Details of the economic calendar on June 20

Yesterday, the U.S. Census Bureau published the report for May, which noted that the volume of new home construction increased by 21.7% compared to the previous month. This growth occurred after a decrease of 2.9% (revised from +2.2%) in April. This figure significantly exceeded market expectations, which predicted a decline of 0.8%.

The report also indicates that the number of building permits issued in May increased by 5.2% compared to analysts' forecasts, which anticipated a decrease of 5%.

The market instantly reacted to these statistical data, strengthening dollar positions.

Analysis of trading charts from June 20

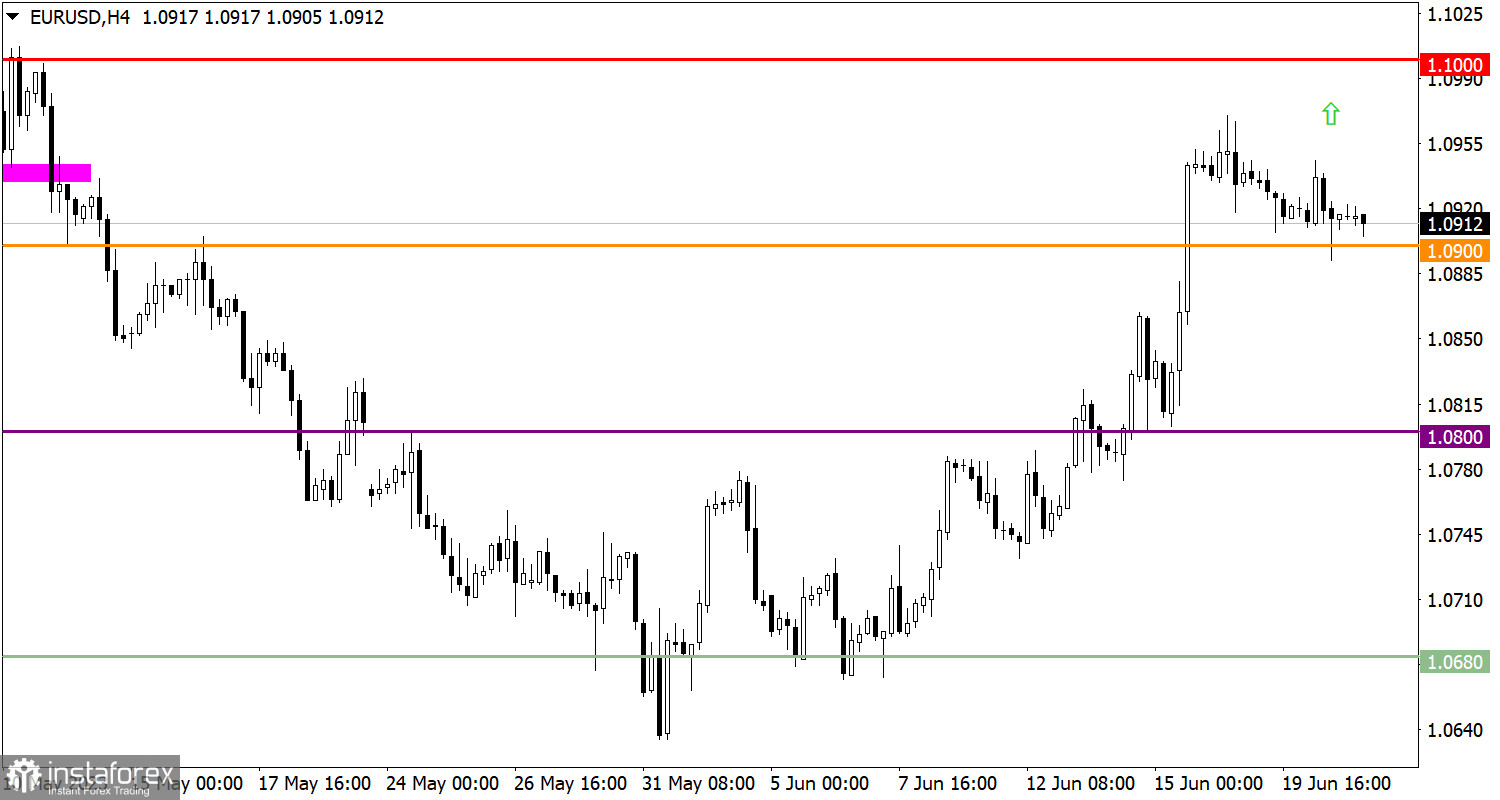

The EUR/USD currency pair recovered after a price pullback and returned to the area of 1.0900, where a consolidation formed. There are no sharp changes on the chart, and the overall trend remains upward, despite the pullback cycle.

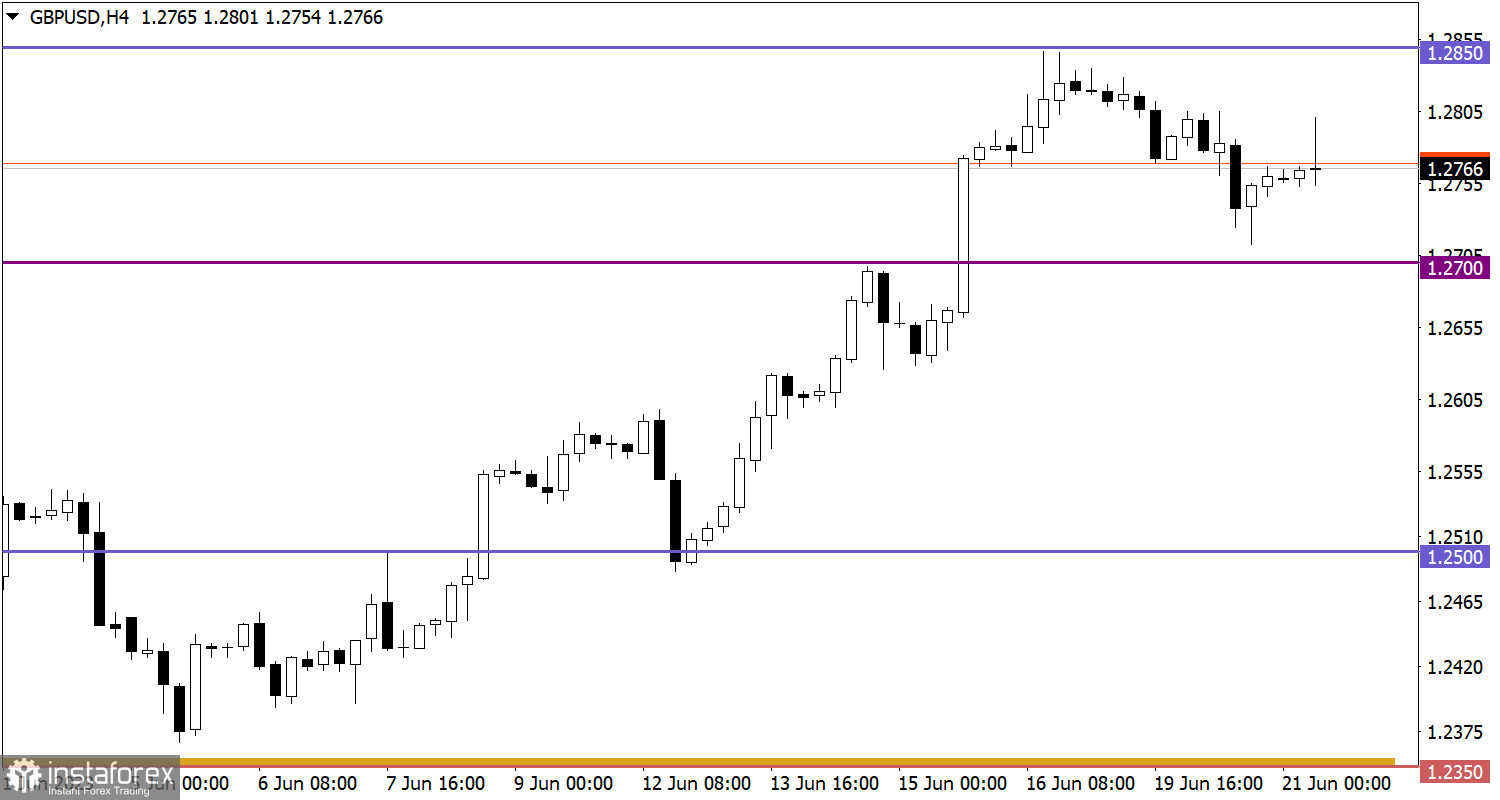

The GBP/USD pair pulled back from the local high of the medium-term trend and almost reached 1.2700, where a reduction in short positions occurred.

Economic calendar for June 21

At the beginning of the European session, inflation data for the UK was published, which stood at 8.7% on an annual basis in May. This value remained at the previous month's level, while analytical agencies forecasted a slowdown in price growth to 8.4%.

Considering this data, there is confidence that the Bank of England will raise its key interest rate tomorrow. Based on this information, the value of the British pound began to rise.

EUR/USD trading plan for June 21

The further upward movement of the euro is expected to occur when the price returns above the 1.0950 level. In this case, there is a possibility of prolonging the euro's course to the upper area of the psychological level 1.1000/1.1050. However, to allow for a downward scenario and subsequent formation of a pullback, it is necessary to keep the price below the 1.0900 level.

GBP/USD trading plan for June 21

For a pullback to form, the quote needs to stay below the 1.2700 level. Otherwise, there is a possibility of subsequent growth in long positions, which could lead the price to return to the 1.2850 level.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română