Overview of trading on Friday

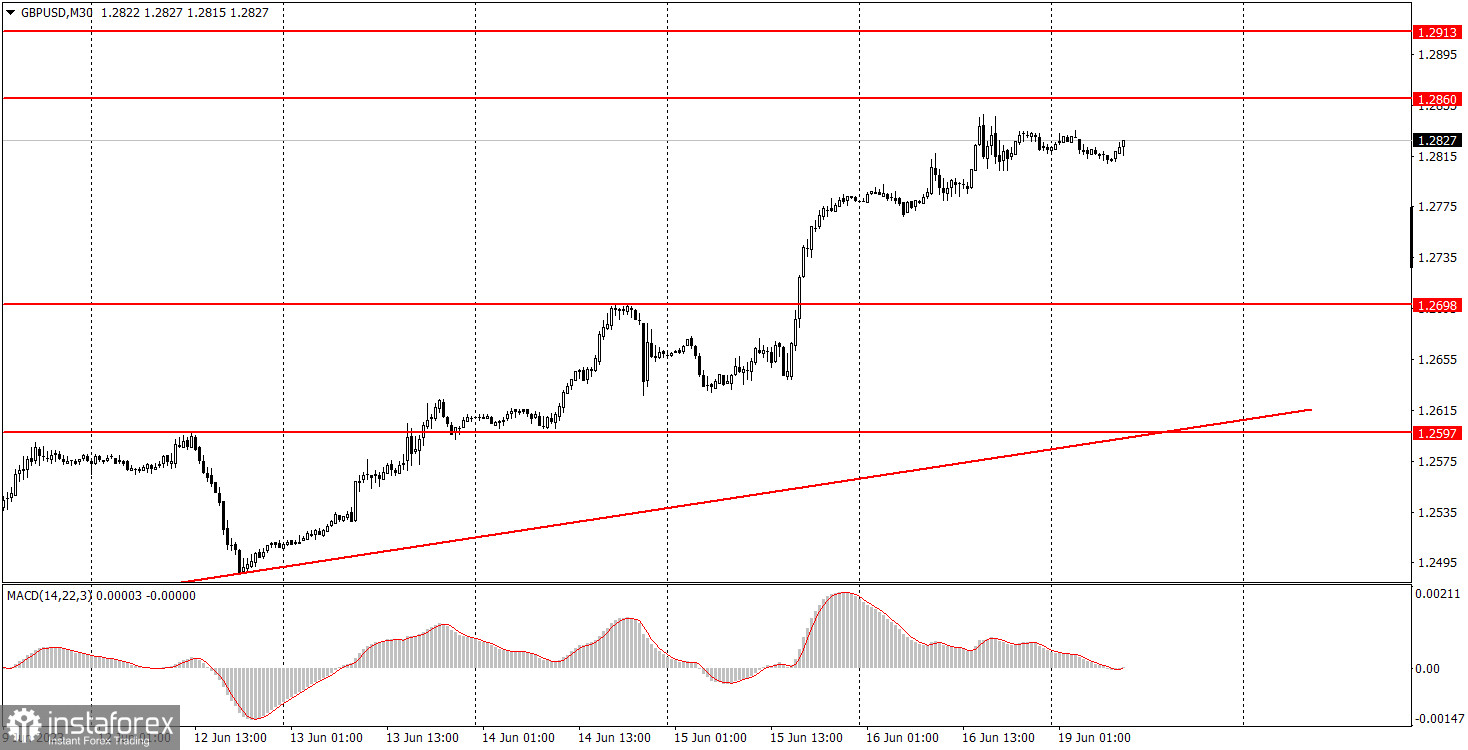

30M chart for GBP/USD

GBP/USD extended its upward move on Friday, albeit without particular reasons. However, during the whole last week, the British currency had no fundamentals to grow every day. Interestingly, the Bank of England's policy meeting will be held this week. The market can work out its hawkish expectations in advance, but once again we have to state the fact: the pound sterling is growing too often, too robust, and correcting very weakly. Remarkably, the sterling has gained 2,500 pips over the past 10 months.

On Friday, even a decent report on consumer sentiment from the University of Michigan in the US could not help the dollar. An ascending trend line clearly indicates a bull market. Besides, the current price is located at an impressive distance from an ascending trend line. This indicates that the pair is strongly overbought. Everyone is certainly aware of it.

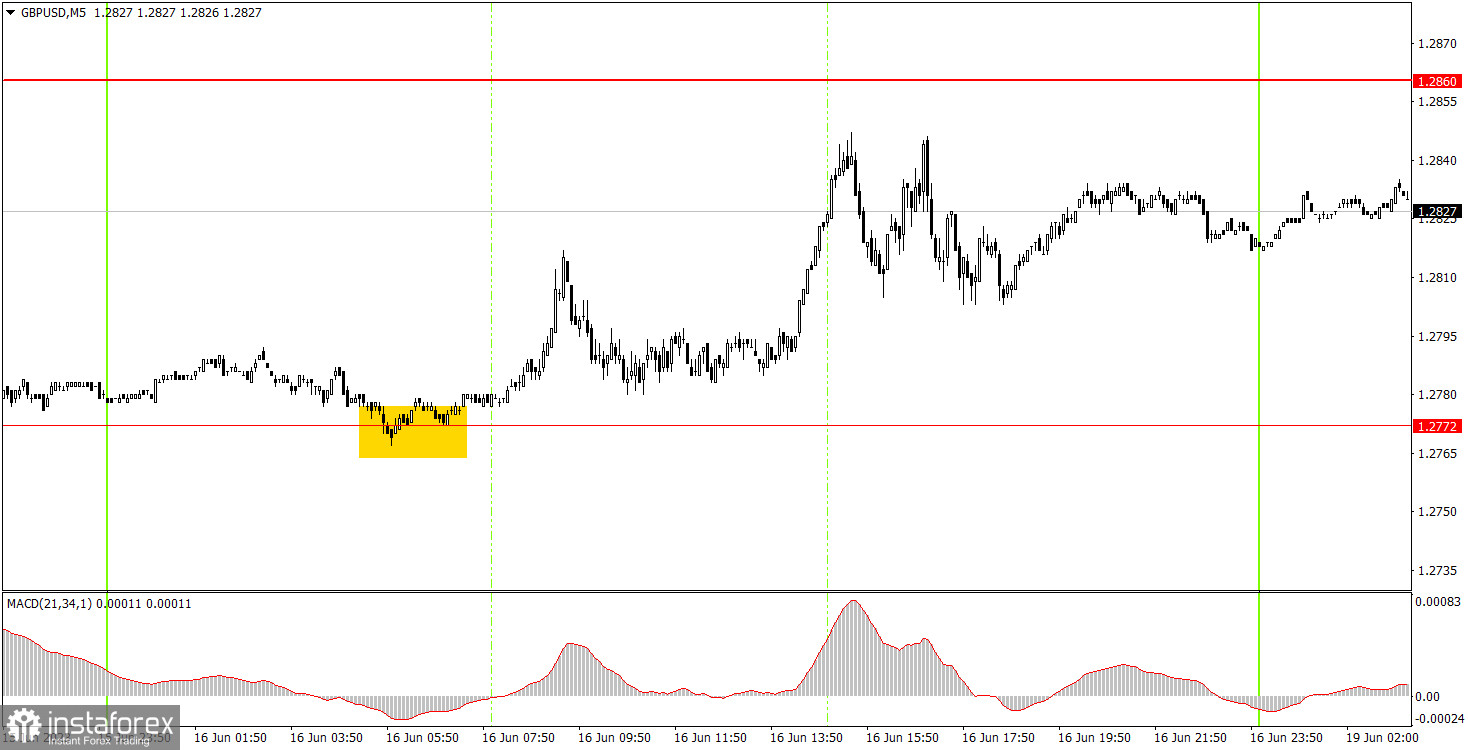

5M chart for GBP/USD

The situation was quite good with trading signals on Friday. The instrument frequently changed its trajectory during the day. This could have entailed a slew of false trading signals. However, in fact, only one signal was generated. Half an hour before the opening of the European trading session, GBP/USD rebounded from the level of 1.2772, forming a buy signal. This signal could have been worked out, since at the time of the opening of the European session, the price did not move away from the formation point. Later, the price passed about 45-55 pips upwards and long positions had to be closed manually because the price could not reach the target level of 1.2860.

How to trade GBP/USD on Monday

In the 30-minute time frame, GBP/USD continues its uptrend in the short term. There is no need to talk about any logic in the movements now as the pound is still heavily overbought and is growing with or without reason. This week, the volatility may be quite high again, but hardly today. The economic calendar reminds us of several important events. In the 5-minute time frame tomorrow, you can trade at the following levels: 1.2457, 1.2499, 1.2538, 1.2597, 1.2629, 1.2698, 1.2772, 1.2860, 1.2913, and 1.2981. When the price passes 20 pips in the right direction after opening positions, you can set a stop loss to breakeven. There are no major events scheduled for Monday in the UK and the US. Volatility may be medium today, and the currency pair may correct slightly down.

Main rules of the trading system:

The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română