Bitcoin has been extending its moderate decline on the 24-hour timeframe from the ascending trend line. Yesterday, the number one cryptocurrency lost its next $1,000 of value, and this happened about an hour before the publication of the results of the Fed meeting and one and a half hour before Jerome Powell's press conference. Of course, you can try to link these events, but we would like to note that Bitcoin has been falling for more than 2 months in a row, so its next bearish sequence does not have to be timed to such an important event as the Fed policy meeting. Most likely, the crypto market just found an excuse to sell some more coins.

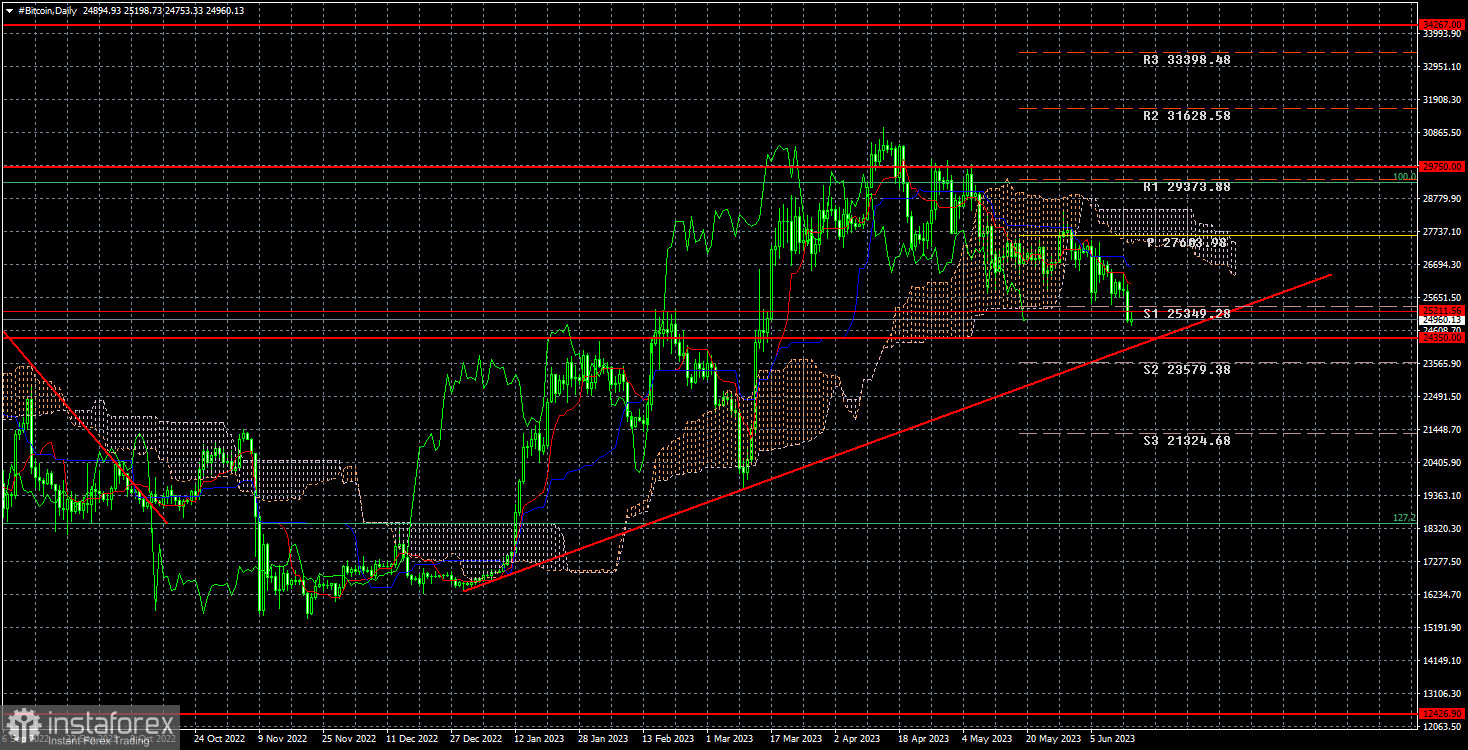

As a result, Bitcoin overcame the level of $25,211, which we determined as the target for a long time. At the moment, the cryptocurrency is declining aiming to hit the target of $24,350, near which there is an ascending trend line. The moment of truth is near. If Bitcoin overcomes the trend line, then the probability of its further fall will increase many times over. We have repeatedly warned that the market worked out in advance those favorable factors that should happen no earlier than 2024. In order to continue the bullish movement, the market needs some new fundamentals. And they are not available. Rather, on the contrary, the recent events around the cryptocurrency exchanges Coinbase and Binance trigger sell-offs in the cryptocurrency market, since no one knows how the trial will end.

Returning to the Fed meeting, we can say that its policy decision can be considered "moderately hawkish". While we believe the Federal Reserve has completed its cycle of rate hikes, Jerome Powell hinted yesterday that the central bank could raise interest rates higher in the future. Naturally, this is due to inflation, which may slow down in its decline or stop deceleration. In this case, the Fed, as an additional measure of influence, will have to tighten monetary policy again. It is common knowledge that the higher interest rates grow, the worse it is for all risky assets.

A riskier asset than Bitcoin is hard to find. Therefore, we believe that the flagship crypto has been falling absolutely fairly and naturally. Moreover, we assume that at this time we are watching the onset of a new bearish trend. After all, if you look closely at the daily timeframe, then the entire increase from $15,000 to $30,000 fits into the definition of a correction. After the correction, the overall trend resumes.

On the 24-hour timeframe, Bitcoin continues its downward correction, which may be the beginning of a new bearish trend. In the near future, we are waiting for a drop to the level of $24,350, around which the further fate of Bitcoin will be decided. We do not rule out a further fall of the cryptocurrency.

We could plan long positions only when the appropriate signal is formed: for example, a rebound from $24,350 or a trend line. Besides, the descending channel in the 4-hour timeframe is also of great importance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română