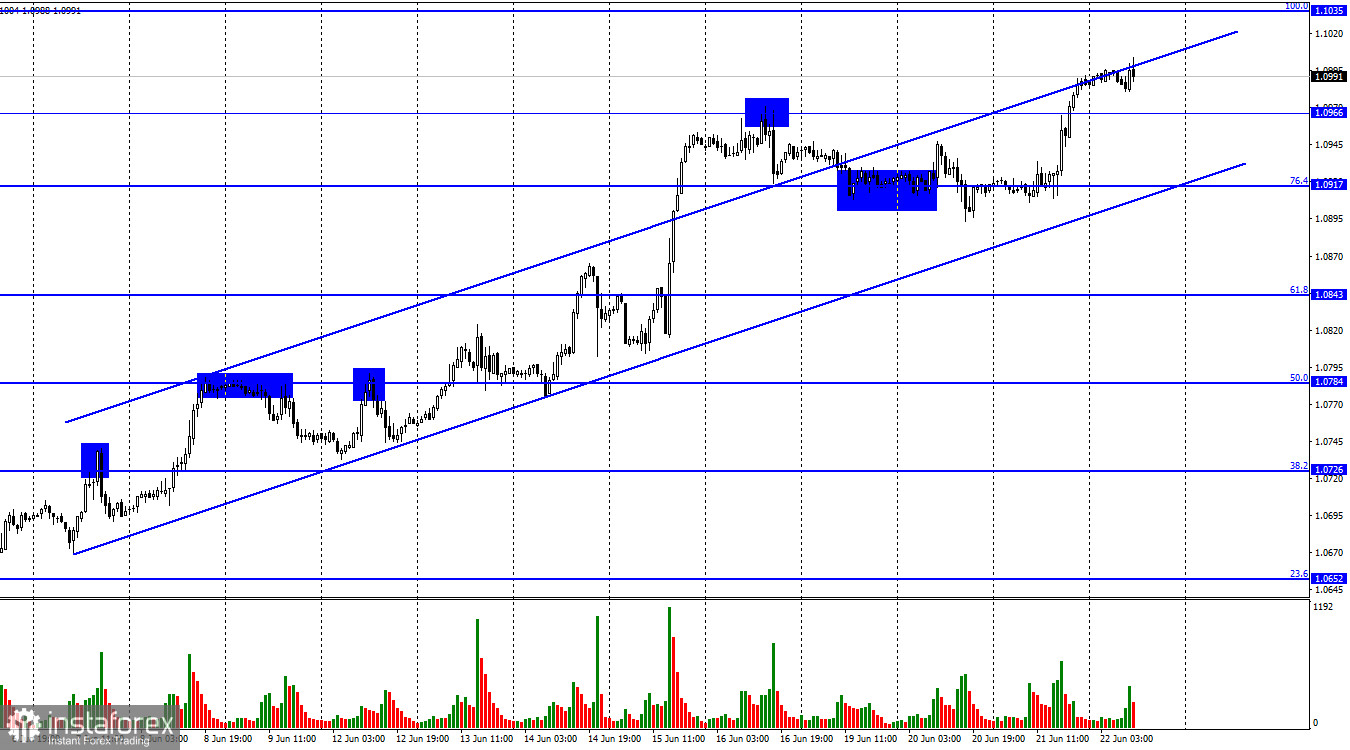

Hi everyone! The EUR/USD pair advanced on Wednesday and resumed an upward movement. The consolidation above 1.0966 signals a further rise to 1.1035 – the Fibonacci correction level of 100.0%. The uptrend corridor indicates that bullish sentiment persists. Only a fall below this channel could trigger a downward movement.

Yesterday, there was only one important event. Jerome Powell testified before congressional lawmakers. In his speech, he noted that the Fed could keep tightening monetary policy in the second half of the year but at a slower pace than before. Economic growth continues to slow down. "We still have historically low unemployment rates and high employment rates now, high participation, a very strong labor market," Powell said. It means that the Fed could raise the key rate several more times. In my opinion, Powell's speech was quite hawkish. He pointed out that there would be another 1-2 interest rate increases. However, the US dollar did not advance following his speech. Despite the fact that the Fed could raise the interest rate higher than expected, the US currency continues to fall, which is a bit strange.

At the same time, several ECB representatives have already made speeches this week. Most of them backed a rate hike at the July meeting. However, they did not provide any comments on moneybag policy prospects. The July meetings of the ECB and the Fed may be the last in the tightening cycles. Any rate increase after the July meeting may occur only if inflation starts rising again. Powell's second speech will take place today before the Senate. He will hardly provide any new details. Yet, he will be asked different questions. Even Powell's hawkish rhetoric did not support the dollar yesterday.

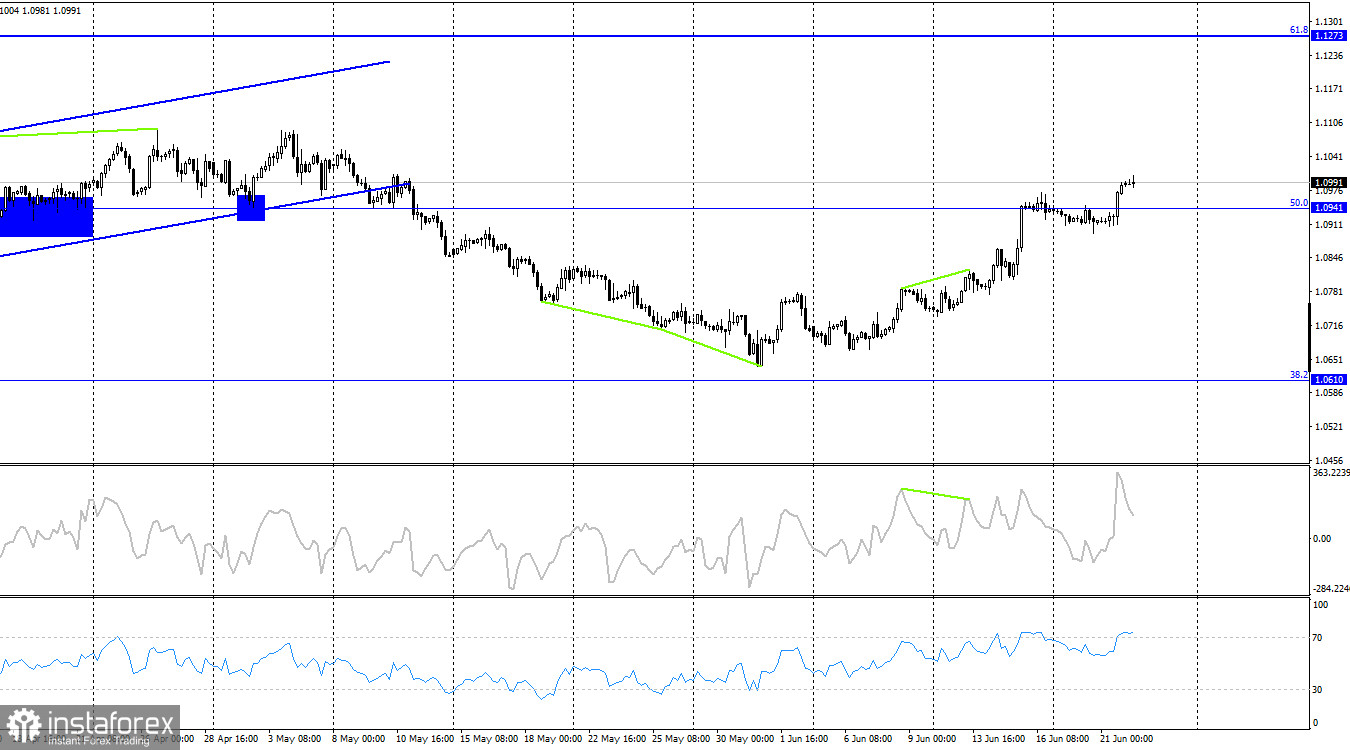

On the 4H chart, the pair grew to 1.0941, the Fibo level of 50.0%. The bearish divergence of the CCI indicator, which was formed last week, vanished. No new divergences are seen in any indicator. A retreat from 1.0941 could lead to a fall to 1.0610. The consolidation above 1.0941 will increase the likelihood of a rise to 1.1273, the Fibonacci correction level of 61.8%.

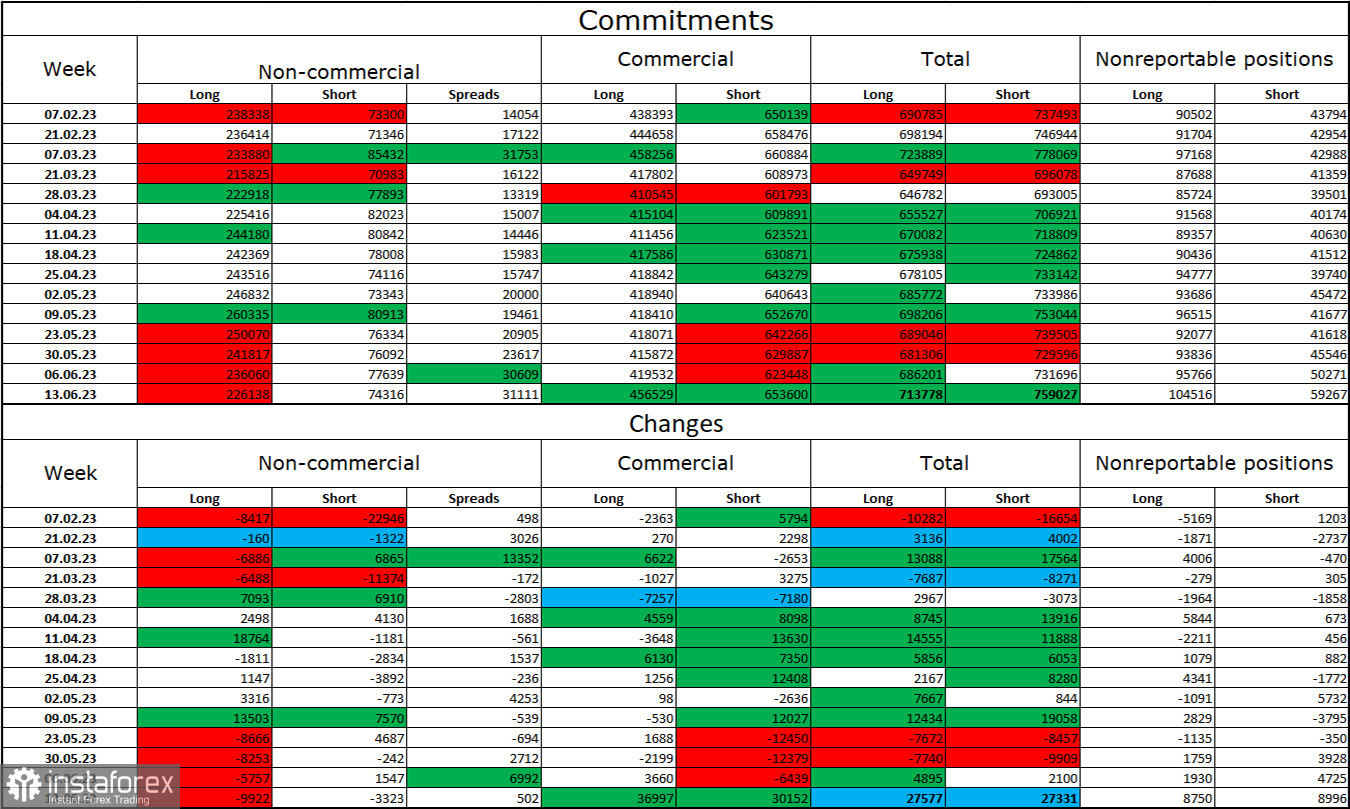

Commitments of Traders (COT):

In the last reporting week, speculators closed 9,922 long positions and 3,323 short ones. The mood of large traders remains bullish but is slowly weakening. The total number of long positions now amounts to 2,260, and short contracts – only to 74,000. The bullish trend prevails. However, the situation may change in the near future. The euro has been declining a little more often for the last two months than it has been growing. The large volume of long open positions suggests that buyers may start closing them in the near future (or have already started as indicated by the latest COT reports). The bullish bias is too strong at the moment. I believe that the current figures signal a new fall in the euro in the near future.

Economic calendar for US and EU:

US– Initial jobless claims (12:30 UTC).

US – Exciting home sales (14:00 UTC).

US – Jerome Powell's testimony (14:00 UTC).

On June 22, the economic calendar includes only Powell's speech and two less important reports. The impact of fundamental background on market sentiment will be moderate today.

Outlook for EUR/USD and trading recommendations:

I would advise you to go short if the pair declines below the trend line on the 1H chart with the target level of 1.0843. You could go long if it rebounds from 1.0917 with targets of 1.0966 and 1.1035. The pair has already achieved the first level. It is aiming at the second one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română