EUR/USD

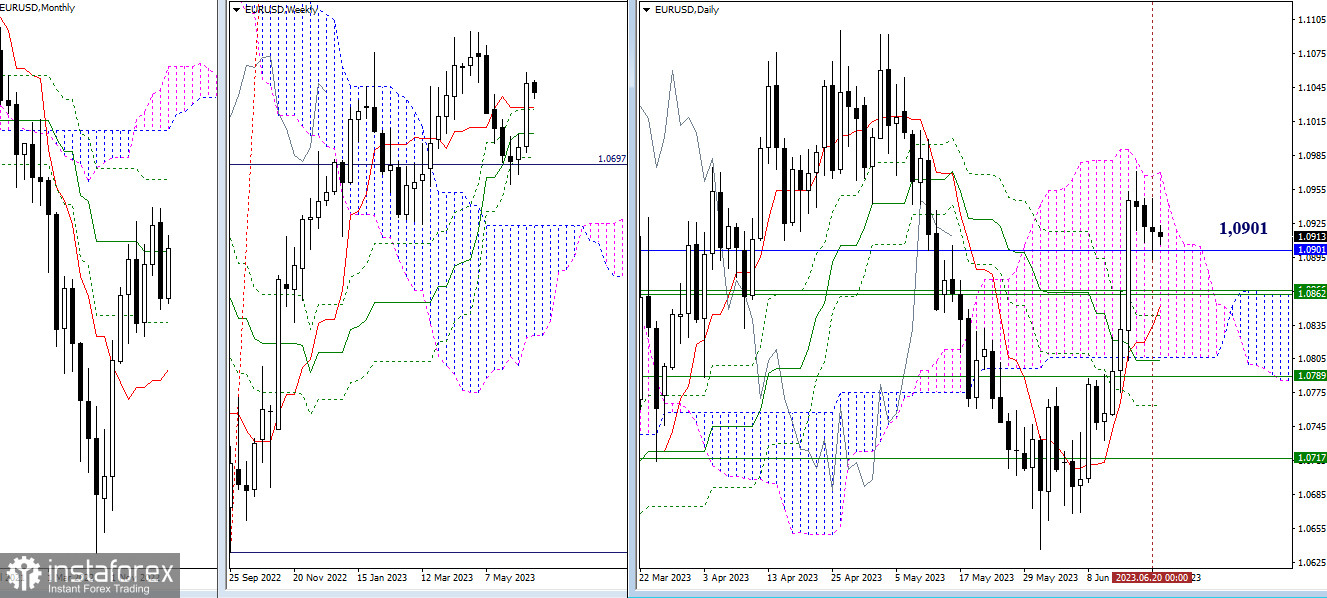

Higher timeframes

The pause allowed by the bulls is maintained. At the same time, the pair is testing the support of the monthly medium-term trend (1.0901). A breakout of this level will shift attention to the next support area of 1.0866 - 1.0843, which combines daily and weekly levels. The bulls' target within the day is to break through the daily Ichimoku cloud (1.0970) into the bullish zone, followed by updating the all-time high of the last months (1.1096), which will allow considering the recovery of the upward trend on the weekly chart.

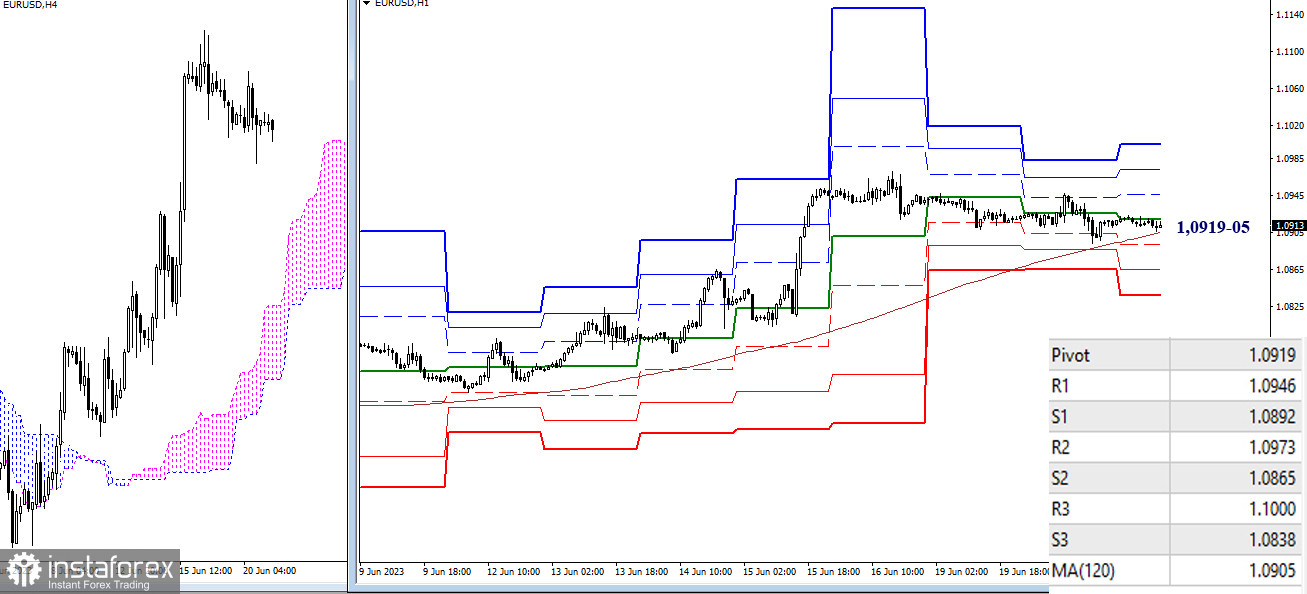

H4 - H1

The pair continues to trade in the correction zone on the lower timeframes. The current corrective decline is insignificant, forming a sideways movement. Today, key levels have joined forces in a relatively narrow range of 1.0919-05 (central pivot point + weekly long-term trend). Trading above the key levels will have bulls maintain the main advantage, with intraday targets at 1.0946 - 1.0973 - 1.1000 (resistances of classic pivot points), while trading below will strengthen bearish sentiments, with the aim of breaking through the supports of classic pivot points (1.0892 - 1.0865 - 1.0838).

***

GBP/USD

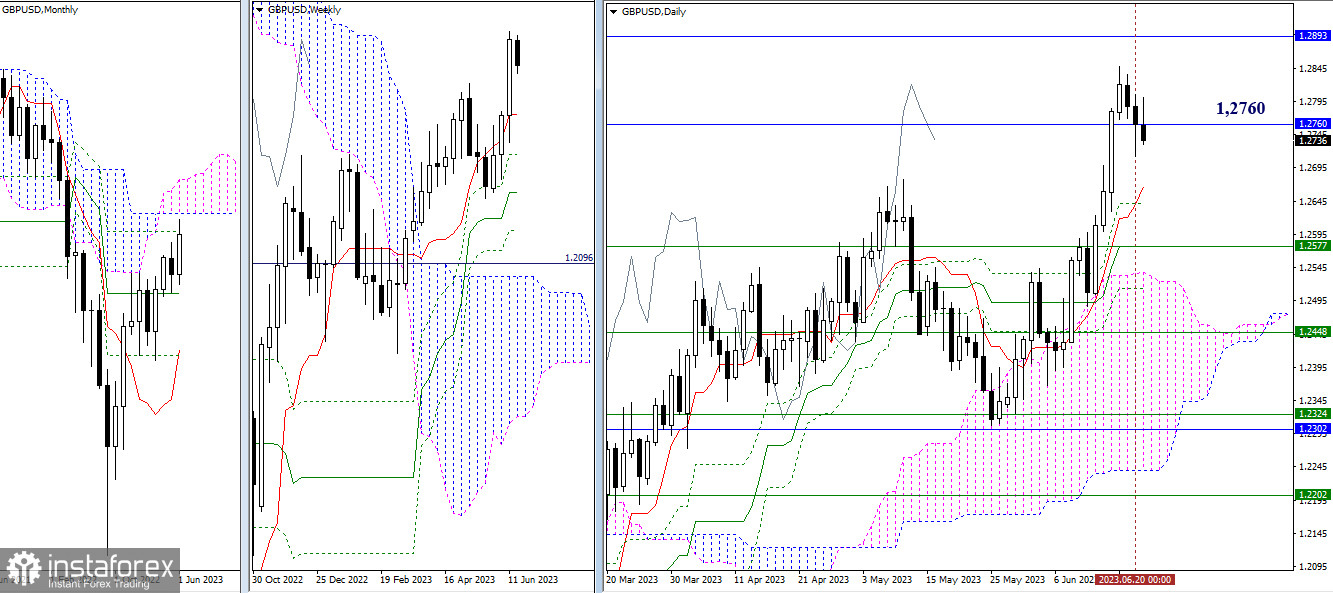

Higher timeframes

Bearish players are trying to recover their positions and capture the monthly level of 1.2760. Their next targets in the current situation are the daily levels (1.2666 - 1.2641) and the weekly short-term trend (1.2577). If bulls can now hold the monthly level of 1.2760, they will face testing of the monthly Ichimoku cloud (1.2893 - 1.3141).

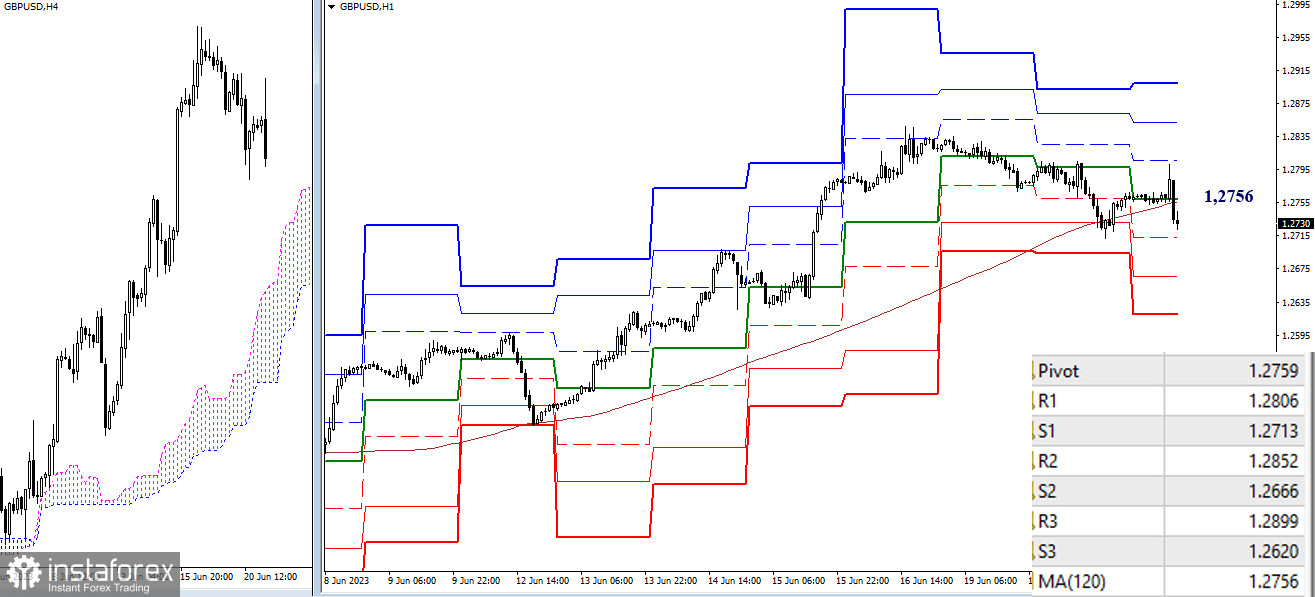

H4 - H1

On the lower timeframes, there is currently a struggle for control of the key levels. Today, they have converged at the level of 1.2756-59 (central pivot point of the day + weekly long-term trend). In the event of a further decline, bears within the day will rely on the supports of classic pivot points (1.2713 - 1.2666 - 1.2620), while in the case of bullish activity, bulls will be interested in the resistances of classic pivot points (1.2806 - 1.2852 - 1.2899).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română