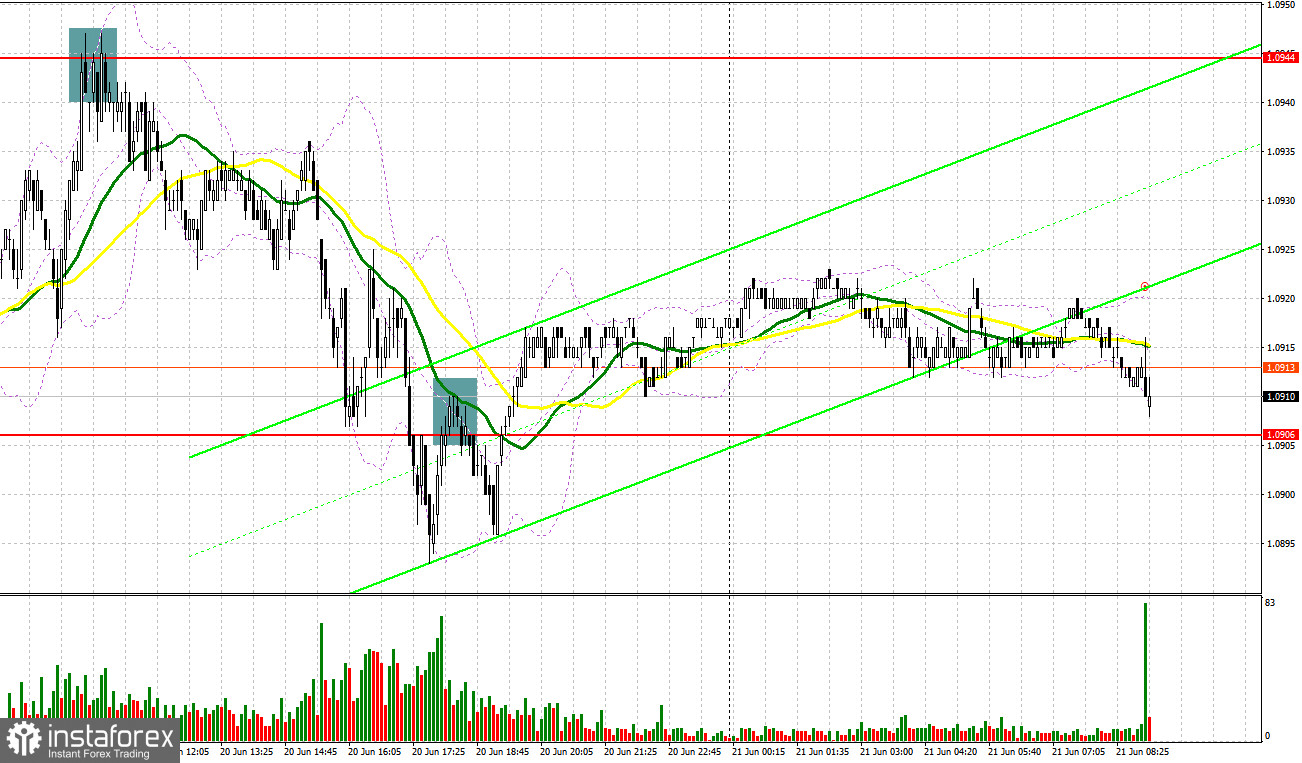

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0940 and recommended making decisions with this level in focus. A rise and a false breakout of this level led to a sell signal, which resulted in a drop of more than 40 pips. In the afternoon, a breakout and an upward retest of 1.0906 also gave a sell signal. However, there was no sharp drop.

When to open long positions on EUR/USD:

After a good correction, the EUR/USD pair is likely to continue growing. It may resume an upward movement after today's speech by Fed Chairman Jerome Powell before Senate Banking Committee. However, this event is scheduled for the afternoon. We will talk about it in more detail in the forecast for the American session. During the European trading, ECB Board Member Joachim Nagel and ECB Executive Board Member Isabelle Schnabel will deliver speeches. Policymakers are likely to stress the need to tame inflation. They could also hint at rate hikes. It may trigger an upward movement.

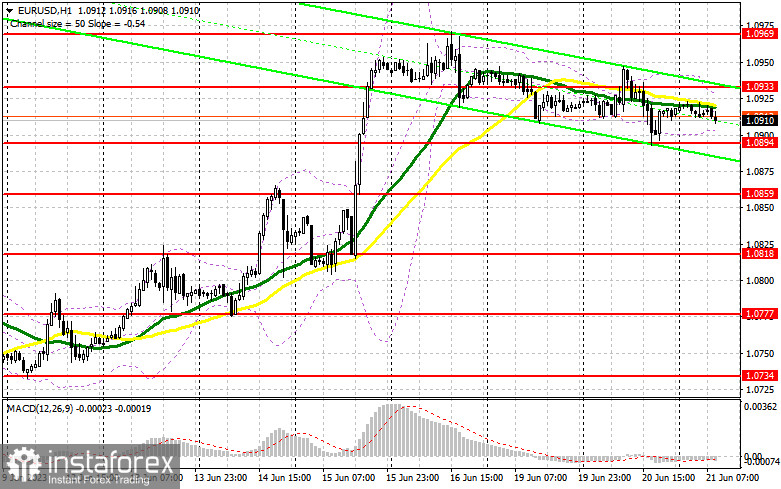

It would be wise to go long on a decline from the support level of 1.0894. A false breakout there will create a buy signal. The pair could return to the resistance level of 1.0933. A breakout and a downward retest of this level will boost demand for the euro, pushing it to a monthly high of 1.0969. A more distant target will be the 1.1029 level where I recommend locking in profits. If EUR/USD declines and bulls fail to defend 1.0894, do not be surprised if the bears return to the market awaiting a trend reversal. Therefore, only a false breakout of the support level of 1.0859 will create new entry points into long positions. You could buy EUR/USD at a bounce from 1.0818, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers are trying to return to the market but bullish sentiment is strong. The euro is rising amid expectations of different monetary policy stances from the ECB and the Fed. As the demand remains high, large traders make a profit on any correction of the pair. Bears need to protect the resistance level of 1.0933 where the moving averages are passing in negative territory. It is better to go short there only after a rise and a false breakout. It may give a sell signal, pushing EUR/USD to the weekly low of 1.0894, formed yesterday. A decline below this level as well as an upward retest could trigger a downward movement to 1.0859. A more distant target will be the 1.0818 level where I recommend locking in profits. If EUR/USD rises during the European session and bears fail to protect 1.0933, the bullish trend will continue. In this case, I would you to postpone short positions until a false breakout of the resistance level of 1.09692. You could sell EUR/USD at a bounce from 1.1029, keeping in mind a downward intraday correction of 30-35 pips.

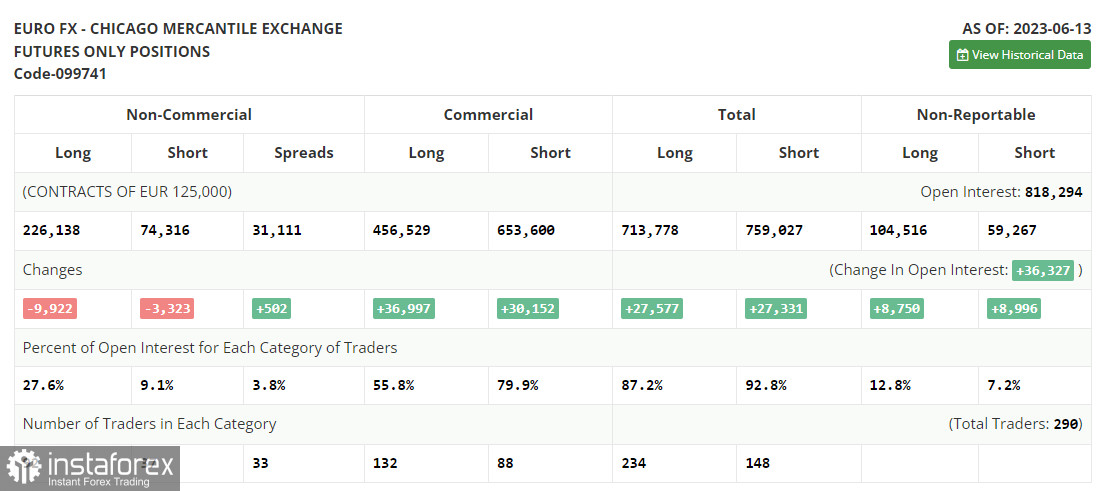

COT report

According to the COT report (Commitment of Traders) for June 13, there was a drop in long and short positions. However, this report was released even before the Federal Reserve's decision on the interest rate. The regulator decided to skip a rate hike in June this year, which significantly affected market sentiment. For this reason, one should not pay too much attention to the report. Demand for the euro remains high as the ECB remains committed to aggressive tightening. The euro is likely to maintain a bullish bias. The best medium-term strategy is to go long on the decline. The COT report showed that long non-commercial positions decreased by 9,922 to 226,138, while short non-commercial positions fell by 3,323 to 74,316. At the end of the week, the total non-commercial net position dropped and amounted to 151 822 against 158 224. The weekly closing price increased and amounted to 1.0794 against 1.0702.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0900 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română