Global markets continue to hover as investors remain uncertain of the prospects of interest rate hikes. On the one hand, they assume the end of the rate increases, but on the other hand, they worry that it would continue, considering that the Fed promised to do so if necessary. This state of affairs will persist for some time, and it will exert significant impact on risk appetite.

Today and tomorrow, market sentiment will be driven by Fed Chairman Jerome Powell's semi-annual testimony to Congress. Just last week, the central bank kept the key interest rate unchanged at 5.25%, but hinted that there could be two more increases before the end of the year. Powell said the bank does not plan to raise rates at the July meeting.

Most likely, the content of Powell's speech will align with the current position of the Fed, repeating what he stated a week ago at the press conference. Therefore, markets will not hear anything new, but rather some details regarding specific criteria for the potential announced rate hikes. This will not have noticeable impact on market dynamics.

Powell also does not want to rock the markets, especially since the US economy also went into recession. Fortunately, inflation began to ease, standing at 4% at this moment. The labor market also remains strong, while economic and business activity started to recover as businesses adapt to new credit conditions.

Forecasts for today:

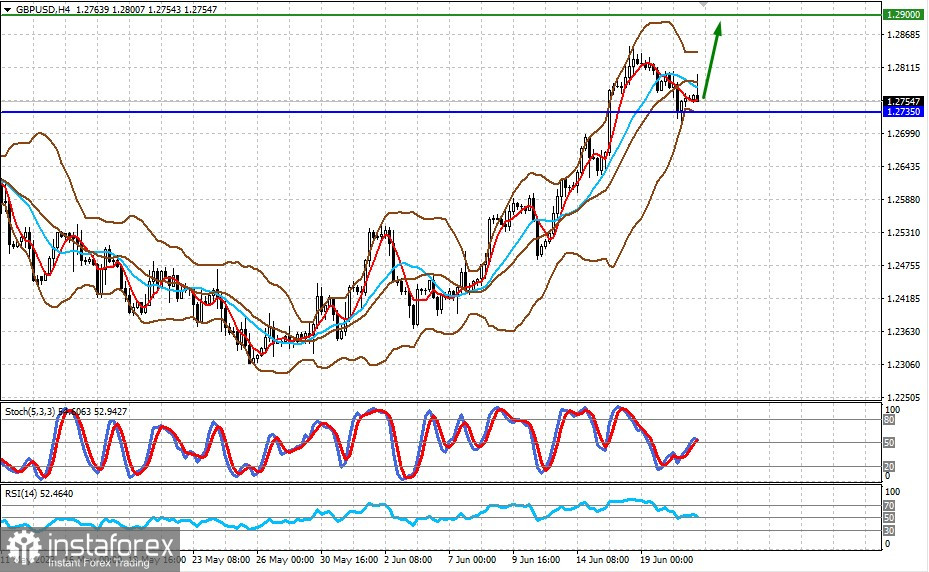

GBP/USD

The pair barely reacted to inflation data in the UK, staying above 1.2735. The stabilization of inflation at 8.7% y/y and its decrease to 0.7% m/m increases the likelihood of the Bank of England raising its interest rate, which will lead to a surge towards 1.2900 in the pair.

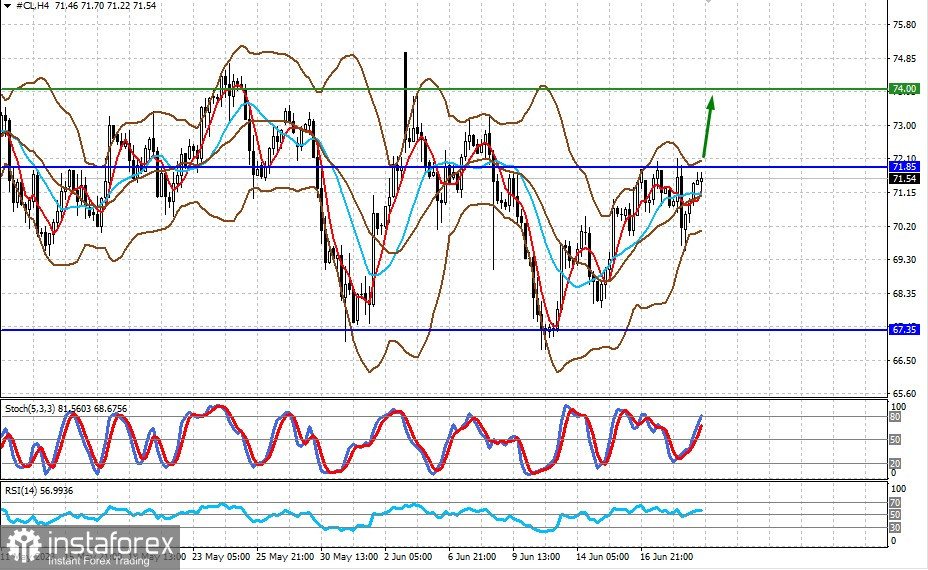

WTI

Oil continue to move within the range of 67.35-74.00 due to concerns about low global demand and potential consumption reduction in China, as well as price regulation by OPEC. If the price surpasses 71.85, there will be limited growth towards 74.00. Positive factors could also include data showing a decrease in oil inventories from the American Petroleum Institute (API).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română