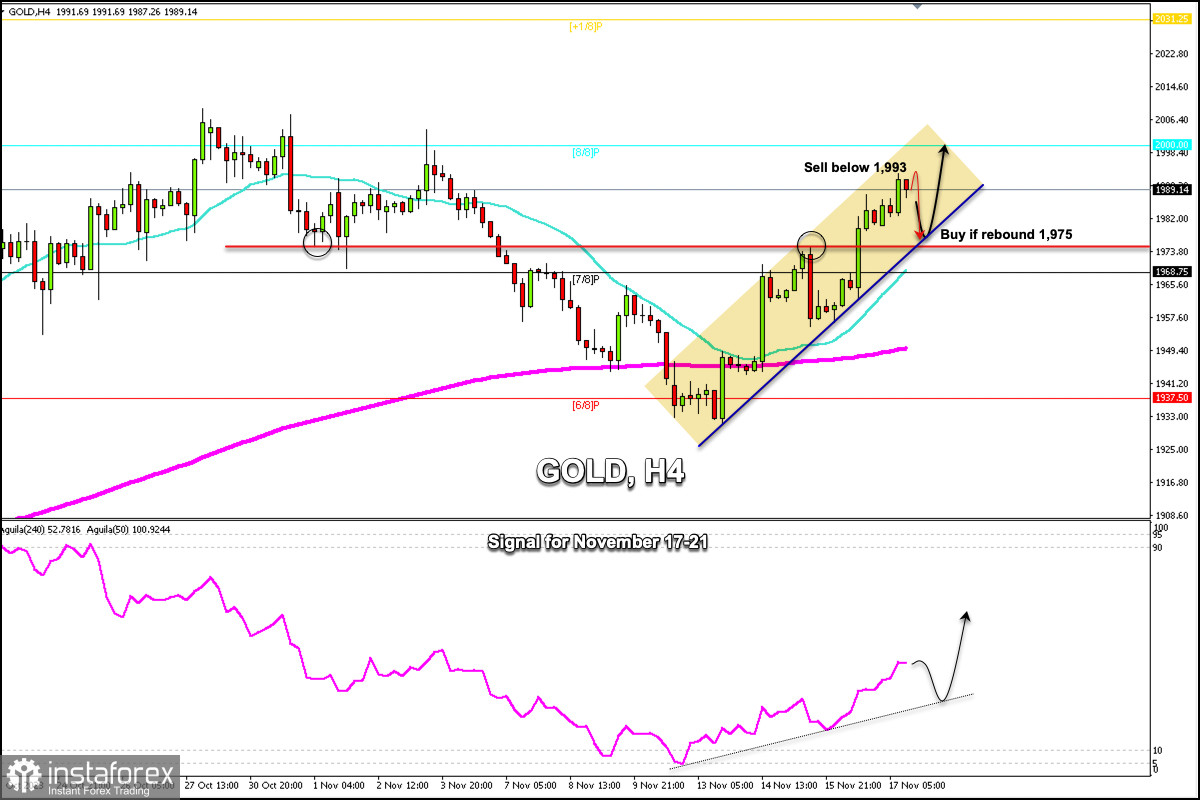

Early in the American session, gold (XAU/USD) is trading around 1,989.14, below the high reached during the European session, and around 1,993.24. This recovery of gold from the 1,931 low towards the 1,993 area reveals strong upside potential. Therefore, any technical correction occurring in the coming days could be seen as a buying opportunity with the target at 2,031.

Gold has a strong resistance zone at around 1,993. In case gold fails to break this level, it could be seen as an opportunity to sell with the target at 1,975. Around this level is the daily pivot point which gives gold a positive outlook.

On the other hand, the psychological level at $2,000 and around 8/8 Murray has become a strong resistance. In case gold continues to rise until it reaches this area, it could also be seen as a signal to sell.

A consolidation and a daily close above $2,000, could mean a new bullish advance and gold could reach 2,031 and even +2/8 Murray at 2,062.

On the other hand, a sharp break of the uptrend channel formed since November 9th and a break below 1,970 could initiate a bearish acceleration. So, gold could reach the 200 EMA located at 1,948 and could even reach 6/8 Murray located at 1,937.

The eagle indicator is giving a positive signal. However, gold could be showing signs of exhaustion and a technical correction is likely to happen in the coming days. If this scenario occurs, it will give us the opportunity to resume buying provided that gold consolidates above 1,976.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română