Given the fact that nothing interesting happened on Friday, and no significant economic reports were released, it's not surprising that the market was generally stagnant. Investors were recovering from the consecutive meetings of the Federal Open Market Committee and the European Central Bank. Traders took the time to recuperate, as both meetings ended with surprises, and mostly unpleasant ones, especially when it comes to the Federal Reserve. After a brief respite, the market will proceed, but it's unclear in which direction the pair will trade. Considering the outcomes of recent meetings, the logical scenario would be for the dollar to appreciate. But take note that the ECB sounded hawkish while raising their interest rates, compared to the U.S Federal Reserve's pause. And there is no guarantee that the US central bank will raise its interest rates in a month and a half. In addition to that, the problem is that today's macroeconomic calendar is completely empty. So, if there is no unexpected news capable of influencing market sentiment, the euro may barely move today.

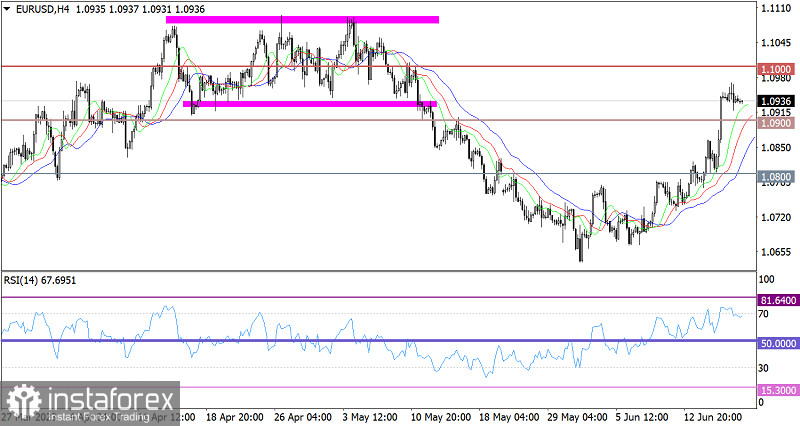

The EUR/USD pair, during its upward cycle, reached the lower range of the psychological level of 1.0950/1.1000. As a result, the volume of long positions declined, leading to stagnation and a retracement.

On the four-hour chart, the RSI indicator temporarily entered the overbought territory, as the price reached the psychological range. A comprehensive technical signal indicated the possibility of a decline in the volume of long positions on the euro.

On the same time frames, the Alligator's MAs are headed upwards, which corresponds to the current upward cycle.

Outlook

Price stagnation can play the role of regrouping trading forces, which removes the overbought status. Updating last week's high will lead to a shift in movement towards the upper range of the psychological level of 1.1000/1.1050. This can strengthen long positions on the euro. As for the bearish scenario, traders consider it as a full-scale retracement towards the 1.0900 level.

The complex indicator analysis unveiled that in the intraday and short-term periods, technical indicators are pointing to stagnation. In the mid-term periods, the indicators are reflecting an upward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română