair reaching around the 5th figure, where the upward three-wave pattern started, and I stand by that prediction.

Considering recent events, particularly in the GBP/USD pair, I have developed an alternative wave analysis that suggests the entire trend between March 15 and April 26 represents wave a. If this is indeed the case, the next wave would be b, and we are currently witnessing the formation of an upward wave c. This alignment of wave analysis for both the British pound and the euro supports the notion of the euro rising above the 1.11 figure.

Boris Vujcic expressed skepticism regarding a "soft landing"

On Thursday, the euro/dollar exchange rate decreased by only 10 basis points. Price movements remained subdued due to Jerome Powell not providing any new information in the Senate compared to his previous speech in the House of Representatives. The Bank of England's meeting mainly affected the pound, not the euro. Although the euro exhibited similar movements to the pound, on a smaller scale, the pound briefly influenced the euro's trajectory. As the current wave analysis may undergo changes and transition into an upward trend phase, the euro requires support from news events to increase by another 200–300 points. The ongoing monetary policy tightening in the European Union could offer such support. While not all members of the ECB are confident about rate increases in the autumn, they do recognize the unacceptable level of inflation.

The rate will not continue to rise at every subsequent meeting until inflation drops to at least 4%. Nonetheless, the euro only needs a little more to complete wave 3 or c (according to the alternative analysis). Regardless, I do not anticipate the current trend phase becoming impulsive, leading the euro to reach figures like 20 or 25. Boris Vujcic (ECB) recently indicated a high probability of a recession, stating that the European economy may not experience a "soft landing." If the regulator continues to raise rates, GDP will further contract, and the last two quarters have already seen slight declines.

In conclusion, based on the analysis, a new downward trend phase is underway, providing the pair with significant potential for decline. Targets around 1.0500–1.0600 remain realistic, and I recommend selling the pair with these targets in mind. The completion of wave b is increasingly probable, although a new "down" signal from the MACD indicator is necessary. According to the alternative analysis, the current wave will be more prolonged but will be followed by a downward trend phase. Therefore, buying is not advised.

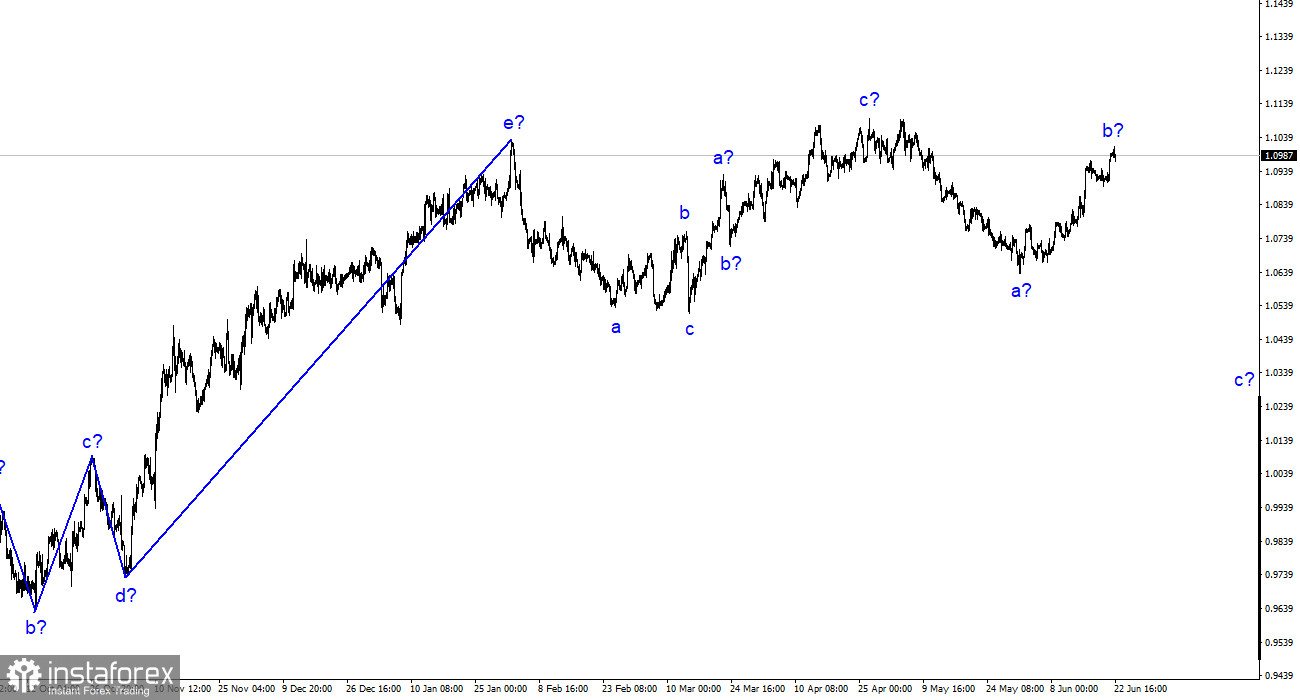

On a higher wave scale, the wave analysis of the ascending trend phase has taken on an extended form, most likely completing five upward waves forming the structure of a-b-c-d-e. Subsequently, the pair constructed two three-wave patterns, one downward and one upward. Currently, it is in the process of forming another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română