As expected, the market continues to move sideways. Technically, the pound has dipped, but the scale of the movement is so insignificant that it can be categorized as symbolic. The stagnation is mainly due to the empty economic calendar and the lack of any significant news capable of influencing market participants' sentiment. It is difficult to say anything about today's news because we don't know what can happen. However, as I mentioned, the economic calendar remains empty. It seems that today we will continue to witness a purely symbolic weakening of the pound.

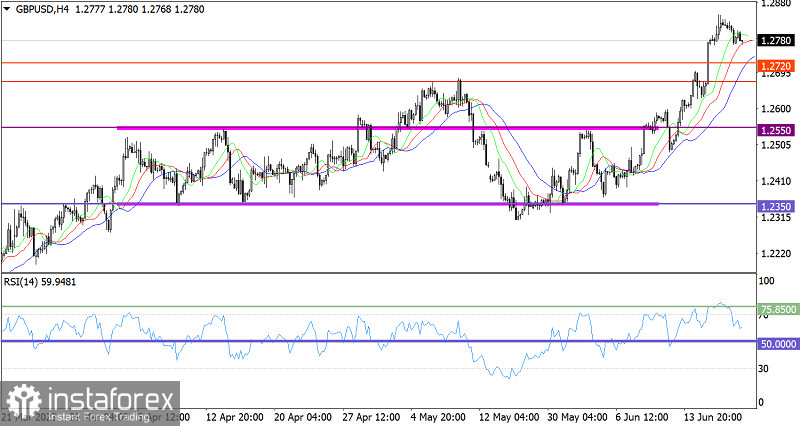

The GBP/USD pair has slowed down its upward cycle around the 1.2850 level, which points to the decline in the volume of long positions. This has led to a pullback, which, considering the overbought status of the British currency, is considered a justified move in the market.

On the four-hour chart, the RSI has left the overbought territory when the pair reversed its course, which could serve as a stage for force realignment.

On the same chart, the Alligator's MAs are headed upwards, which reflects the upward cycle.

Outlook:

The pullback is still relevant, but it does not disrupt the rhythmic component of the uptrend. If this persists, the price could move towards the 1.2700 level. Regarding the bullish scenario, we will receive a technical signal for the continuation of the medium-term trend once the price stays above the 1.2850 level.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators suggest a pullback. In the mid-term period, indicators are reflecting an uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română