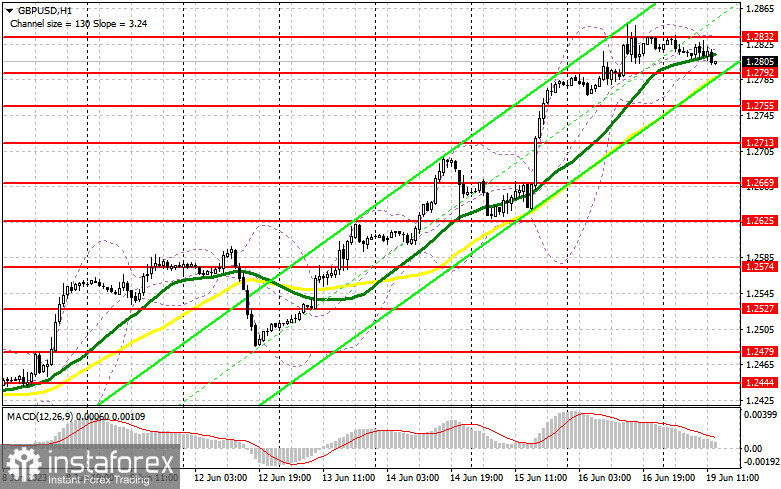

In my morning forecast, I highlighted the level of 1.2802 and recommended making entry decisions with this level in mind. Let's take a look at the 5-minute chart and analyze what happened. Despite some pressure on the pair, it didn't reach that level. As a result, the outlook was slightly revised for the second half of the day.

When to open long positions on GBP/USD:

With no significant US data releases coming up, except for the NAHB Housing Market Index report in the second half of the day, the pressure on the pair may persist. Therefore, I will act only if the pair declines towards the nearest support at 1.2792, which formed following Friday's trading session. A false breakout of this level will serve as a good entry point for increasing long positions. GBP/USD may then return to 1.2832. A breakout and subsequent downward retest of this level will leave no chances for bearish traders, forming an additional buy signal and sending the pair towards a new monthly high at 1.2876. This will strengthen the uptrend. The most distant target will be the area around 1.2911, where I will take profits.

If GBP/USD declines to 1.2792 amid the lack of activity, which is less likely, the pressure on the pound may increase at the beginning of this week. The moving averages in that area favor the bulls. However, any significant technical changes might not occur until the meeting of the Bank of England. In that case, defending the next area at 1.2755 and a false breakout below it will provide a buy signal. I plan to buy GBP/USD immediately if it rebounds from 1.2713, targeting an intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Despite the best efforts of bears, the pound sterling is not particularly inclined to move down. It is better to act during the upsurges and go short on GBP around the monthly highs rather than trying to do something during a correction. A false breakout of the new resistance level of 1.2832 and continuing MACD divergence will signal a sell-off, leading to a downward movement towards 1.2792. A breakout and subsequent upward retest of this level will deliver a more serious blow to bulls' positions at the beginning of the week, restoring pressure on GBP/USD and forming a sell signal. The pair may then decline towards 1.2755. The most distant target remains at the low of 1.2713, where I will take profits.

If GBP/USD rises amid a lack of activity around 1.2832 in the second half of the day, which is more likely as there is simply no data capable of supporting the US dollar, bulls will continue to control the market. They will expect the pair to hit local highs once again. In such a case, I will postpone opening short positions until the resistance at 1.2876 is tested. A false breakout of that level will provide an entry point for short positions. If there is no downward movement at that level, I will open short positions on GBP/USD immediately after a rebound from 1.2911, but only targeting a downward intraday correction down of 30-35 pips.

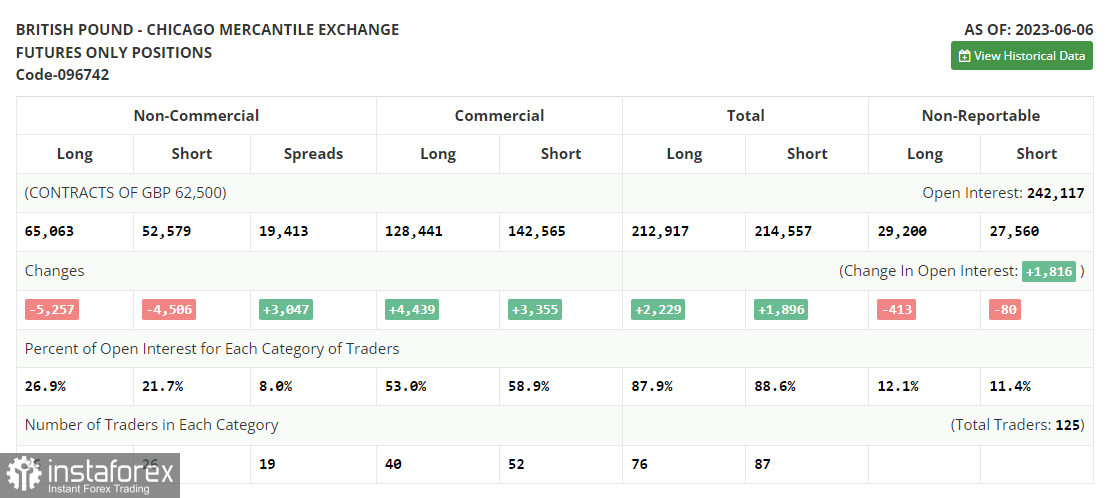

Commitment of Traders (COT) report:

The Commitment of Traders (COT) report for June 6 showed that both long and short positions declined. The pound has grown significantly recently. This indicates that many market participants continue to bet on a rate hike by the Bank of England. Recent forecasts and expectations that the UK economy will avoid a recession this year have also pushed up demand for risk assets. The Fed tightening cycle pause also favors GBP/USD bulls. According to the latest COT report, non-commercial short positions decreased by 4,056 to 52,579, while non-commercial long positions fell by 5,257 to 65,063. As a result the non-commercial net position decreased slightly to 12,454 from 13,235 a week earlier. The weekly price rose to 1.2434 from 1.2398.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further growth of the pair.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD declines, the lower boundary of the indicator around 1.2790 will provide support.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română