Euro continues to climb upwards thanks to the market's reassessment of the ECB's expected deposit rate ceiling and hawkish comments from the Governing Council officials. The European Central Bank has outpaced the Federal Reserve in the race to tighten financial conditions, and for now, the EUR/USD bulls are enjoying their success. In my view, it's undeserved. However, that's the market for you: it's not always fair.

According to Bundesbank President Joachim Nagel, the cycle of monetary policy tightening will likely need to be extended after the summer break. This includes raising borrowing costs not only in July but also in September. His colleagues from Austria, Slovenia, and Lithuania share a similar opinion. Pierre Wunsch, the Governor of the National Bank of Belgium, even announced his intention to raise the deposit rate in October.

This hawkish attack aligns with the IMF's call for the ECB to further tighten its monetary policy due to inflation being too high in the eurozone. Yes, consumer prices have significantly slowed down from their peak of 10.6% in October, but core inflation has remained at roughly the same level.

Dynamics of European Inflation

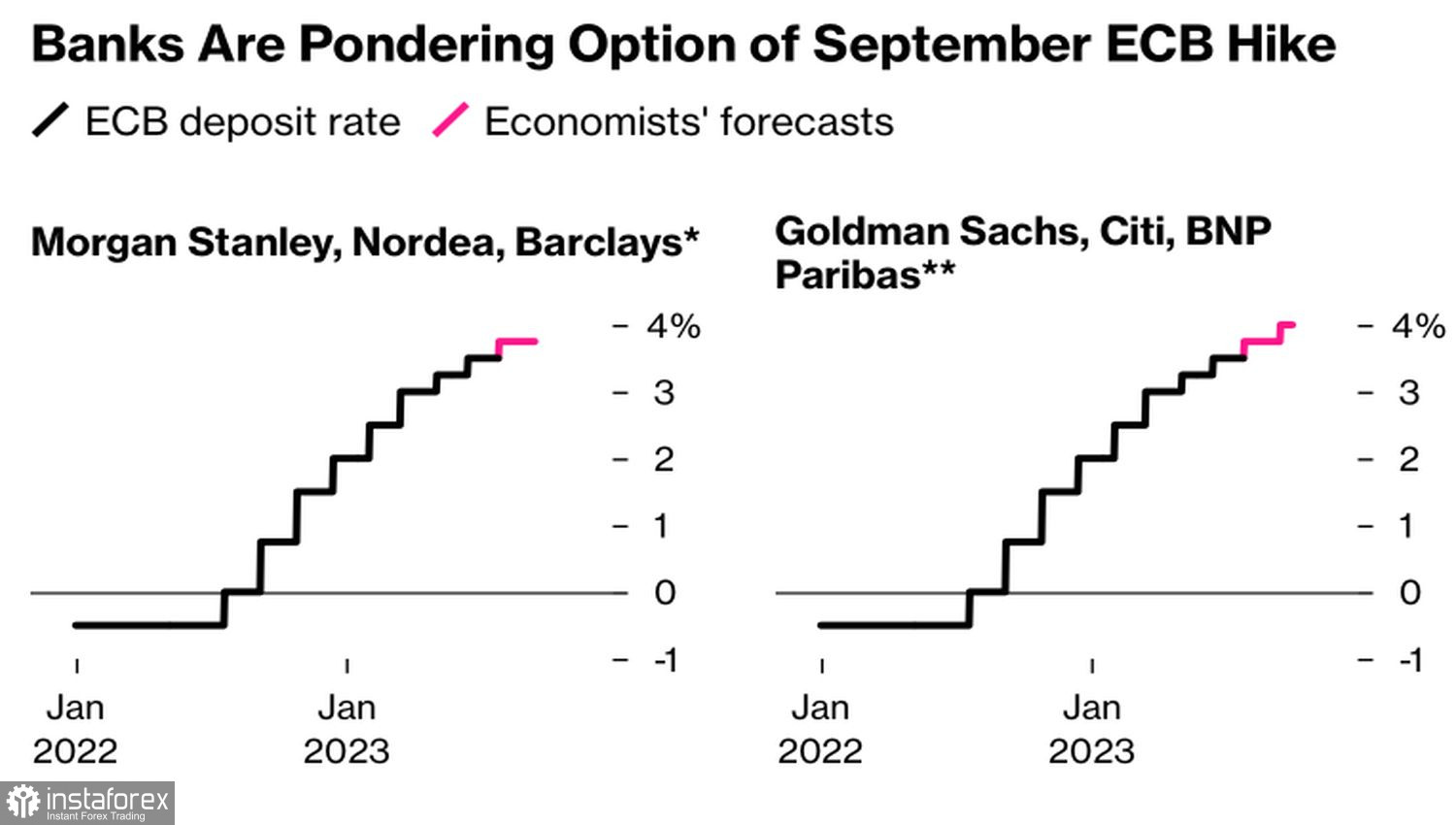

Looking at the results of the ECB meeting, the hawkish speeches by its officials, and the IMF's recommendations, major banks are starting to revise their deposit rate forecasts. Goldman Sachs, UniCredit, and BNP Paribas, for example, see the rate at 4%. They justify this projection by citing a slower decline in price growth amid a strong labor market and robust wage growth.

On the other hand, Morgan Stanley and Nordea have maintained their previous opinion of a rate increase only up to 3.75%. They argue that the previous steps to tighten monetary policy, sluggish GDP growth, and the ECB officials' reluctance to push the eurozone into a new recession all play a role in this decision.

ECB Deposit Rate Forecasts

Therefore, the EUR/USD bulls have plenty of optimism. However, what goes up must come down. The rally of the main currency pair was supported by the rise of U.S. stock indices. Fueled by hopes of the end of the Federal Reserve's monetary policy tightening cycle, stocks reached their highest levels since 2022. Moreover, retail sales in May demonstrated better dynamics than expected. The U.S. economy is strong, which supports the S&P 500.

Nevertheless, the stronger the domestic demand, the more resilient the inflation becomes. Investors are completely ignoring the signal from the Fed to raise the rate by 50 basis points to 5.75%. If the markets go against the Fed, they are usually punished for it. The pullback in stock indices will set a ceiling for EUR/USD. The question is, where exactly is that level?

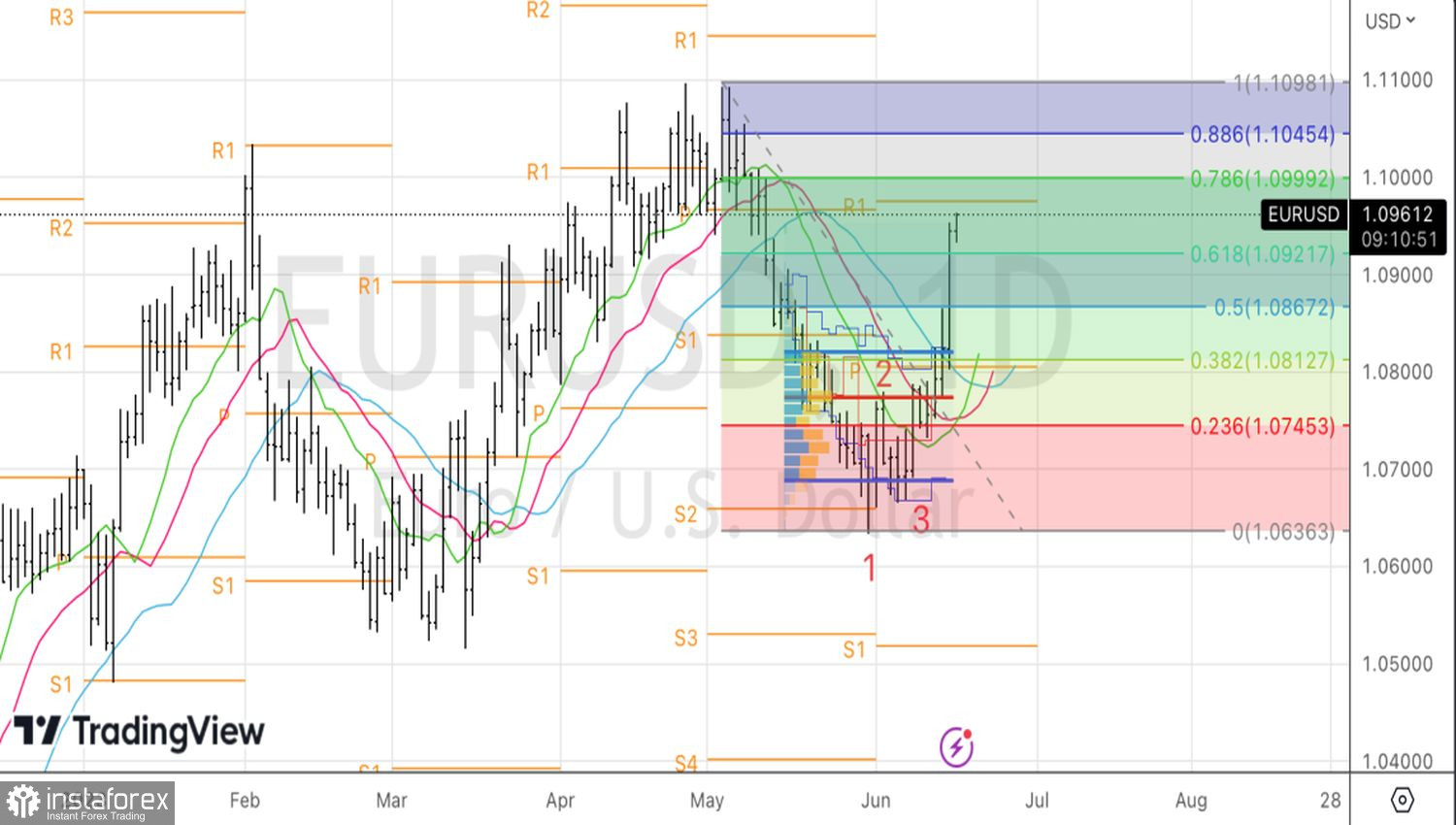

Technically, the euro rally may continue to $1.1 and $1.1045. Those levels correspond to the 78.6% and 88.6% Fibonacci levels of the downward wave of the 1-2-3 pattern. However, the inability of EUR/USD bulls to break through the convergence zone between 1.0965 and 1.0975 will indicate their weakness and serve as a reason for profit-taking on long positions, followed by a shift towards short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română