While weak bullish sentiments are observed in the market, gold prices are unable to rise to $2,000 per ounce.

According to the weekly gold survey among analysts from Wall Street and retail investors from Main Street, there is little confidence in the yellow metal. Currently, traders and investors are reevaluating their stance as the Federal Reserve left interest rates unchanged at the June meeting but signaled that its hawkish position remains unchanged. Their forecasts sees two more rate hikes are expected later this year.

After Friday's market close, analysts do not anticipate any significant price movements in the near future.

Ole Hansen, head of commodity strategy at Saxo Bank, said the bounce in gold ahead of the weekend indicates solid demand for the precious metal, and gold receives support as the yield curve continues to highlight the threat of a recession. However, there is no trigger for a full-fledged price growth.

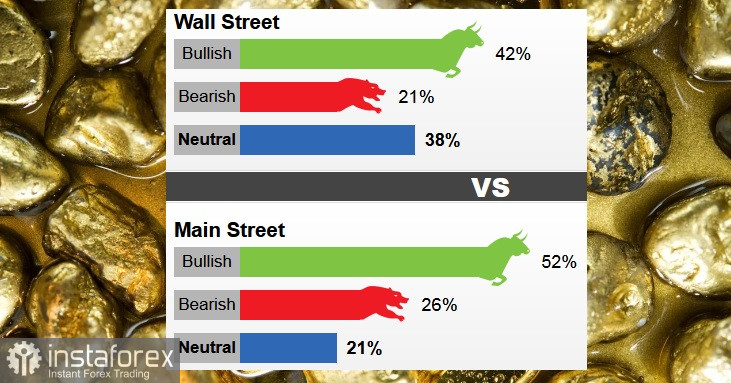

Last week, 24 analysts from Wall Street participated in a gold survey. Among the participants, ten analysts, or 42%, expressed optimism about the precious metal for the current week. Five analysts, or 21%, sided with the bears. And nine analysts, or 38%, remained neutral.

In online surveys, there were 487 votes. Of these, 258 respondents, or 52%, expect price growth for the current week. Another 126, or 26%, sided with the bears. And 103 voters, or 21%, remained neutral.

Despite retail investors maintaining their optimistic outlook, sentiments have dropped to the lowest level since May. With limited price growth towards the end of the week, investors settled around $1,982 per ounce.

Michele Schneider, director of trading education and research at MarketGauge, said she remains optimistic on gold as inflation remains a threat.

On the bearish side, despite gold's long-term upward trend, there may be some selling pressure as the Federal Reserve maintains its aggressive hawkish stance in monetary policy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română