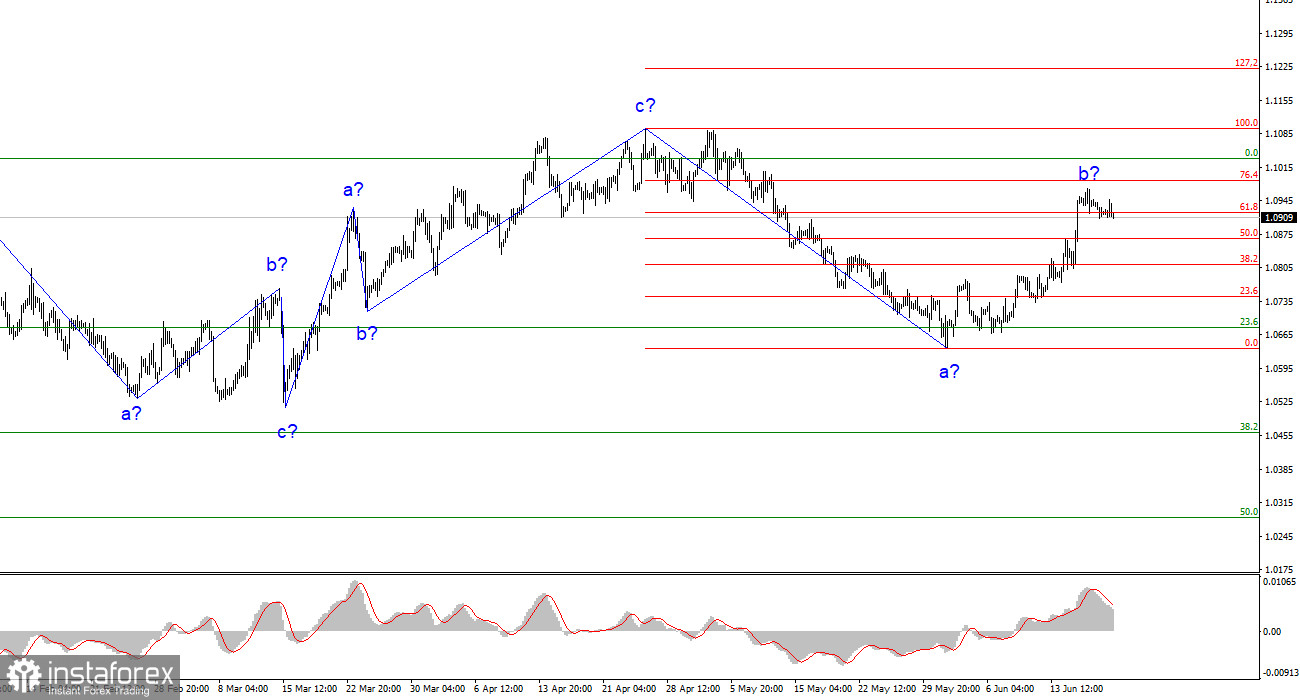

The wave analysis of the 4-hour chart for the euro/dollar pair remains somewhat unconventional but understandable. The price quotes continue to move away from previous lows, presumably within wave b. Although the upward trend that began on March 15 may have a more complex structure, for now, a descending segment consisting of three waves is expected to develop. Previous discussions have consistently pointed to the pair near the 5th figure, where the upward three-wave structure originated. This viewpoint still holds.

The high point of the last trend segment was only slightly higher than the peak of the previous upward segment. Since December of the previous year, the pair's movement can be considered horizontal, and this trend is anticipated to persist. The presumed wave b, which began forming on May 31, appears convincing and could conclude at any time as it exhibits three waves within. Additionally, it has taken on an elongated shape.

Olli Rehn expresses dissatisfaction with the rate of inflation slowdown.

The euro/dollar exchange rate experienced a minor decrease of 10 basis points on Tuesday, which, when combined with Monday's similarly slight decrease, is insufficient to conclude the completion of the presumed wave b. The magnitude of price movements is currently very small, and the news background remains weak. The market lacks significant catalysts, particularly following the meetings of the US and EU central banks the previous week, which guided the near future. Both central banks continue to emphasize tightening. Despite inflation in the United States slowing to 4%, the Federal Reserve still signals its readiness to raise interest rates at the earliest opportunity. In the European Union, where inflation stands at 6%, it is still premature for the ECB to discuss ending the tightening process. ECB members reiterated this stance on Monday and Tuesday.

Olli Rehn, one of the members, stated that the inflation slowdown is "too slow" and core inflation is "very slow." This suggests that in July, the interest rate in the European Union could increase by another 25 basis points. Subsequently, it becomes more intriguing as many analysts currently believe the ECB might halt at a main rate of 4.25%. If this occurs, there could be a significant decrease in demand for the euro, aligning with the current wave pattern. However, even the members of the Governing Council themselves are still determining the duration of the rate increases. Reliance on wave analysis indicates a potential decline for the pair in this situation.

Based on the analysis, it is concluded that forming a new descending segment of the trend is ongoing. There is ample room for a further decline in the pair. Targets around 1.0500-1.0600 are still considered realistic, and it is advised to sell the pair with these targets in mind. The completion of wave b is reasonably likely, supported by the "down" signal formed by the MACD indicator. Selling with a Stop Loss above the presumed wave b's current peak is possible.

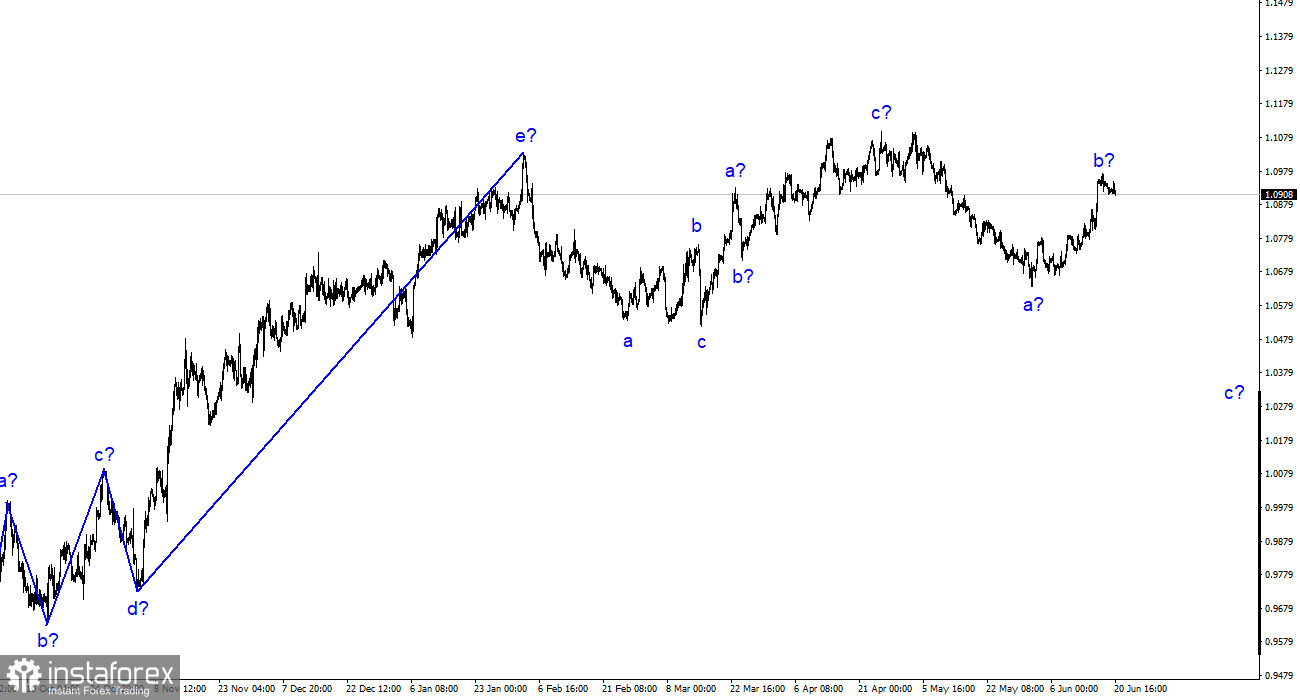

On a broader scale, the wave analysis of the upward segment of the trend has taken an elongated form, indicating potential completion. Five upward waves have been observed, likely forming the structure of a-b-c-d-e. Additionally, the pair has formed two three-wave patterns, one downward and one upward. It is likely in the process of forming another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română