Over the past three months, activity in the cryptocurrency market has significantly declined. After reaching a price high of $31k, interest in digital assets began to wane. As a result, as of June 16, the trading volumes in the Bitcoin market barely reach $15 billion.

Nevertheless, the overall market capitalization of the crypto market remains confidently near the $1 trillion mark. However, the main problem lies in the fact that a large portion of digital asset volumes are held passively in decentralized or cold wallets of users. As a result, the price movement of BTC and other assets is influenced by a small group of investors.

Bitcoin loses ground

Fundamental events and news also fail to impact the price trend of Bitcoin. A vivid example of this is the worsening downward trend in the crypto market despite positive inflation data and actions by the Federal Reserve. BTC experienced a bearish breakdown of $26k due to low trading activity and pessimistic sentiments in the cryptocurrency market.

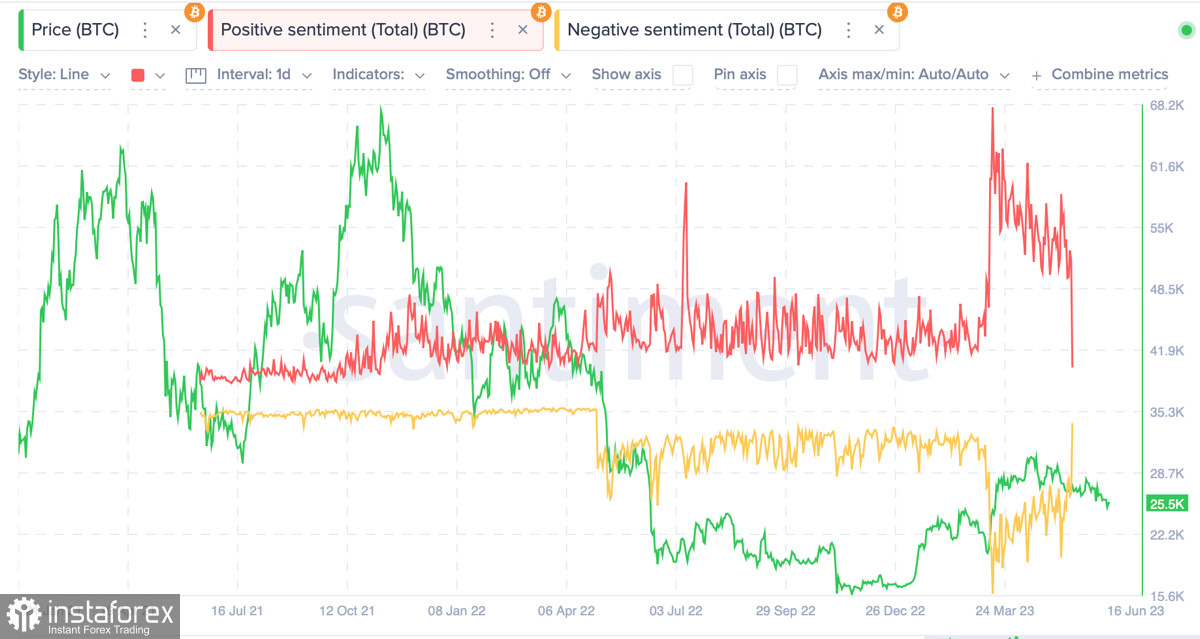

Regarding market sentiment, it is worth noting that the most negative expectations regarding the future of the crypto market have been present since March 2020. These negative sentiments largely contribute to bearish dominance and low bullish volumes, which are barely sufficient to protect key support levels.

The situation significantly worsened in the past 1.5 months when the SEC made several high-profile statements and equated crypto assets from the top 15 to securities. In addition to this, the regulator initiated legal actions against the largest crypto exchanges operating in the United States. As it is known, a significant percentage of crypto bulls were located in the U.S.

As a result of all the aforementioned factors, the correlation between BTC and the key stock index, the S&P 500, has been completely lost. The S&P 500 continues to demonstrate bullish resilience, largely due to crypto investors shifting to the stock market. As a result, BTC and other assets fail to demonstrate reasonable results.

Despite the overall negative sentiment in the crypto market, fundamental interest in the assets has not declined. For example, BlackRock Capital has officially filed an application for a spot BTC-ETF. This is happening against the backdrop of a significant increase in the stake of Morgan Stanley and Fidelity in MicroStrategy stocks, indicating that institutional investors are seeking alternative investment routes in crypto assets.

BTC/USD Analysis

Over the past day, Bitcoin has recovered by 2.5% and is attempting to establish itself above the $25.5k support level. At the same time, there is an increase in daily trading volumes up to $14 billion. The upward surge of BTC was triggered by the price drop to the lower boundary of the support area at $24.6k–$25k, which jeopardizes the structure of the upward trend.

It is worth noting that buyers failed to absorb bearish volumes, highlighting the absence of strong buying pressure. Technical metrics indicate the completion of a short-term impulse that allowed BTC to recover above $25.5k, which means that a downward movement may resume in the near future.

In such a scenario, Bitcoin will not be able to hold and establish itself above the $25.5k level. A retest of the $24.6k level is likely to expected, which will eventually lead to a breakdown of this threshold. As of June 16, there is no reason to believe that bulls will be able to defend $24.6k, given the current trading volumes.

Conclusion

The $24.6k–$25k range is gradually losing its relevance, Bitcoin bulls continue to lose ground and trading volumes, while the main focus of sellers is shifting to the $20k–$21k range, where a massive accumulation of BTC positions took place. However, despite bearish trends in the market, declines will be interspersed with long consolidation periods necessary for volume accumulation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română