EUR/USD

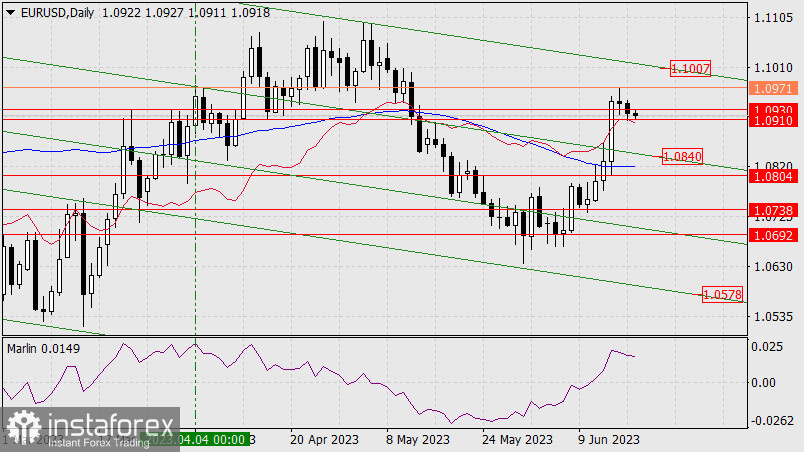

Yesterday, the euro fell by 18 pips, marking the lower limit of the target range at 1.0910/30 with its lower shadow. Consolidation below the range will allow for an advance towards the lower line of the price channel around the 1.0840 mark. However, the signal line of the Marlin oscillator is falling sluggishly, indicating that the euro still has a potential to rise. At the same time, the price is above the balance indicator line (which also halted its decline yesterday), indicating a maintained upward potential along with Marlin.

The situation could be reversed by a strong downward movement surpassing yesterday's level. This is possible if the US construction data turns out to be good and today's speeches by James Bullard and John Williams demonstrate firmness, hinting at Federal Reserve Chairman Jerome Powell's stance in his key speech in the House of Representatives tomorrow.

On the four-hour chart, the signal line of the Marlin oscillator sharply declines in a straight line. This often indicates a reversal of the price upwards. If the price finds the strength to break below the MACD line, the upward reversal is either postponed until the completion of a deep correction or canceled. The price is about 65 pips away from the MACD line, and an additional 15-20 pips would be needed for confirmation below it, which may prove to be an unattainable task for today. Powell's speech will take place in 9 four-hour candles (green vertical line). If the price does not deviate from its plan, it will only need to cover 50 pips since the MACD line is rising and approaching the price. The ultimate signal level is the peak on June 14 at 1.0865. The task is achievable, but the first impulse is necessary. The main plan will be canceled if the price breaks above the peak on June 16, allowing the price to continue rising towards 1.1007.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română