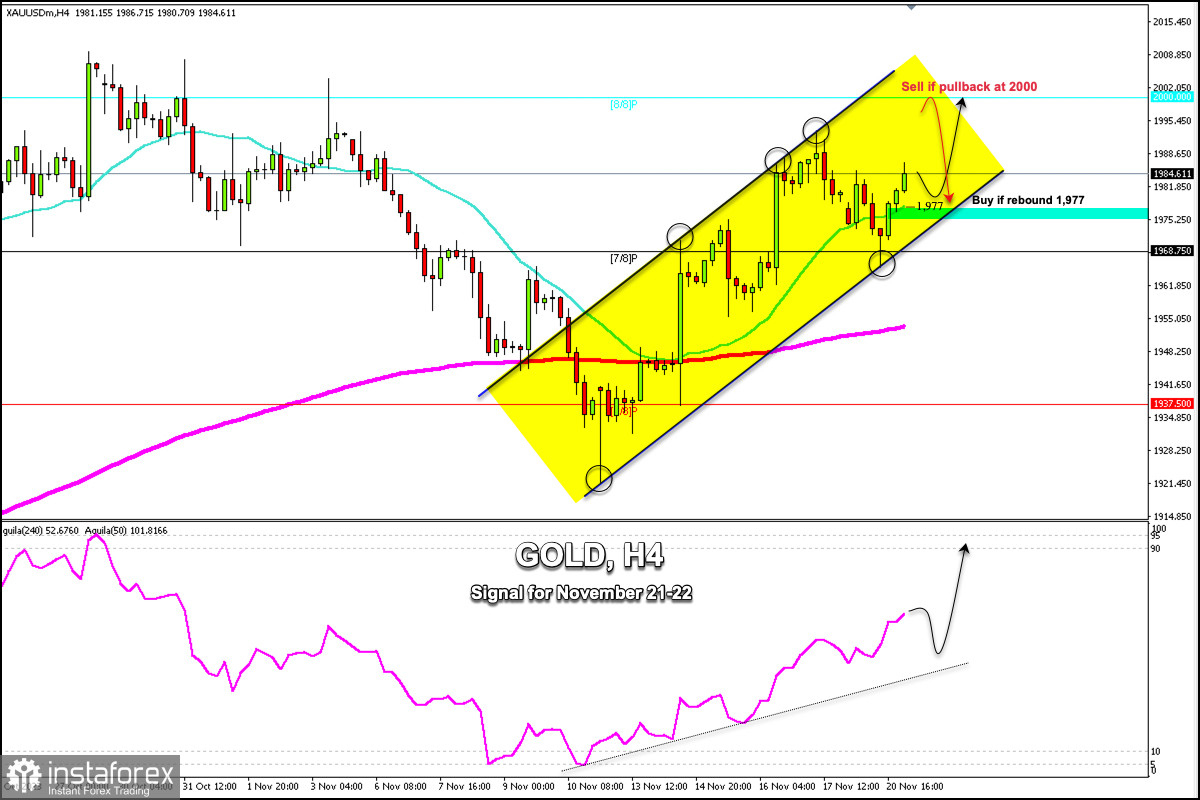

Early in the European session, gold (XAU/USD) is trading around 1,984.61, above the 21 SMA, and inside the uptrend channel formed since November 10th.

According to the H4 chart, we can observe that yesterday gold touched the bottom of the uptrend channel around 1,965.41. Since then, a strong technical rebound occurred that could continue in the coming days and the metal could reach the psychological level of $2,000.

Gold continues to trade with a bullish trend. In case a technical correction occurs in the next hours towards the 21 SMA located at 1,977, this could be seen as a buying opportunity with targets at 1,993 and $2,000.

In case XAU/USD breaks sharply the uptrend channel and consolidates below 1,968, we could expect a bearish acceleration and the price could reach 1,955 (200 EMA) and even 6/8 Murray at 1,937.

On the other hand, in case gold continues to gain bullish strength, we could expect it to reach the resistance zone of 1,992. If this level is exceeded, gold could quickly reach the psychological level of $2,000.

In case gold reaches 8/8 Murray and fails to consolidate above this level, it will be seen as an opportunity to sell with a target at 1,978. In the next few hours, we expect the XAU to trade within the range of 1,975 to 1,995 - $2,000.

The eagle indicator is giving a positive signal. It means that any pullback could be seen as a buying opportunity only if gold remains within the uptrend channel and above 1,972.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română