To initiate long positions on EUR/USD, the following conditions are necessary:

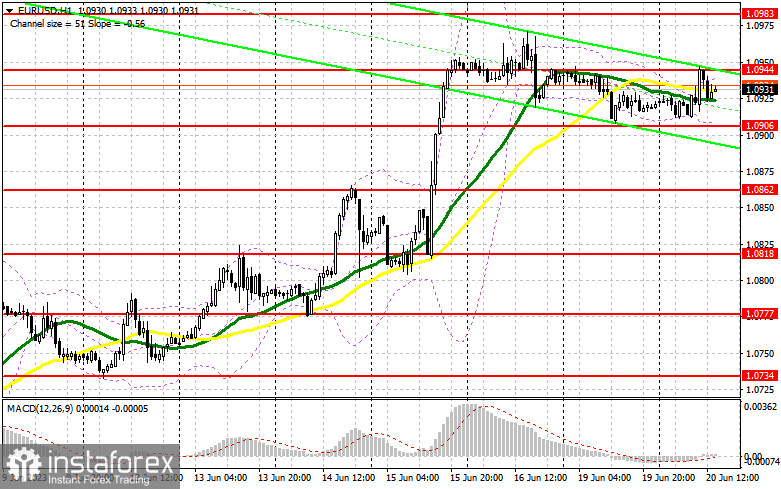

The scheduled data on building permits and new housing starts in the US will likely trigger market movements, as these figures are crucial indicators of economic recession. Additionally, speeches by FOMC members John Williams and James Bullard could remind traders that the Federal Reserve's pause in June was temporary and interest rates will resume their ascent. These factors might lead to a decline in EUR/USD in the latter half of the day. Therefore, for buying opportunities, it's advisable to wait for a new support level at 1.0906, which was established based on yesterday's results. Forming a false breakout similar to what was discussed in the morning forecast would present a buying signal, enabling a return to the intermediate resistance at 1.0944. If there is a breakout and subsequent test of this range from above to below, it will strengthen the demand for the euro, potentially reaching 1.0983. The ultimate target remains around 1.1029, at which point I would take a profit.

In the event of a downward movement in EUR/USD and the absence of buyers at 1.0906, bears may become more active in establishing a downward correction in the latter half of the day. Consequently, only a false breakout formation near the next support level at 1.0862 would provide a buying signal for the euro. I would initiate long positions starting from a minimum of 1.0818 with a target of a 30-35 point upward correction within the day.

To open short positions on EUR/USD, the following conditions are necessary:

Sellers achieved their morning objective by preventing the pair from surpassing 1.0940. However, it is premature to discuss any technical changes in the market. Bullish traders are waiting for more favorable prices, and expecting a significant decline in the euro in the medium term is unlikely. Therefore, following the approach I previously described, I prefer to act solely on the upside and a false breakout around the new resistance at 1.0944. This level was established during the first half of the day. A failed consolidation at this level would generate a selling signal, potentially pushing EUR/USD towards 1.0906. A consolidation below this range, accompanied by a subsequent reverse test from below to above, would pave the way to 1.0862. The ultimate target would be the minimum at 1.0818, where I would take profit.

If there is an upward movement in EUR/USD during the American session and bears are absent at 1.0944, the market situation will be controlled by buyers. In such a scenario, I would postpone short positions until the next resistance at 1.0983. Selling can also be considered there, but only after a failed consolidation. I would initiate short positions from a maximum of 1.1029 with a 30-35 point downward correction target.

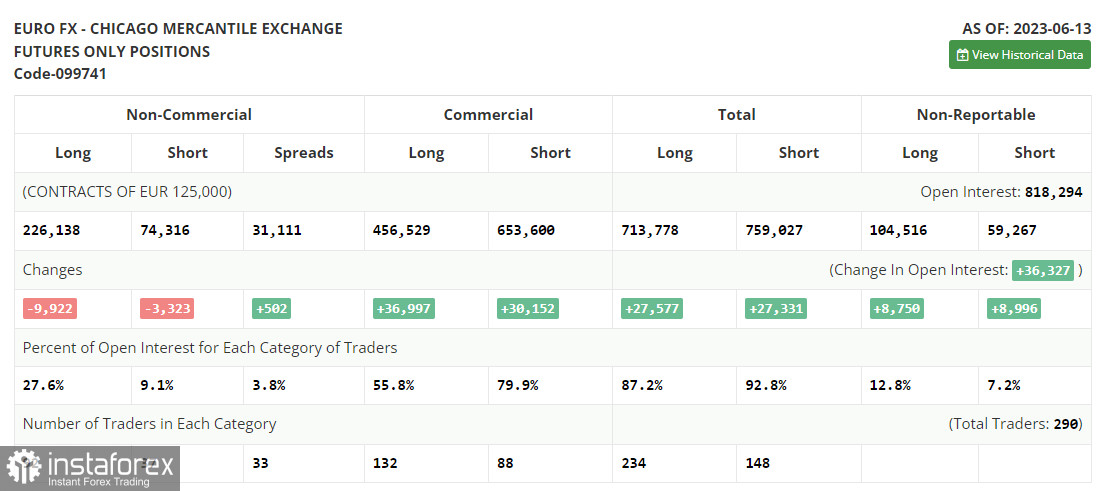

In the COT (Commitment of Traders) report for June 13, there was a decrease in both long and short positions. However, it's important to understand that the report was released before the Federal Reserve decided on interest rates, which remained unchanged in June and significantly influenced market dynamics. Therefore, the current report should be given little attention. It's important to note that there is still demand for the euro due to the continued aggressive policy of the European Central Bank, and this trend is expected to persist. In the current conditions, the optimal medium-term strategy would be to buy during declines. The COT report indicates that non-commercial long positions decreased by 9,922 to 226,138, while non-commercial short positions fell by 3,323 to 74,316. The overall non-commercial net position decreased to 151,822 from 158,224 by the end of the week. The weekly closing price increased to 1.0794 from 1.0702.

Indicator signals:

Moving averages.

Trading activity is centered around the 30-day and 50-day moving averages, indicating a need for market clarity.

Please note that the author's consideration of the moving average period and prices are based on the H1 hourly chart, which differs from the standard definition of classical daily moving averages on the D1 daily chart.

Regarding the Bollinger Bands, if there is an upward trend, the upper boundary of the indicator around 1.0940 will serve as a resistance level.

Here is an overview of the indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands - Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română