Although the Fed hinted at two more rate hikes by the end of this year, market players resumed buying risk assets while intensifying the sell-off of dollar. This suggests that investors view the Fed's statement as a verbal intervention, believing that there will be no increase in rates, especially if US CPI continues to decline.

The decision to leave rates unchanged this June also gives light to the possibility that there will not be any rate increase in July. Much will depend on the consumer inflation data for July, as well as other inflation components such as average wage earnings, personal consumption expenditure index, and similar indicators.

On another note, euro rose on Thursday after the ECB announced another 0.25% increase in rates, pushing it to a level of 3.50%. Then, Christine Lagarde hinted at the continuation of rate hikes in July, which could reduce the difference in interest rates between the ECB and the Fed. Such a scenario will be in favor of the former.

The updated data on consumer inflation in the eurozone will be of interest today as forecasts say it will fall from 7.0% to 6.1% y/y, and then show no growth on a monthly basis. If this happens, or if the numbers come out slightly lower, the rally in euro will halt, albeit for a short period only. Afterwards, EUR/USD will resume rising as inflation remains far from the 2.0% target value.

Forecasts for today:

EUR/USD

The pair trades above 1.0900. A correction may be seen upon the release of inflation data in the Eurozone. However, it will be followed by a reversal and growth towards 1.1000.

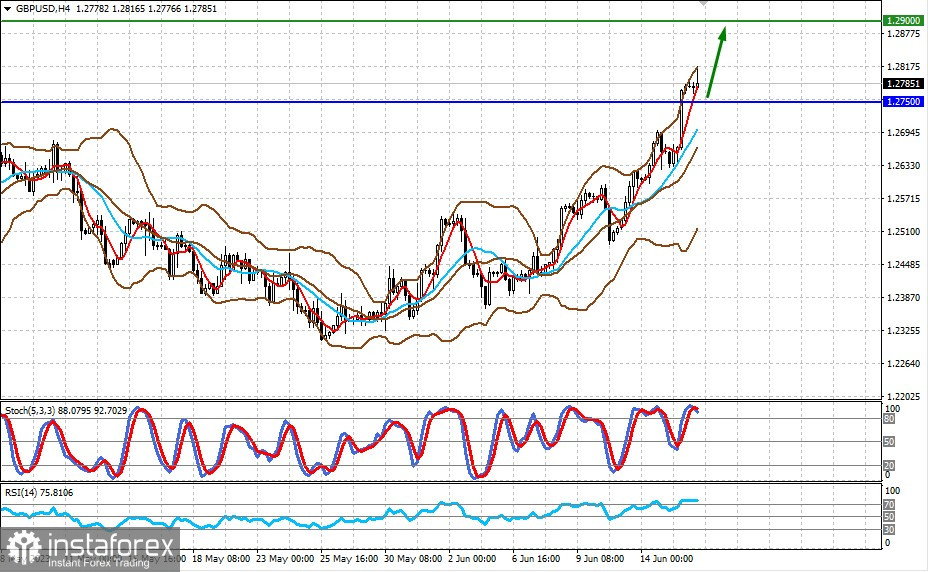

GBP/USD

The pair trades above 1.2750. A correction may occur towards this level, but then the quote will bounce back and move towards 1.2900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română